Debit Card

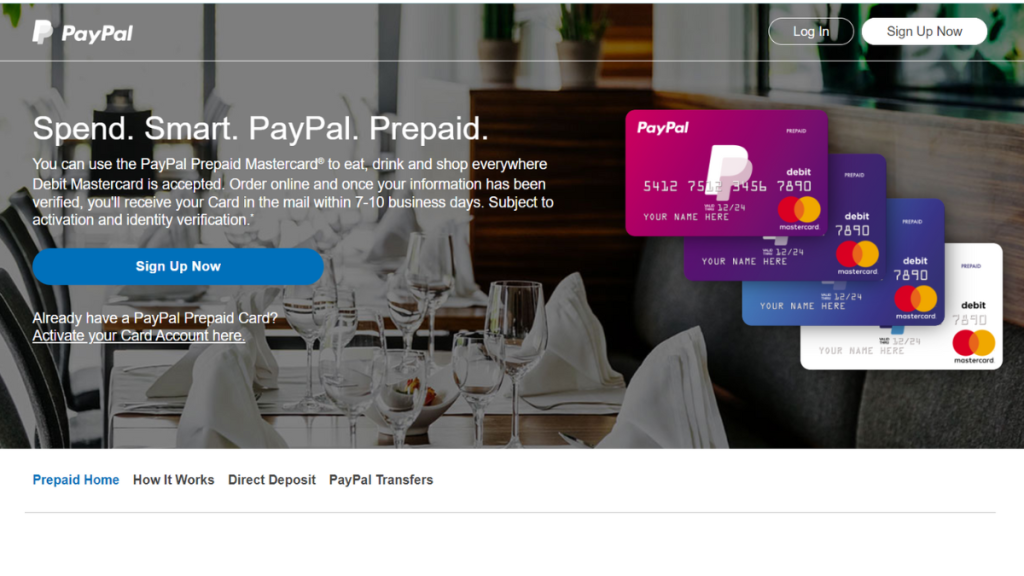

PayPal Prepaid Mastercard® review: Earn Payback Rewards

Discover the ins and outs of secure spending with our PayPal Prepaid Mastercard® review. Get to know insights to make the most of your financial management.

Advertisement

Empower your wallet and use the card anywhere Mastercard® is accepted

Uncover savvy spending with our PayPal Prepaid Mastercard® review. Get the lowdown on how this card reshapes your financial flexibility.

Apply for the PayPal Prepaid Mastercard®

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

From online shopping to in-store splurges, we’ll guide you through its perks and quirks. Further, navigate money matters with confidence!

| Credit Score | It being a prepaid card, there are no minimum requirements. |

| Annual Fee | $4.95 monthly fee. |

| Purchase APR | N/A. |

| Cash Advance APR | N/A. |

| Welcome Bonus | There are no welcome offers or bonuses. |

| Rewards | You can earn Payback Rewards on qualifying purchases. |

PayPal Prepaid Mastercard®: All you need to know

Unlock the gateway to effortless spending with the PayPal Prepaid Mastercard®. Say hello to a world of financial flexibility.

Indeed, being prepaid, this Mastercard welcomes all applicants, making financial transactions accessible to everyone.

By enrolling in the Payback Rewards program, you can have access to points and exclusive offers. That way, your spending becomes rewards.

The PayPal Prepaid Mastercard® comes with a monthly fee of $4.95 – an investment into a system that offers you control, security, and convenience.

Also, you can add funds with ease through NetSpend Reload ATMs or directly from your PayPal account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the PayPal Prepaid Mastercard®

Ready to dive deeper? Then explore our PayPal Prepaid Mastercard® review below.

So let’s unveil the crucial advantages and potential drawbacks to guide your financial journey.

Pros

- Usable anywhere Mastercard is accepted.

- No credit check since it’s prepaid.

- Enroll in the Payback Rewards program to earn points and get special offers.

- Direct deposit offers access to funds 2 days earlier.

- Add funds via PayPal or NetSpend Reload ATMs.

- Manage your card on-the-go with PayPal’s mobile app.

Cons

- The card incurs a $4.95 charge each month.

- Being prepaid, it doesn’t build your credit history.

- Additional charges for ATM withdrawals may apply.

- Unlike credit cards, it offers limited purchase protection.

What credit score do you need to apply?

Indeed, one of the enticing aspects of the PayPal Prepaid Mastercard® is its accessibility.

You don’t need any specific credit score to apply for this card because it’s a prepaid option.

Since it’s not a credit card, your credit history isn’t scrutinized.

Thus, everyone can apply, making it a fantastic financial tool for managing spending without delving into credit.

How to easily apply for the PayPal Prepaid Mastercard®?

Curious about expanding your financial tools after exploring our First Latitude Secured Mastercard® Credit Card review?

Learn how to step into a stress-free application journey by following the link below. Your path to smart, secure spending with insightful guidance is just a click away.

Apply for the PayPal Prepaid Mastercard®

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

Trending Topics

Up to 3% cash back: Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Keep Reading

Upgrade Loans review: Quick Approvals, Easy Process

Check our Upgrade Loans review to explore low rates and flexible terms that cater to your financial needs. Unlock smarter borrowing

Keep Reading

Credit Report Repair Involves Goodwill And Friendliness

Unlock financial freedom with credit report repair. Our tips will help you improve your credit score and secure your financial future.

Keep ReadingYou may also like

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep Reading

Destiny Mastercard® review: A Stepping Stone For Good Credit

Unlock the secrets of the Destiny Mastercard® in our comprehensive review to see if it's the right choice for your financial future.

Keep Reading