Are you looking for a reliable card with great perks and easy loading?

Then the Brink's Prepaid Mastercard® is the perfect choice for your financial needs!

Advertisement

Discover the magic of the Brink’s Prepaid Mastercard®, where top-notch safety intertwines with attractive rewards. Enjoy the convenience of easy loading and a series of standout perks that make every transaction special. With the trust of Brink’s in your pocket, every purchase brings peace of mind and an elevated spending experience. It’s more than just a card; it’s a lifestyle upgrade.

Discover the magic of the Brink’s Prepaid Mastercard®, where top-notch safety intertwines with attractive rewards. Enjoy the convenience of easy loading and a series of standout perks that make every transaction special. With the trust of Brink’s in your pocket, every purchase brings peace of mind and an elevated spending experience. It’s more than just a card; it’s a lifestyle upgrade.

You will remain in the same website

The Brink's Prepaid Mastercard® offers an array of perks and extra convenience for your banking life. Check some of its benefits!

Unveiling the Brink’s Prepaid Mastercard® Credit Card – where financial reliability meets modern-day convenience.

Infused with the trustworthiness Brink’s is renowned for and the global acceptance of Mastercard®, this card promises to be your steadfast financial partner in an ever-evolving world.

Advantages and special perks

- Trusted Legacy: With the Brink’s name backing it, you’re assured of a card that prioritizes your financial security and well-being.

- Payback Rewards™: Engage in everyday transactions and earn cashback rewards with specific purchases, ensuring your spending is both delightful and rewarding.

- Quick Direct Deposit: Get quicker access to your paycheck or government benefits with the card’s direct deposit feature, allowing you to use your funds faster than traditional methods.

- No Credit Check Hurdles: Say goodbye to the apprehensions of credit checks. The Brink’s Prepaid Mastercard® offers an application process that doesn’t involve credit inquiries.

- Mobile App Management: Take control of your finances on the go. From balance checks to transaction history, the mobile app offers a comprehensive suite of management tools at your fingertips.

- Customizable Alerts: Stay informed and updated with customizable alerts. Whether it’s low balance warnings or transaction notifications, you’re always in the loop.

Disadvantages

- Monthly Fee Implications: The card comes with a monthly fee, which could add up over time and might deter potential users looking for a no-cost option.

- ATM Withdrawal Costs: While having the convenience of ATM access, users might face fees when withdrawing money, especially from non-network ATMs.

- Foreign Transaction Fees: International travelers, beware! The card charges a fee for foreign transactions, which can increase costs when used abroad.

- No Credit Building Feature: As a prepaid card, the Brink’s Prepaid Mastercard® doesn’t offer a pathway to building or improving your credit score.

The Brink’s Prepaid Mastercard® Credit Card seamlessly blends the reliability of Brink’s with the universality of Mastercard®, offering users a robust financial tool.

While its benefits are undeniably compelling, it’s essential to weigh them against potential costs to ensure it aligns with your specific financial goals and requirements.

The Brink’s Prepaid Mastercard® is special because it merges Brink’s long-standing reputation for safety with the ease of modern banking. It’s not just about storing money; it’s about having a safe and handy tool that makes spending simpler and smarter. With Brink’s, you get the best of both old-school trust and new-age convenience.

The brilliance of the Brink’s Prepaid Mastercard® lies in its user-friendly mobile app. There, you can dive deep into your spending habits, review detailed transaction histories, and set up notifications to match your preferences. It’s like having a personal financial assistant. With easy-to-navigate features and transparent reporting, you are always in the driver’s seat, ensuring your finances are on the right track.

Absolutely! The Brink’s Prepaid Mastercard® is your trusty companion in the world of online shopping. Whether you’re splurging on the latest tech, buying daily essentials, or even covering monthly bills, this card makes it hassle-free. But beyond convenience, it’s the top-notch security features that truly shine, making sure every online transaction you make is safe from potential threats.

Accessing your online account is simple and user-friendly. Start by heading over to the Brink’s Prepaid Mastercard® official website. From there, find the login section and enter your credentials. Once inside, a comprehensive suite of financial tools and insights await, making card management a pleasure.

Yes, the Brink’s Prepaid Mastercard® is FDIC insured. This means that the funds that you load onto the card are protected and insured up to the maximum allowed by law, just as they would be with traditional bank accounts. This provides an additional layer of security and peace of mind regarding the safety of your money. But always make sure to check the card’s terms and conditions to learn about its current protections

The Brink’s Prepaid Mastercard® offers trusted security with modern convenience. It’s a top pick for many, but alternatives are out there.

How to apply for the Brink's Prepaid Mastercard®

Learn how to apply for the Brink's Prepaid Mastercard® and waive all monthly fees with direct deposit. Elevate your banking experience!

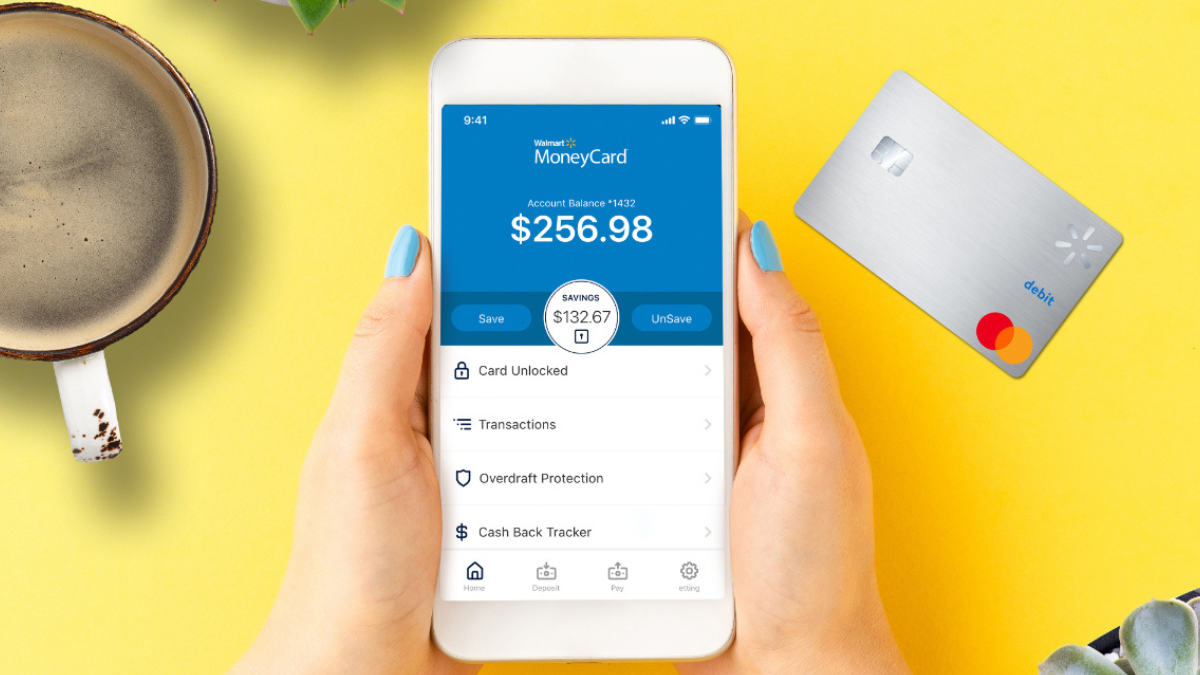

Like the Walmart MoneyCard. With the backing of a retail giant, it promises rewards and wide acceptance, presenting a solid alternative.

Interested in exploring more? Dive into the Walmart MoneyCard’s features and benefits in the following link!

How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide – earn up to 3% cash back on purchases! Read on and learn more!

Trending Topics

OneMain Financial Personal Loans Review: Borrow up to 20k!

Explore our OneMain Financial Personal Loans review – a lifeline for those with low credit, offering unique flexibility in payments.

Keep Reading

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Keep ReadingYou may also like

Apply for the First Access Visa® Card: Free credit score access

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

Keep Reading

PayPal Prepaid Mastercard® review: Earn Payback Rewards

Dive into our PayPal Prepaid Mastercard® review to learn about its benefits, manage your funds wisely, and spend securely everywhere!

Keep Reading

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading