Credit Card

Reflex Mastercard® review: Boost Your Credit Score

With no security deposit required and a credit limit of up to $1,000 (which could double to up to $2,000), this card is a great option.

Advertisement

Double your credit limit quickly

Are you looking to improve your credit score? Then don’t miss our Reflex Mastercard® review.

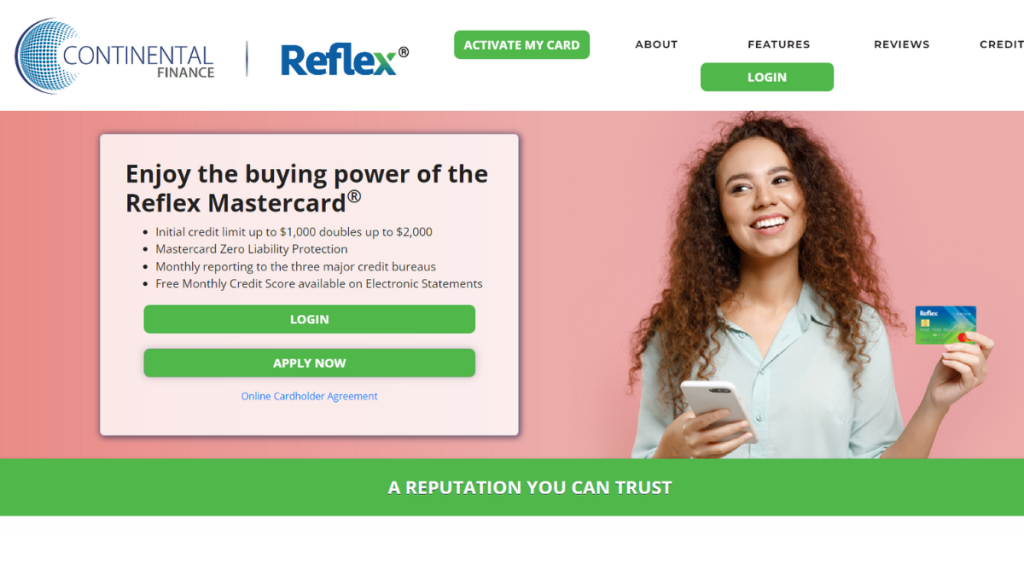

Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Further, we’ll take a closer look at what the Reflex Mastercard® has to offer and help you decide if it’s the right choice for you.

| Credit Score | 300-719 (Poor – Good); |

| Annual Fee | $75 – $125; |

| Purchase APR | 29.99% APR (Variable); |

| Cash Advance APR | Not disclosed; |

| Welcome Bonus | Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time); |

| Rewards | None. |

Reflex Mastercard®: All you need to know

The Reflex Mastercard® is designed for individuals looking to build or improve their credit score.

Moreover, this card offers a security deposit required, a credit limit of up to $1,000 (which could double), and a competitive annual fee of just $99.

The online application process is simple, and you can access various features, including 24/7 account management and free credit score access.

So if you’re looking for a straightforward credit-building card, the Reflex Mastercard® could be your right choice.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Reflex Mastercard®

The Reflex Mastercard® is designed for individuals looking to build or improve their credit score.

Also, with no security deposit required, this unsecured credit card offers a credit limit of up to $1,000.

The Reflex Mastercard® also offers an easy online application process, which takes just a few minutes to complete.

Once you’re approved, you can start using your card right away. So, check out the pros and cons.

Pros

- Easy application process;

- No security deposit required;

- Credit limit up to $1,000 (which could double to up to $2,000).

Cons

- High APR of 29.99% (variable);

- No rewards program.

What credit score do you need to apply?

Indeed, the Reflex Mastercard® is designed for individuals with poor to good credit scores, ranging from 300-719.

If you’re struggling to get approved for other credit cards or want to build your credit score, the Reflex Mastercard® could be a great option.

Remember that while this card may have a higher APR than others, it can still be a valuable tool for improving your credit score.

How to easily apply for the Reflex Mastercard®?

Overall, if you’re looking for a straightforward credit card to help you improve your credit score, the Reflex Mastercard® is a great choice.

With its easy application process, competitive annual fee, and credit-building benefits, this card can help you take control of your financial future.

So why wait? Further, learn our post below and how to apply for the Reflex Mastercard® today and start building your credit score immediately!

Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

About the author / Sabrina Paes

Trending Topics

Apply for First Progress Platinum Prestige Secured Card: 1% back

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Keep Reading

Apply for the PenFed Power Cash Rewards Visa Signature® Card

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

Keep Reading

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep ReadingYou may also like

Earn up to 5% back: Capital One Walmart Rewards® Card review

Looking for a card with great rewards and no $0 annual fee? Learn how to with this Capital One Walmart Rewards® Card review!

Keep Reading

Apply for the First Latitude Secured Mastercard® Credit Card

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Keep Reading

Can an Overdraft Affect Your Credit Score?

Does overdraft affect your credit score? Learn facts and tips to protect your financial health and credit rating. Stay informed and secure.

Keep Reading