Credit Card

Double your limit in no time: Apply for the Reflex Mastercard®

Don't let complicated credit applications hold you back. Reflex Mastercard® is here to help you build credit in no time!

Advertisement

24/7 account management by app and application in a few steps

If you’re looking for a credit card to help you build or improve your credit score, then apply for the Reflex Mastercard®.

With features like 24/7 account management and free credit score access, managing your finances has never been easier. So read on!

Online application

The easiest way to apply for the Reflex Mastercard® is online. To start, visit the Reflex Mastercard® website and click the “Apply Now” button.

You’ll be taken to a page where you’ll need to provide some basic information, including your name, address, date of birth, and Social Security number.

You’ll also need to provide information about your income and employment status. Once you’ve completed the application, click the “Submit” button.

You should receive a response within a few minutes, letting you know whether your application has been approved.

However, you’ll be asked to sign an agreement and provide any additional information needed if approved.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

If you prefer to apply for the Reflex Mastercard® using your mobile device, you can download the Mission Lane app from the App Store or Google Play.

Once you’ve downloaded the app, create an account and follow the instructions to apply for the card.

The application process is similar to the online one, but you’ll need to provide additional information about your device, such as its make and model.

You’ll also need to take a photo of your ID and upload it to the app.

Reflex Mastercard® or Petal® 1 “No Annual Fee” Visa® Credit Card?

If you’re considering the Reflex Mastercard®, you may also be interested in the Petal® 1 “No Annual Fee” Visa® Credit Card.

Both cards are designed to help you build or improve your credit score, but they have some key differences.

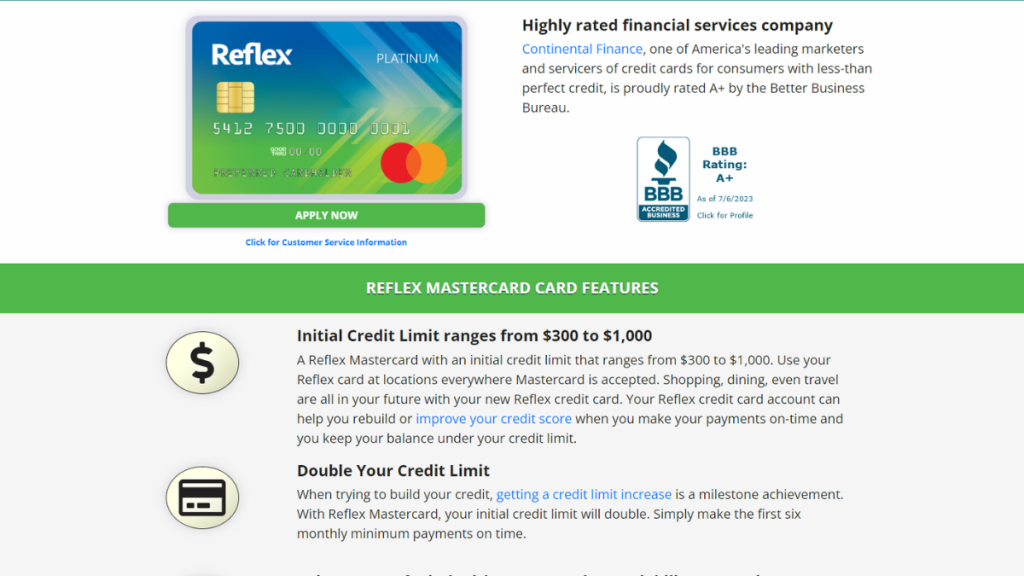

The Reflex Mastercard® offers a welcome bonus of up to $1,000 credit limit that doubles up to $2,000.

The Petal® 1 “No Annual Fee” Visa® Credit Card offers cash back on purchases!

So, if you plan to use your credit card for international travel or online shopping, this could be an important factor to consider. Check out!

| Reflex Mastercard® | Petal® 1 “No Annual Fee” Visa® Credit Card | |

| Credit Score | 300-719 (Poor – Good); | Poor – Fair; |

| Annual Fee | $75 – $125; | No annual fee; |

| Purchase APR | 29.99% APR (Variable); | 25.24% – 34.74% variable APR; |

| Cash Advance APR | Not disclosed; | Not disclosed; |

| Welcome Bonus | Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time); | None; |

| Rewards | None. | Earn up to 10% cash back on select merchants. |

If you’re interested in applying for Petal® 1 “No Annual Fee” Visa® Credit Card, check out our step-by-step guide on applying.

Finally, it’s quick and easy and can help you get on your way to building better credit.

Apply Petal® 1 “No Annual Fee” Visa® Credit Card

Wondering how to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card? Then read on! Earn up to 10% cash back on purchases!

About the author / Sabrina Paes

Trending Topics

Chase Freedom Flex℠ Credit Card Review: 0% APR and Much More!

Explore our Chase Freedom Flex℠ Credit Card review for exclusive cash back rewards & 0% intro APR benefits. Maximize your spending smartly!

Keep Reading

Avant Personal Loans Review: Quick Cash, Your Way!

Explore our Avant Personal Loans review and see how to get fast funding with loans up to $35,000! Dive into rates, terms, and more.

Keep Reading

Reflex Mastercard® review: Boost Your Credit Score

Looking to boost your credit score? This Reflex Mastercard® review could be the answer! After all, this card is for all credit scores!

Keep ReadingYou may also like

Earn up to 5% back: Capital One Walmart Rewards® Card review

Looking for a card with great rewards and no $0 annual fee? Learn how to with this Capital One Walmart Rewards® Card review!

Keep Reading

Apply for the Rocket Personal Loans: Easy Online Process!

Take a leap forward when you apply for the Rocket Personal Loans. It features instant decisions and a hassle-free online application.

Keep Reading

Things that might happen if you don’t use your credit card!

Have you ever wondered what happens if you don't use your credit card? Don't worry! We'll explain everything your need here! Keep reading!

Keep Reading