Credit Card

Apply for the Boost Platinum Card: 7-day trial period

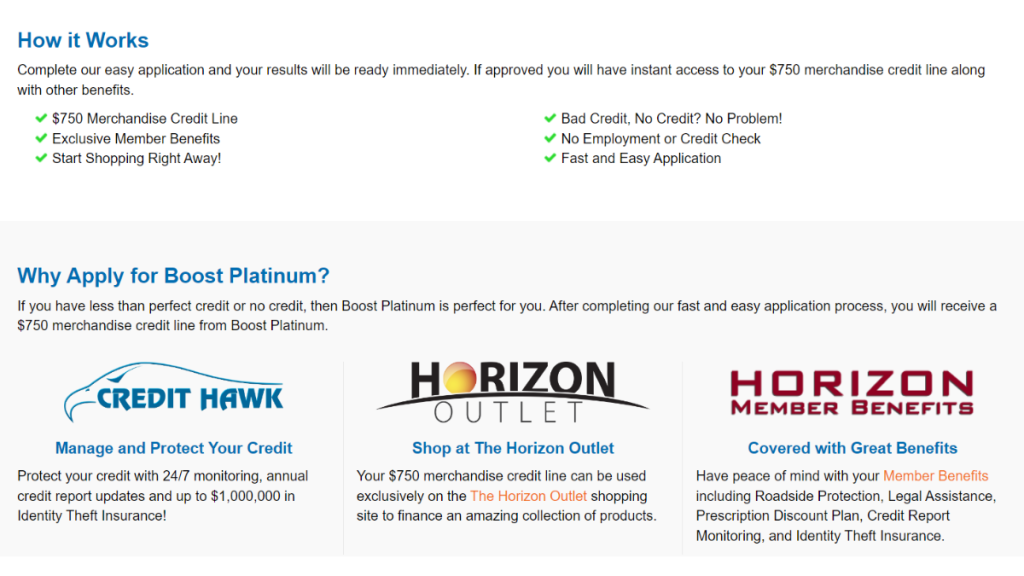

Exploring options for your financial future? Our guide walks you through the steps to apply for the Boost Platinum Card. $750 credit limit!

Advertisement

Dive into our easy application guide and secure your $750 merchandise credit line!

Ready to apply for the Boost Platinum Card? With our guidance, you’ll have the card in your hands quickly.

Indeed, the Boost Platinum Card offers an unsecured line of credit up to $750, and people of all credit scores are welcome to apply. So read on!

Online application

To apply for the Boost Platinum Card online, visit the website. On the homepage, you’ll see a section offering you access to a $750 card.

To begin your application, simply write down your email and ZIP code. Check all the boxes that apply to you, then click “continue activation process”.

Further, the next step is creating a profile. So provide your personal information and contact details. Next, put down your financial info.

Before submitting your profile, review all the details you provided and take a few minutes to read the card’s Terms & Costs.

If you agree to the issuer’s terms, submit your profile and wait for them to review it. Furthermore, you’ll be contacted via email or SMS if you get the card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Indeed, there is no mobile app available for this card.

You can only apply for the Boost Platinum Card by visiting their official website and filling out your request from there.

Boost Platinum Card or Petal® 1 “No Annual Fee” Visa® Credit Card?

If you’ve had financial mishaps, you don’t need to settle for a merchandise card if you’re not inclined to.

While the Boost Platinum offers great perks for those who wish to regain their purchasing power, the Petal® 1 Visa® is also a solid option.

The Petal card is also designed for individuals with limited credit history and offers a fresh approach to approvals.

Another standout feature is that while fees are associated with the Boost, the Petal® 1 card has no annual fee.

So, if you’re interested in no annual fees and a unique approach to credit assessment, it might be worth exploring the Petal® 1 Card.

| Boost Platinum Card | Petal® 1 “No Annual Fee” Visa® Credit Card | |

| Credit Score: | Damaged to Fair Credit; | No Credit to Fair Credit; |

| Annual Fee: | $14.77 per month ($177.24 annually); | $0; |

| Purchase APR: | None; | 25.24% – 34.74% variable; |

| Cash Advance APR: | Does not apply; | N/A; |

| Welcome Bonus: | None; | None, currently; |

| Rewards: | This is not a rewards card. | 2% – 10% cash back at select merchants. |

Check the following link to learn how to apply for it.

Apply Petal® 1 “No Annual Fee” Visa® Credit Card

Wondering how to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card? Then read on! Earn up to 10% cash back on purchases!

Trending Topics

Apply for the FIT® Platinum Mastercard®: Unlock Better Credit!

Thinking to boost your credit? See how to apply for the FIT® Platinum Mastercard® and embark on a journey to financial growth.

Keep Reading

Apply for the Discover it® Cash Back Credit Card: Extra Perks

Learn the steps to apply for the Discover it® Cash Back Credit Card and enjoy its hefty welcome bonus. Check our quick and simple guide!

Keep Reading

Apply for the Rocket Personal Loans: Easy Online Process!

Take a leap forward when you apply for the Rocket Personal Loans. It features instant decisions and a hassle-free online application.

Keep ReadingYou may also like

First Digital Mastercard® Credit Card review: 1% cash back

Discover the main features of this card in our First Digital Mastercard® Credit Card review! Start building credit today! Read on!

Keep Reading

Maximized earnings: Apply the Capital One Walmart Rewards® Card

Looking to apply for the Capital One Walmart Rewards® Card? We've got you covered! Read on and discover how to earn unlimited cash back!

Keep Reading