Debit Card

Brink’s Prepaid Mastercard® review: Earn cash back rewards!

Experience the convenience of the Brink's Prepaid Mastercard®. Designed for the modern spender, it promises secure transactions and unmatched rewards!

Advertisement

Navigate through modern banking solutions tailored to your financial habits

In our Brink’s Prepaid Mastercard® review, we’re going to dive into why this card isn’t just about transactions; it’s about how you manage your money.

How to apply for the Brink's Prepaid Mastercard®

Learn how to apply for the Brink's Prepaid Mastercard® and waive all monthly fees with direct deposit. Elevate your banking experience!

Whether you’re budgeting for daily expenses or planning bigger purchases, Brink’s is set to be your trusty financial companion. So let’s explore why.

| Credit Score | All credit levels are welcome to apply; |

| Annual Fee | Pay-As-You-Go℠ Plan: No fees; Monthly Plan: $9.95 per month; Reduced Monthly Plan: $5 per month. |

| Purchase APR | Does not apply; |

| Cash Advance APR | Does not apply; |

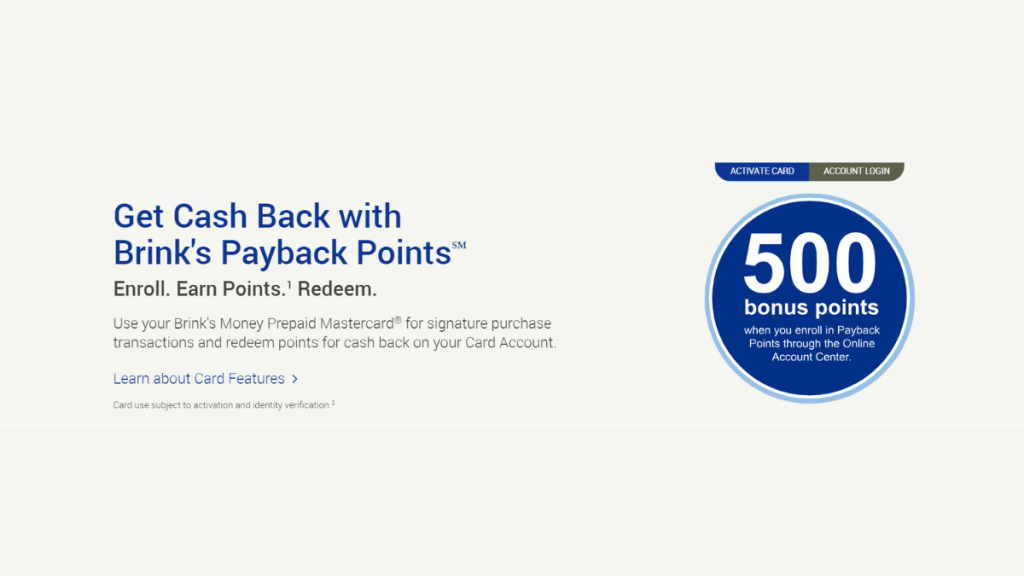

| Welcome Bonus | Earn 500 bonus points once you enroll in the Payback Points program online; |

| Rewards | By enrolling in the Payback Points program, you can earn cash back rewards on selected transactions. |

Brink’s Prepaid Mastercard®: All you need to know

Navigating today’s financial waters requires a reliable tool. Enter the Brink’s Prepaid Mastercard®. It is a revolution in money management.

With Brink’s, you’re not just spending; you’re protected. Known for its robust security measures, every transaction is wrapped in a layer of trust.

Furthermore, you can choose which of their plans aligns with you, and even enroll in their Payback Points program to earn cash back on selected purchases.

Also, the card provides an impressive set of features, including the ability to earn your paycheck two days in advance with direct deposit.

It also offers flexible loading options, a $10 purchase cushion for overdrafts, and the option to earn up to 5% APY with their Savings Account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Brink’s Prepaid Mastercard®

Diving further into our Brink’s Prepaid Mastercard® review, we’ll unpack the standout pros and a few considerations to keep in mind.

Pros

- Benefit from Brink’s renowned protection ensuring safe transactions every time;

- Cash back rewards on selected purchases (terms apply);

- Waive your monthly fee with $500+ direct deposits every month;

- Opt-in Savings Account with 5.00% APY savings up to $1,000;

- Referral bonuses for you and your friends;

- Intuitive app for easy account management and seamless transactions.

Cons

- Be aware of charges for certain transactions and plans, which can add up;

- No credit building features, so usage won’t impact your current score;

- This is a prepaid card, so you won’t have access to an unsecured credit line.

What credit score do you need to apply?

Indeed, there’s no credit score requirements for the Brink’s Prepaid Mastercard®.

It’s a prepaid card, which means you’re not being extended a line of credit by the issuer. Instead, you load the card with your own funds and then use it.

Since there’s no borrowing involved, there’s no credit check, and it doesn’t impact your score like a credit card.

How to easily apply for the Brink’s Prepaid Mastercard®?

So, are you ready to redefine your spending experience? Hopefully, our Brink’s Prepaid Mastercard® review has shed light on its unmatched perks.

Now, dive into the next post to discover how easy it is to get your card and unlock a world of financial convenience.

Indeed, the future of simplified banking is just an application away!

How to apply for the Brink's Prepaid Mastercard®

Learn how to apply for the Brink's Prepaid Mastercard® and waive all monthly fees with direct deposit. Elevate your banking experience!

Trending Topics

Discover it® Cash Back Credit Card Review: Boost Earnings

Explore our Discover it® Cash Back Credit Card review to uncover exclusive benefits, including a generous cash back and zero annual fees.

Keep Reading

Apply for the Discover it® Cash Back Credit Card: Extra Perks

Learn the steps to apply for the Discover it® Cash Back Credit Card and enjoy its hefty welcome bonus. Check our quick and simple guide!

Keep Reading

Choose Your 0% APR Credit Card: Maximize Your Savings on Interest

Discover the best 0% APR Credit Card for your needs. Our tips will guide you in choosing wisely. Learn more and make smart financial moves!

Keep ReadingYou may also like

Citi Custom Cash® Card Review: Smart Spending Rewarded

Read our Citi Custom Cash® Card review for insights on its fantastic welcome bonus, 5% cash back in select categories, and no annual fee.

Keep Reading

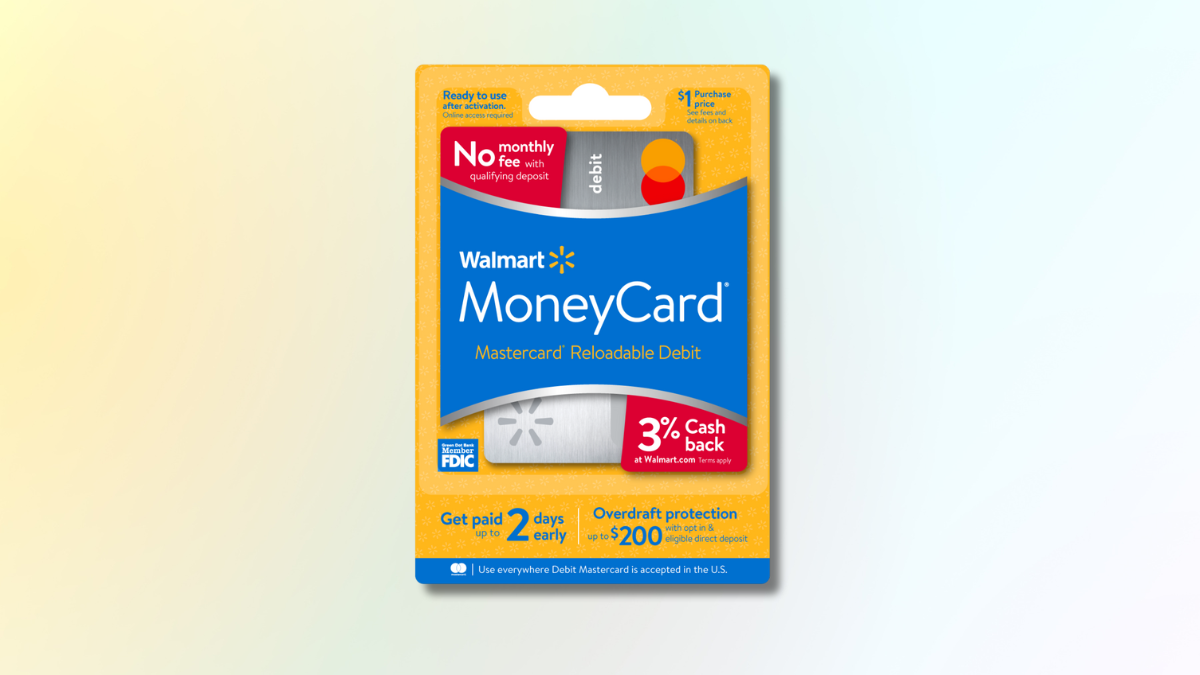

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep Reading

Find your perfect match: Choose the right credit card

Choose the right credit card for your finances and unlock your real potential! Keep reading and learn what you need to know!

Keep Reading