Credit Card

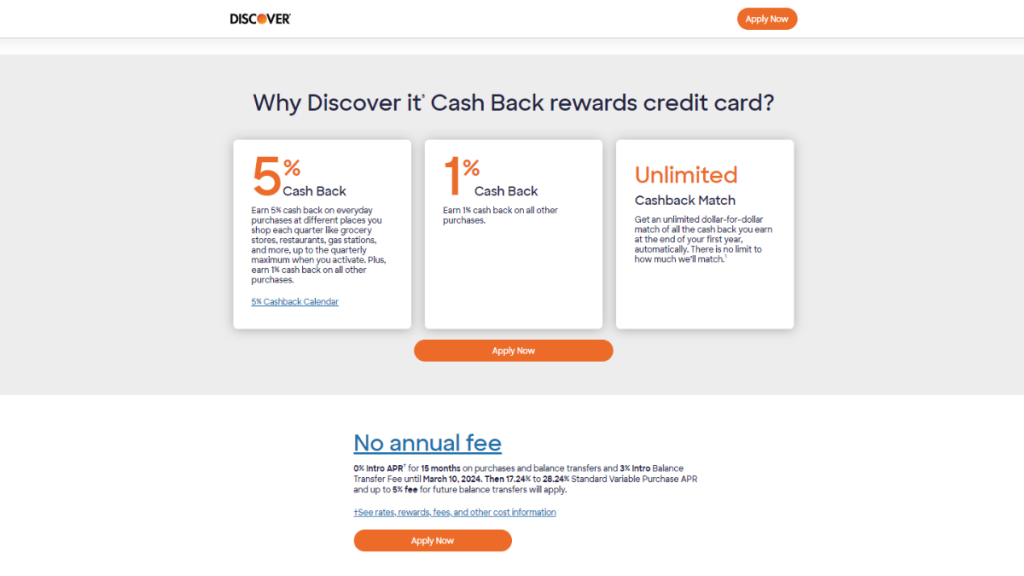

Apply for the Discover it® Cash Back Credit Card: Extra Perks

Learn how to easily apply for the Discover it® Cash Back Credit Card through our simple guide and start enjoying its exclusive benefits and rewards effortlessly with every swipe!

Advertisement

Unlock a world of benefits and bonuses with this exclusive card offer!

Looking to apply for the Discover it® Cash Back Credit Card? Inded, our guide simplifies the process, making it easy and straightforward for you.

Stay tuned to uncover the steps to apply and unlock the card’s full potential. So check our full article for a comprehensive walkthrough.

Online application

To start the process to apply for the Discover it® Cash Back Credit Card, first visit Discover’s official website.

Following this, locate and hit the ‘Apply Now’ button. This will lead you to the application form, where you’ll need to enter your personal details.

Before submitting, take a step back to double-check all the information you’ve inputted.

Furthermore, in the final step, confidently submit your application.

Responses are usually prompt, and if approved, you’ll soon receive your card, ready to be activated and put to use.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Moreover, you can’t apply for the Discover it® Cash Back Credit Card through their mobile app.

However, it’s worth noting that Discover’s website is mobile-friendly.

This means you can easily navigate and apply for the card using your smartphone’s browser.

Once you have the card, the Discover mobile app becomes a valuable tool.

So it allows you to manage your account, track spending, and redeem rewards right from your phone.

Discover it® Cash Back Credit Card or Chase Freedom Unlimited® Credit Card?

In conclusion, the Discover it® Cash Back Credit Card stands out for its cash back rewards and user-friendly features.

It’s a solid choice for those looking to maximize their spending.

If you’re considering alternatives, the Chase Freedom Unlimited® Credit Card is an excellent option.

Furthermore, it offers different benefits that might suit your needs better.

The Chase Freedom Unlimited® comes with unlimited 1.5% cash back on every purchase, no annual fee, and a generous welcome bonus, making it a competitive choice in the market.

| Discover it® Cash Back Credit Card | Chase Freedom Unlimited® Credit Card | |

| Credit Score | Ideal for those with scores from 670 upwards. | Best for those with a FICO ® score of 690-850. |

| Annual Fee | Absolutely no annual fee, making it a savvy choice. | This card is a practical choice for daily spending with no annual fee. |

| Purchase APR | 0% for the first 15 months, valid for purchases and balance transfers, then a variable 17.24% to 28.24% APR thereafter. | Initially, enjoy a 0% APR for 15 months. Subsequently, it shifts to a variable rate of 20.49% to 29.24%. |

| Cash Advance APR | Stands at a variable 29.99%. | The variable rate is currently 29.99%. |

| Welcome Bonus | A one-of-a-kind match of all cash back earned in your first year, without any upper limit. | $200 bonus and 5% back on purchases at gas stations and grocery stores (terms apply), after spending $500 within the first three months. |

| Rewards | 5% cash back in rotating categories each quarter up to a quarterly max upon activation, plus an ongoing 1% on all other purchases. | Up to 5% cash back rewards on select purchases. |

To explore more about the Chase Freedom Unlimited® Credit Card and learn how to apply, check out the link below.

Dive into its features and see if it aligns with your financial goals.

Apply for Chase Freedom Unlimited® Credit Card

Learn how to apply for the Chase Freedom Unlimited® Credit Card and explore its benefits – maximize rewards and savings effortlessly!

Trending Topics

Hassle-free: Apply for Chime Credit Builder Secured Visa® Card

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Keep ReadingYou may also like

Credit Report Repair Involves Goodwill And Friendliness

Unlock financial freedom with credit report repair. Our tips will help you improve your credit score and secure your financial future.

Keep Reading

Apply for First Progress Platinum Prestige Secured Card: 1% back

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Keep Reading

Mission Lane Visa® Credit Card review: Simplify your finances

Discover the Mission Lane Visa® Credit Card: A credit card that simplifies your life. With global acceptance. Check out!

Keep Reading