Credit Card

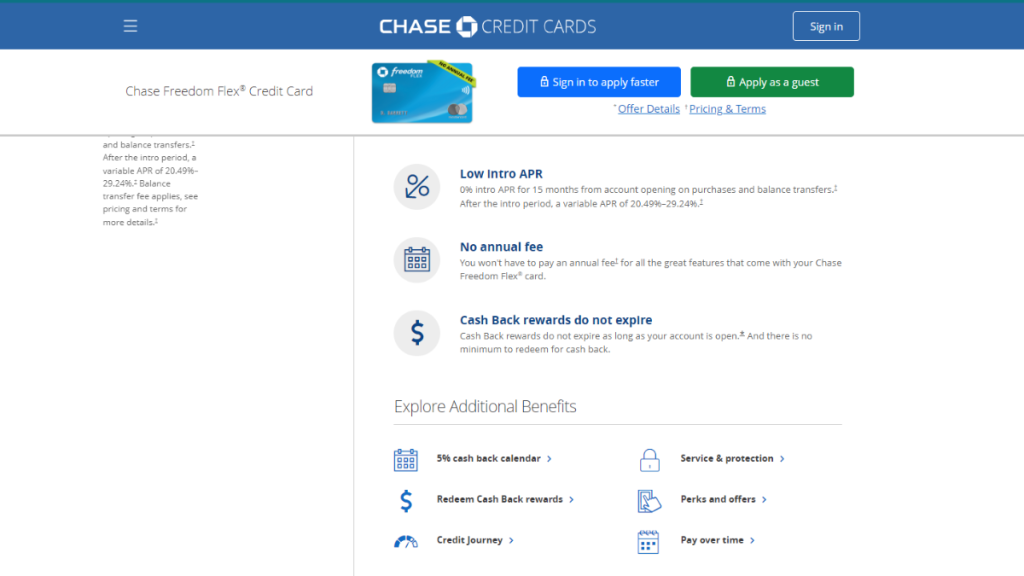

Apply for the Chase Freedom Flex℠ Credit Card: $200 Bonus

Discover the easy steps to apply for the Chase Freedom Flex℠ Credit Card. Get ready to earn a $200 bonus and up to 5% cash back on various purchases.

Advertisement

See how to apply and embrace a rewarding journey with no annual fee

So, are you ready to apply for the Chase Freedom Flex℠ Credit Card? This guide will then outline the key steps to take, from checking your credit score to understanding the card’s benefits.

Get a head start on your application process and unlock the potential of this rewarding credit card. Stay tuned to learn more in our comprehensive article.

Online application

Firstly, navigate to Chase’s website and select ‘Credit Cards’. Secondly, locate the Chase Freedom Flex℠ to apply and click on it. This page provides all essential details about the card.

Thirdly, hit the ‘Apply Now’ button. You’ll then be asked to fill in personal details like your name, address, and income.

Accuracy is key here to ensure a smooth application process.

Then, carefully review your financial information. Now confirm your employment and annual income, as this helps determine your creditworthiness. Accuracy in these details is crucial.

Finally, upon submission, await the decision. If approved, you can start enjoying the perks of Chase Freedom Flex℠. Use your new card wisely to reap its full benefits.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

While you can’t directly apply for Chase Freedom Flex℠ Credit Card through their mobile app, the process is streamlined via their mobile-friendly website.

Once you’ve applied online, the Chase mobile app becomes a valuable tool for managing your Chase Freedom Flex℠ Credit Card.

From tracking your spending to paying bills.

So while the application for the Chase Freedom Flex℠ Credit Card needs to be done online, the process is mobile-friendly.

Post-application, the app serves as an efficient platform.

Chase Freedom Flex℠ or Discover it® Cash Back?

In conclusion, the Chase Freedom Flex℠ Credit Card stands out with its robust rewards and benefits. It’s an excellent choice for those seeking value and versatility in a credit card.

Alternatively, consider the Discover it® Cash Back card. It offers a different set of perks that might better suit your spending habits and financial goals, providing another great option.

| Chase Freedom Flex℠ | Discover it® Cash Back | |

| Credit Score | Best suited for people with a robust credit rating. | Ideal for those with scores from 670 upwards. |

| Annual Fee | Zero yearly cost for endless benefits. | Absolutely no annual fee, making it a savvy choice. |

| Purchase APR | Enjoy 0% interest for the first 15 months, followed by a variable rate of 20.49%–29.24%, dependent on your credit standing. | Lengthy low APR of 0% for the first 15 months of membership, valid for purchases and balance transfers, then a variable 17.24% to 28.24% APR thereafter. |

| Cash Advance APR | Variable at 29.99%, applicable for immediate cash needs. | Stands at a variable 29.99%. |

| Welcome Bonus | Earn a swift $200 incentive by spending $500 in the first quarter, an enticing offer for new users. | A one-of-a-kind match of all cash back earned in your first year, without any upper limit. |

| Rewards | 5% cash back in rotating quarterly categories upon activation (terms apply); constant 5% back on travel purchased through Chase’s travel program; daily delights with 3% back on dining and drugstore purchases; a solid 1% return on all other spending. | 5% cash back in rotating categories each quarter up to a quarterly max upon activation, plus an ongoing 1% on all other purchases. |

Moreover, to delve deeper into what the Discover it® Cash Back offers and to understand the application process, check out the link below.

Indeed, it’s your gateway to a world of benefits.

Apply for the Discover it® Cash Back Credit Card

Learn the steps to apply for the Discover it® Cash Back Credit Card and enjoy its hefty welcome bonus. Check our quick and simple guide!

Trending Topics

Transunion vs. Equifax: the credit reporting giants

Transunion vs. Equifax are different credit report agencies that provide your credit score! But how do they differ? Keep reading and learn!

Keep Reading

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep Reading

Recensione Carta di Credito Oro American Express: Ci sei arrivato

Il modo più economico per vivere la tua esperienza con la Carta di Credito Oro American Express. Zero anuità il primo anno!

Keep ReadingYou may also like

First Progress Platinum Select Mastercard® Secured Credit Card review

Check our First Progress Platinum Select Mastercard® Secured Credit Card review and begin the path to building credit!

Keep Reading

Apply for First Progress Platinum Elite Mastercard® Secured fast

See how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card and get a flexible credit limit of up to $2,000.

Keep Reading