Debit Card

Get paid early: How to apply for the Brink’s Prepaid Mastercard®

Applying for the Brink's Prepaid Mastercard® is your gateway to exceptional rewards with every swipe. Dive in to upgrade your wallet.

Advertisement

A seamless application journey for a premium financial experience

Stepping into the world of premium banking is simple. To apply for the Brink’s Prepaid Mastercard® is to embrace a world of financial perks.

Curious about the process? So read on to get a step-by-step guide on how to easily secure your card and take advantage of its countless benefits.

Online application

Begin by heading over to the Brink’s Prepaid Mastercard® website. Make sure you’re on the official site to maintain your data’s security.

Once on the homepage, look for a button or link that says “Get a Card.” This is your starting point to enter the world of Brink’s financial benefits.

This is when you can choose what you’d like to receive with direct deposit. You can select between a paycheck, tax refund, government benefits, or nothing at all.

You’ll have to provide personal information and other relevant details. Ensure it’s accurate to make the process smooth and to get your card faster.

So, after submitting your application, you’ll receive a confirmation. Follow any steps if required, and soon, you’ll have your Brink’s card in hand.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

The mobile landscape is all about quick tasks, but unfortunately, you can’t apply for the Brink’s Prepaid Mastercard® through their app.

In order to get the card, their website is your go-to. The website offers a detailed, secure platform, ensuring all your data is captured without any issues.

Also, security is important for Brink’s, and their website offers top-notch encryption to protect your information.

But once you get the card, you can download their app and manage your account, pay your balance, check your rewards, and much more!

Brink’s Prepaid Mastercard® or Walmart MoneyCard?

If you’re not sure if you’d like to apply for the Brink’s Prepaid Mastercard® yet and are looking for similar options, then we have a recommendation.

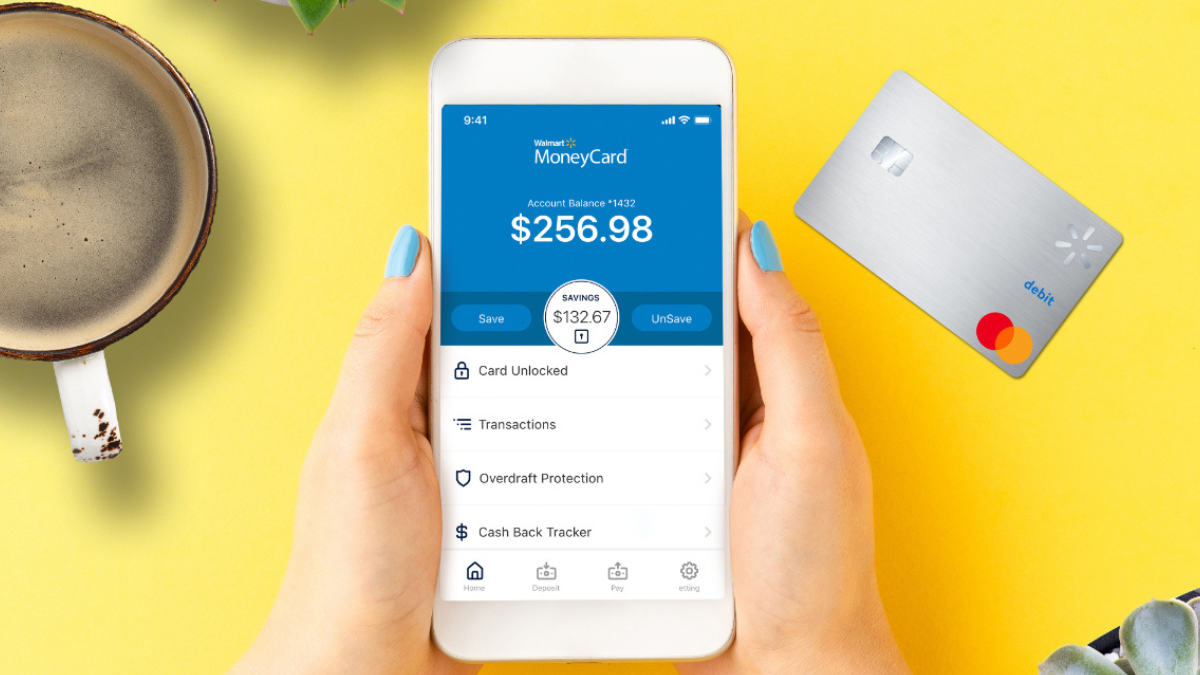

The Walmart MoneyCard is a prepaid card in which you can choose between Visa or Mastercard and earn valuable cash back rewards at Walmart stores.

Explore the comparison table below between these two options so you can choose the one that’s best for your finances.

| Brink’s Prepaid Mastercard® | Walmart MoneyCard | |

| Credit Score | All credit levels are welcome to apply; | All credit levels are welcome; |

| Annual Fee | Pay-As-You-Go℠ Plan: No fees; Monthly Plan: $9.95 per month; Reduced Monthly Plan: $5 per month; | $5.94 monthly fee, which can be waived with a $500+ direct deposit in the previous monthly statement period; |

| Purchase APR | Does not apply; | It does not apply; |

| Cash Advance APR | Does not apply; | None; |

| Welcome Bonus | Earn 500 bonus points once you enroll in the Payback Points program online; | There are no welcome offers currently; |

| Rewards | By enrolling in the Payback Points program, you can earn cash back rewards on selected transactions. | You can earn 3% back at Walmart’s online store, 2% at Walmart fuel stations, and 1% at physical stores. Cash back rewards are up to $75 per year. |

If you like what the Walmart MoneyCard has to offer and would like to learn more about it, check out the following link.

Further, we’ll show you its perks and tell you how to apply for it!

How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide – earn up to 3% cash back on purchases! Read on and learn more!

Trending Topics

Apply for the Upgrade Loans: Borrow Up to $50,000

Learn how to apply for Upgrade Loans and benefit from low-interest rates and flexible terms with our step-by-step guidance.

Keep Reading

Apply for First Progress Platinum Prestige Secured Card: 1% back

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Keep Reading

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep ReadingYou may also like

Up to 3% cash back: Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Keep Reading

Credit builder: Apply for First Digital Mastercard® Credit Card

The process to apply for the First Digital Mastercard® Credit Card is simple and quick! Earn 1% cash back on payments and build credit fast!

Keep Reading