Credit Card

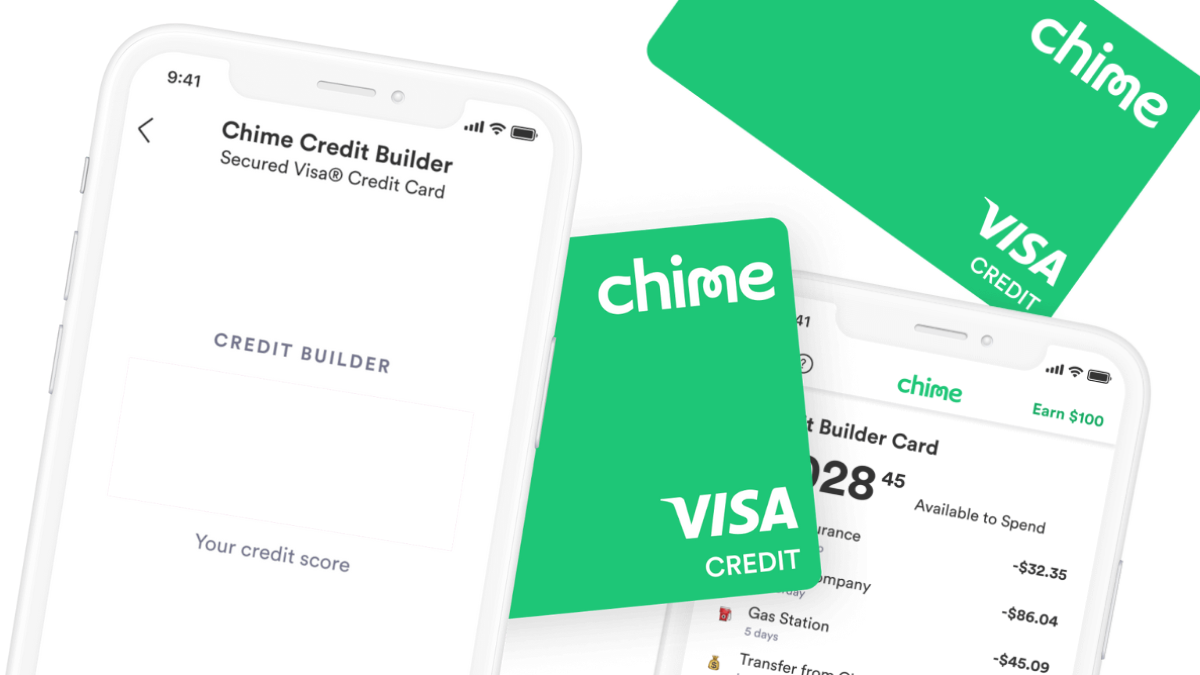

$0 annual fee: Chime Credit Builder Secured Visa® Card review

The Chime Credit Builder Secured Visa® Card requires no minimum security deposit! Qualify with no credit check! Read on and learn more!

Advertisement

Pay no interest and build credit fast

Your credit-building journey will change once and for all after this Chime Credit Builder Secured Visa® Card review! That is right!

Apply for the Chime Credit Builder Secured Visa®

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

You can build credit fast with this secured credit card! So keep reading and learn all that is to know about it! Are you ready? Then let’s go!

| Credit Score | No credit check is required; |

| Annual Fee | $0; |

| Purchase APR | 0%; |

| Cash Advance APR | N/A; |

| Welcome Bonus | N/A; |

| Rewards | N/A. |

Chime Credit Builder Secured Visa® Card: All you need to know

If you don’t have a credit history and want to build it quickly, the Chime Credit Builder Secured Visa® Card is a must!

Firstly, we are talking about a very cheap credit card! In fact, it charges no annual fee and no APR! Yes, that is true!

Also, this secured credit has no minimum security deposit requirement. But you must know that this deposit will be your credit limit!

Indeed, this credit card offers a secure and affordable option to those who need to build their credit scores safely.

All you need to do is stay on top of your payments! This way, your activity will be reported to the major credit bureaus, and your rating will surely increase.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Chime Credit Builder Secured Visa® Card

You don’t often find a cheap credit card that will help establish a credit history like this one!

But to make the right decision, you must consider all its details! Especially compare the benefits and drawbacks it might bring to your finances!

So below, review the Chime Credit Builder Secured Visa® Card pros and cons! Check it out!

Pros

- No annual fee;

- No interest;

- No minimum security deposit;

- Enjoy an adjustable credit limit;

- Build a credit history.

Cons

- You must open a Chime account to get this credit card;

- It offers no rewards or welcome bonuses;

- There are no upgrade perspectives.

What credit score do you need to apply?

Since we are talking about a secured credit card, there is no credit check to qualify for it!

In fact, as you can see in our review, the Chime Credit Builder Secured Visa® Card is an easy-to-get credit card option!

So all you have to do is open a Chime account! Simple, isn’t it?

How to easily apply for the Chime Credit Builder Secured Visa® Card?

Are you ready to start a new path in your credit-building journey? Then you must apply for the Chime Credit Builder Secured Visa® Card fast!

So if you want to learn more about this card’s application process, follow the next article! We’ve explained everything you need to know!

Apply for the Chime Credit Builder Secured Visa®

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

About the author / Luis Felipe Xavier

Trending Topics

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep Reading

Transunion vs. Equifax: the credit reporting giants

Transunion vs. Equifax are different credit report agencies that provide your credit score! But how do they differ? Keep reading and learn!

Keep Reading

Apply for the Citi Custom Cash® Card: Unlock Elite Perks

Learn how to apply for the Citi Custom Cash® Card to enjoy an extensive low-rate intro, incredible rewards, and flexible redemption options!

Keep ReadingYou may also like

PayPal Prepaid Mastercard® review: Earn Payback Rewards

Dive into our PayPal Prepaid Mastercard® review to learn about its benefits, manage your funds wisely, and spend securely everywhere!

Keep Reading

First Progress Platinum Select Mastercard® Secured Credit Card review

Check our First Progress Platinum Select Mastercard® Secured Credit Card review and begin the path to building credit!

Keep Reading

How to Invest in Mutual Funds: 5 Practical Steps

Learn how to invest in mutual funds with our easy guide. Explore types, smart strategies, fees, and tips for a successful investing journey.

Keep Reading