Debit Card

Apply for the PayPal Prepaid Mastercard®: Hassle-free and online

Take control of your finances and learn how to easily apply for the PayPal Prepaid Mastercard® in our step-by-step guide!

Advertisement

Simplify your money management and experience convenience with the PayPal Prepaid Mastercard®

Are you looking for a convenient way to manage your finances? Apply for the PayPal Prepaid Mastercard® and you’ll have the power of Mastercard®.

Explore our guide below to learn how you can easily request this card online and take advantage of its incredible features.

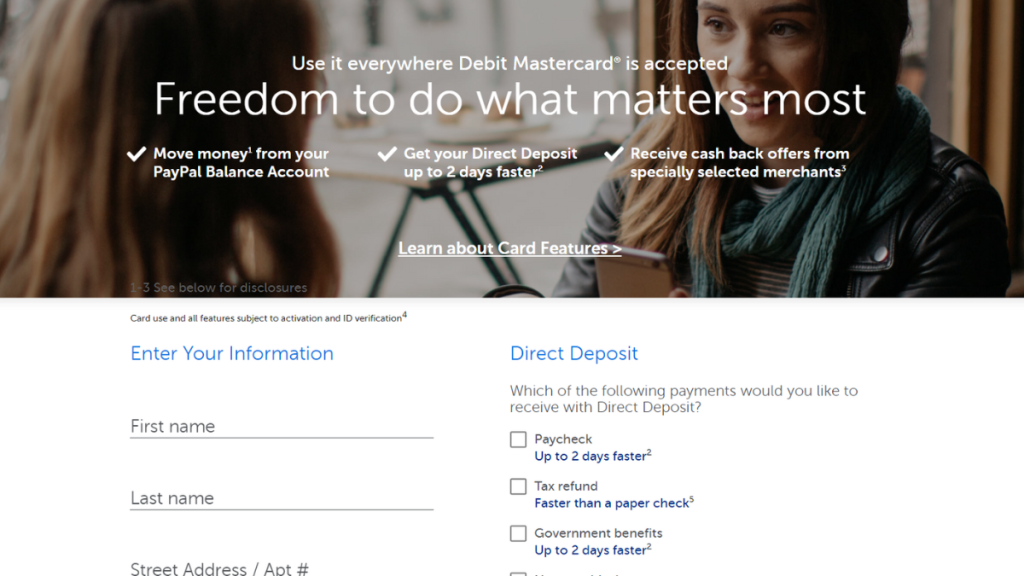

Online application

The first step in applying for the PayPal Prepaid Mastercard® is to go to the official website.

Once you’re on the website, hit the “Get Started” button, which can be found on the homepage. The website will then direct you to the application page.

This is where you’ll fill out personal information such as your name, address, and email.

Review your application and click on “Order Card”. Then, you will receive an email from PayPal asking you to confirm your email address.

Confirm your email and that is it. You will need to wait for your PayPal Prepaid Mastercard® to arrive at your address, which usually takes 7-10 business days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Sadly, you can’t apply for the PayPal Prepaid Mastercard® using the app.

This measure is employed to keep your information safe during the sign-up process.

To get the card, you need to use its official website. It’s set up to protect your details and make sure everything is accurate and secure when you apply.

Once you have the card, the mobile app becomes your financial companion!

It allows you to check your account balance, review transactions, and manage your funds easily.

PayPal Prepaid Mastercard® or Brink’s Prepaid Mastercard®?

The PayPal Prepaid Mastercard gives you easy access to your money.

You can shop, pay bills, and manage funds easily with features tailored for convenient financial transactions.

But if you’re looking for alternatives, the Brink’s Prepaid Mastercard® provides a practical and secure way to manage, spend, and save your money effectively.

Indeed, the card allows for safe online shopping, simple bill payment, and offers an organized way to budget your spending.

Further, compare both cards below to learn more:

| PayPal Prepaid Mastercard® | Brink’s Prepaid Mastercard® | |

| Credit Score | It being a prepaid card, there are no minimum requirements. | All credit levels are welcome to apply. |

| Annual Fee | $4.95 monthly fee. | Pay-As-You-Go℠ Plan: No fees; Monthly Plan: $9.95 per month; Reduced Monthly Plan: $5 per month. |

| Purchase APR | N/A. | Does not apply. |

| Cash Advance APR | N/A. | Does not apply. |

| Welcome Bonus | There are no welcome offers or bonuses. | Earn 500 bonus points once you enroll in the Payback Points program online. |

| Rewards | You can earn Payback Rewards on qualifying purchases. | By enrolling in the Payback Points program, you can earn cash back rewards on selected transactions. |

Do you believe that Brink’s Prepaid Mastercard® suits you better?

Then learn how to apply and explore a new world of managing your money in the following link.

How to apply for the Brink's Prepaid Mastercard®

Learn how to apply for the Brink's Prepaid Mastercard® and waive all monthly fees with direct deposit. Elevate your banking experience!

Trending Topics

Apply for the Chase Freedom Flex℠ Credit Card: $200 Bonus

Learn how to apply for the Chase Freedom Flex℠ Credit Card to enjoy a $200 welcome bonus and grand cash back on rotating categories.

Keep Reading

First Access Visa® Card review: Earn 1% back on card payments!

Explore our detailed First Access Visa® Card review to learn about its features and benefits. Earn 1% cash back on purchases and more!

Keep Reading

Group One Platinum Card Review: Easy $750 Credit Boost

Read our Group One Platinum Card review to learn how to get a $750 credit line with no credit check and increase your purchasing power.

Keep ReadingYou may also like

GO2bank Secured Visa® Credit Card review: Build credit fast

Explore our GO2bank Secured Visa® Credit Card review and discover a smart way to boost your credit journey - no credit check!

Keep Reading

Apply for the First Access Visa® Card: Free credit score access

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

Keep Reading