Debt & Credit Information

Cheap Loans – the Car Cost Down

Advertisement

If you want to get a car to satisfy your need, either to leave the house or operate a business, you can acquire a loan that caters to your needs. These loans are available to take care of any kind of requirements you have for whatever purpose they serve. These can be used for purchasing a brand-new or used car. In the UK, certain companies offer loans on a certain age and value of the property desired. The company evaluates the value of the home that you are planning to buy prior to providing you with the loan. The primary advantage of these types of cars is purchasing discussions are made easy.

Cheap loans are normally of three kinds- secured, unsecured, and same-day. Secured cheap loans can be procured when a borrower provides a security to affix the borrower’s signature on the loan documentation. Secured loans give ample firmness to the money borrowed. One can procure commercial vehicle loans with the lowest possible interest rates by signing an agreement with the vehicle dealer or a mortgage firm.

Unsecured loans need no money to be deposited with the bank or the lending firm. Nevertheless, lenders take stricter procedures to ascertain the repayment ability of the borrowers. The loan is procured for a smaller margin. While getting the loan, lenders focus on factors such as credit status, monthly savings, guaranteed income, and the borrowers’ income from the previous six months.

Convincing income to be able to get a self-cert is a pain in the neck. All loans are subject to credit scoring and this might hinder the desire to get cheap loans. Same-day cheap loans are normally provided at a higher interest rate.

Getting commercial vehicle loans is an exhausting task. It requires time, effort, and research. Before engaging a lender, try to carry out some research on a reliable firm. This will ensure that the quotes are accurate and you will not be cheated. Lenders keep their interest rates pretty low to encourage applicants. Even unlike home loans, the amount is lent by the bank or finance company and not taken from the borrowers as a single amount.

To get a cheap loan, the application is provided by the entire transaction in a span of 30 days. After the technical evaluation of the documents is done, the package of cheap loans is sent to the borrower. The loan is disbursed in a day’s time, generally within a week. The loan on these terms remains offset for the period of the loan. The repayment schedule is very straightforward. The amount of payments depends on the schedule at the time of disbursement. The dollar amount of a car is decided on the amount of money being borrowed. The more your income is, the more you can avail a loan.

A cheap loan is a pain-free means of getting a car. It is a hassle-free way of investing money. Lenders take care of the back and forth of the process, making sure that you are able to make the payments easily.

A car is not a luxury item but a necessity of life. You should be careful while investing in cheap car loans. Quality loans are the ones that are worth the paper they are written on because they will cater to your specific needs. So that you are free from repayment trouble, they offer customer-friendly interest rates.

Trending Topics

Destiny Mastercard® review: A Stepping Stone For Good Credit

Unlock the secrets of the Destiny Mastercard® in our comprehensive review to see if it's the right choice for your financial future.

Keep Reading

Maximized earnings: Apply the Capital One Walmart Rewards® Card

Looking to apply for the Capital One Walmart Rewards® Card? We've got you covered! Read on and discover how to earn unlimited cash back!

Keep ReadingYou may also like

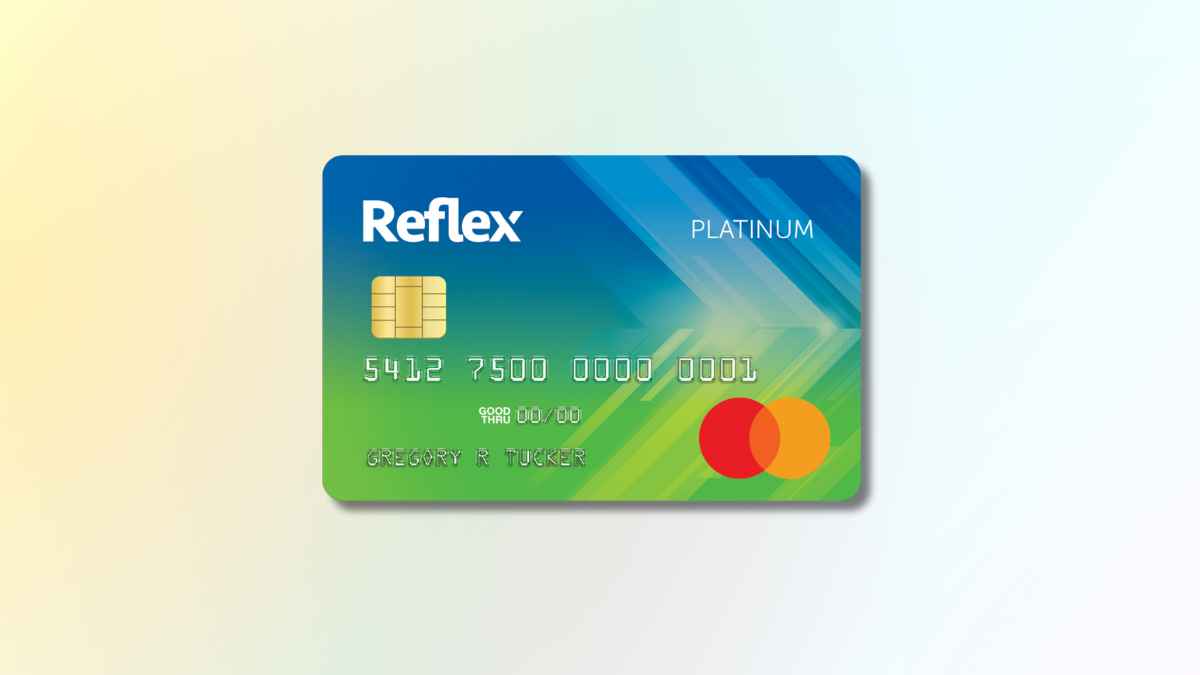

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading

Up to 3% cash back: Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Keep Reading

FIT® Platinum Mastercard® review: Your Gateway to Better Credit

Dive into our FIT® Platinum Mastercard® review to discover how this credit builder card can elevate your financial journey. Learn more!

Keep Reading