Credit Card

Apply for Chase Freedom Unlimited® Credit Card: $0 annual fee

Get the complete guide on how to apply for the Chase Freedom Unlimited® Credit Card. 0% intro APR for 15 months!

Advertisement

Unlock exclusive rewards and benefits with a simple online application!

So, are you excited to apply for the Chase Freedom Unlimited® Credit Card? Then discover the easy steps to unlock a world of rewards.

Curious about the perks that await? Continue reading our article to learn how to apply and start reaping the benefits of this exceptional card!

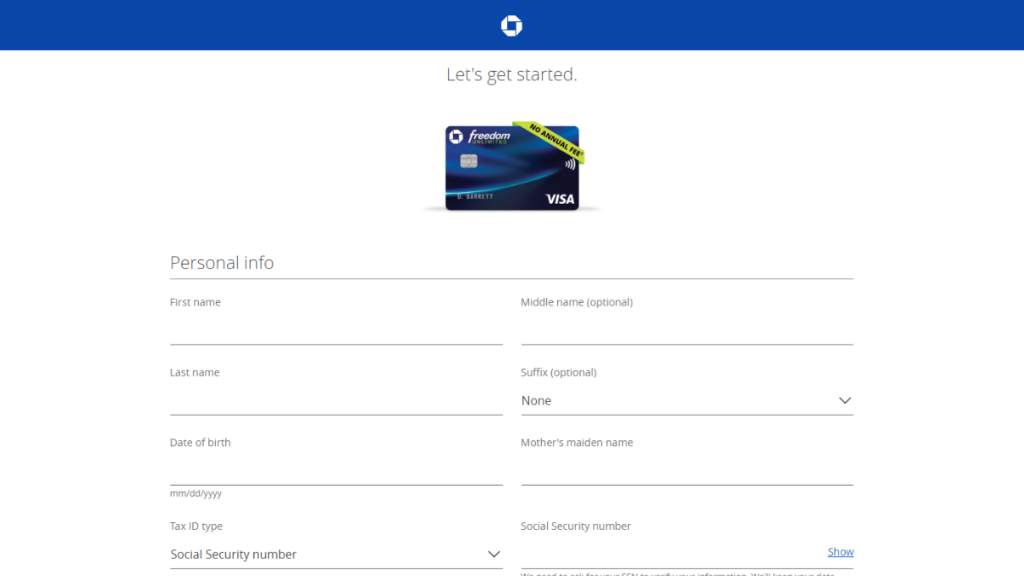

Online application

To apply for the Chase Freedom Unlimited® Credit Card, visit the Chase website. We’ve provided the link above.

Now, it’s time to start the application process. Click the ‘Apply as a Guest’ button. You’ll be prompted to enter personal information.

Afterward, you’ll need to provide additional details, including your social security number and employment information.

Once you’ve completed the form, ensure all the information is correct to avoid any delays in processing. When you’re ready, hit ‘Submit’.

Finally, you’ll receive a confirmation message from Chase. They typically review applications quickly, and you can expect a response soon.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

While you can’t directly apply for Chase Freedom Unlimited® Credit Card through their mobile app, don’t worry.

Also, Chase’s website is fully mobile-friendly!

Furthermore, once you’ve successfully applied via the website and received your card, the Chase mobile app allows you to manage your card easily.

Additionally, using the Chase app, you can set up alerts for your Freedom Unlimited® card, view recent transactions, and even make payments.

Chase Freedom Unlimited® Credit Card or Bank of America® Customized Cash Rewards Credit Card?

The Chase Freedom Unlimited® Credit Card wraps up with compelling rewards, perfect for diverse spending. It’s a solid choice for those seeking flexibility and value.

Intrigued by different choices? Dive into the world of the Bank of America® Customized Cash Rewards.

Indeed, it’s crafted to match your spending style, offering unique perks just for you.

| Chase Freedom Unlimited® Credit Card | Bank of America® Customized Cash Rewards Credit Card | |

| Credit Score | Ideal for individuals with a good to excellent credit score range. | Aim for good to excellent. |

| Annual Fee | Get all the benefits with no annual fee, making this card a smart pick for your everyday spending. | Enjoy $0 annual fee luxury. |

| Purchase APR | Enjoy 0% APR for the first 15 months for more spending freedom. After that, the APR changes to a variable rate between 20.49% and 29.24%. | 0% intro APR for 15 billing cycles; 18.24% to 28.24% after. |

| Cash Advance APR | 29.99% varying in line with market rates. | 21.24% to 29.24%. |

| Welcome Bonus | Earn a $200 bonus and a 5% rebate on gas stations and grocery stores after spending $500 on purchases within the first 3 months. | Online $200 bonus in the first 90 days of account opening on purchases of at least $1,000. |

| Rewards | Rack up 5% rewards on travel through Chase Ultimate Rewards®, enjoy 3% back on dining and drugstore purchases, and accumulate 1.5% on all your other spending. | Earn 3% back in your chosen category, 2% cash back at grocery stores and wholesale clubs, 1% on all other purchases, and more. |

Further, check a full rundown on the Bank of America® Customized Cash Rewards and discover how to make this adaptable card yours.

Apply for Bank of America® Customized Cash Rewards

Discover how to apply for a Bank of America® Customized Cash Rewards Credit Card today! Ensure 0% intro APR for 15 months and more! Read on!

Trending Topics

$0 annual fee: Bank of America® Customized Cash Rewards Credit Card review

Looking for cash-back, benefits, and more? Get into this review of the Bank of America® Customized Cash Rewards Credit Card and discover!

Keep Reading

First Digital Mastercard® Credit Card review: 1% cash back

Discover the main features of this card in our First Digital Mastercard® Credit Card review! Start building credit today! Read on!

Keep Reading

How many mortgages can you have? A guide for investors

Are you an investor looking to maximize your returns? Discover how many mortgages you can have and the best strategies for utilizing them!

Keep ReadingYou may also like

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep Reading

First Access Visa® Card review: Earn 1% back on card payments!

Explore our detailed First Access Visa® Card review to learn about its features and benefits. Earn 1% cash back on purchases and more!

Keep Reading

Apply for the Boost Platinum Card: 7-day trial period

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

Keep Reading