Credit Card

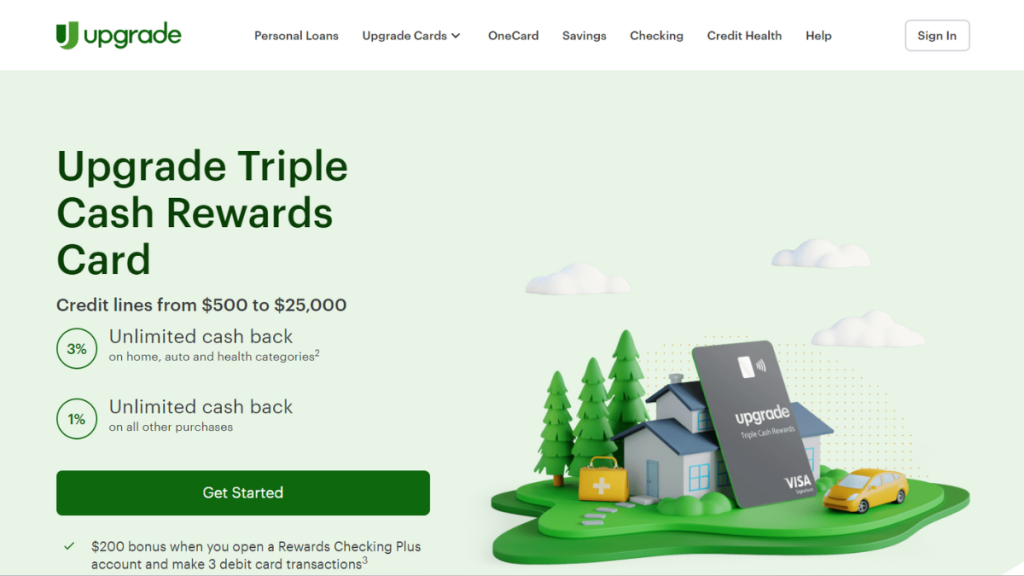

Up to 3% cash back: Apply for Upgrade Triple Cash Rewards Visa®

Upgrade Triple Cash Rewards Visa® provides up to 3% cash back and $200 bonus offer! Keep reading and learn the application process works.

Advertisement

Earn cash back and pay no annual fee!

Are you ready to apply for the Upgrade Triple Cash Rewards Visa®? Great! Then I’ll provide the ins and out of this card’s process!

You can earn up to 3% cash back and a $200 bonus! Amazing, right? So keep reading and learn all that is to know about it! Then let’s go!

Online application

To apply for the Upgrade Triple Cash Rewards Visa®, you must first access their official website.

Further, hit the “Get Started” green button to access the application form. There, you must provide your basic information, including income!

Further, provide an email address and create a password. You must create an account to apply for the Upgrade Triple Cash Rewards Visa®!

Once done, submit the form and wait for the response! So if approved, you can start enjoying your credit card!

Lastly, remember that to earn the $200 bonus, you must open a Rewards Checking account and make 3 transactions with your debit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

You can only apply for the Upgrade Triple Cash Rewards Visa® through their official website. Still, you can do it through your mobile device.

Thus, you can enjoy the Upgrade mobile app to manage your account if approved! Indeed, it is available at the Google Play and Apple stores!

There, you can make payments, view your card’s available limit, make transactions, redeem cash back, and much more!

Upgrade Triple Cash Rewards Visa® or PenFed Power Cash Rewards Visa Signature® Card?

The Upgrade Triple Cash Rewards Visa® and the PenFed Power Cash Rewards Visa Signature® Card are excellent options to earn while spending!

The Upgrade Triple, Cash Rewards Visa®, offers up to 3% cash back on purchases and a $200 welcome bonus!

On the other hand, the PenFed Power Cash Rewards Visa Signature® Card offers up to 2% back and a $100 bonus! Plus, 0% intro APR on balance transfers!

Which one to choose? Well, it is up to you! Further, compare both cards’ main features!

| Upgrade Triple Cash Rewards Visa® | PenFed Power Cash Rewards Visa Signature® Card | |

| Credit Score | Good to excellent; | Good to excellent; |

| Annual Fee | No annual fee; | $0 annual fee; |

| Purchase APR | 14.99% – 29.99%; | 17.99% variable APR; |

| Cash Advance APR | Not disclosed; | 17.99%; |

| Welcome Bonus | Earn a $200 bonus after opening a Reward Checking account and making 3 debit card transactions; | Earn a $100 bonus in statement credit after spending $1,500 in the first 90 days from account opening; |

| Rewards | Earn 3% cash back in select home, auto, and health brands. Earn 1% cash back on all other purchases. | Earn 2% cash back if you are a PenFed Honors Advantage Member; earn 1.5% on all other purchases. |

Further, learn how to easily apply for the PenFed Power Cash Rewards Visa Signature® Card! Keep reading for more!

Apply for PenFed Power Cash Rewards Visa Signature

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

About the author / Luis Felipe Xavier

Trending Topics

OneMain Financial Personal Loans Review: Borrow up to 20k!

Explore our OneMain Financial Personal Loans review – a lifeline for those with low credit, offering unique flexibility in payments.

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard® today and earn a mile for every dollar spent! Sign-up bonus of 50K miles!

Keep ReadingYou may also like

How to make $5k a month: The ultimate blueprint for success

Are you wondering how to make $5k a month? Then you're in the right place! Keep reading and find out our top-notch tips to make extra money!

Keep Reading

Earn up to 5% back: Capital One Walmart Rewards® Card review

Looking for a card with great rewards and no $0 annual fee? Learn how to with this Capital One Walmart Rewards® Card review!

Keep Reading

Brink’s Prepaid Mastercard® review: Earn cash back rewards!

Discover insights in our comprehensive Brink's Prepaid Mastercard® review! Enjoy flexible loading options, and cash back rewards.

Keep Reading