Credit Card

Apply for First Progress Platinum Elite Mastercard® Secured fast

Discover the pathway to credit building with the First Progress Platinum Elite Mastercard® Secured Credit Card! Enjoy a hassle-free process. Read on!

Advertisement

Master your credit journey with our simple step-by-step guidance

Discover the steps to apply for the First Progress Platinum Elite Mastercard® Secured and begin your journey towards wellness.

We’re here to guide you through the application steps, ensuring a smooth experience. So come with us and uncover a world of perks.

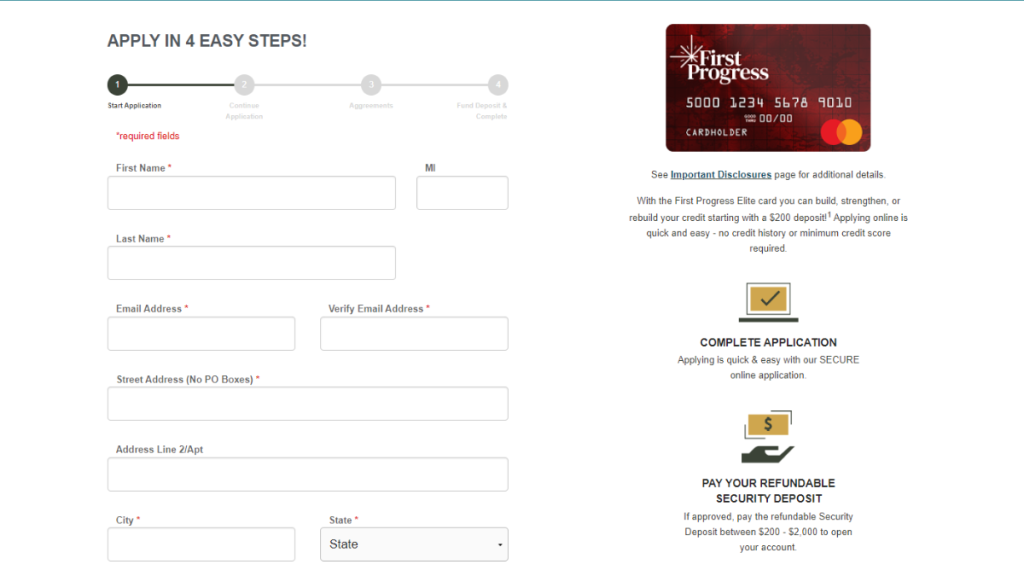

Online application

Firstly, kickstart your application process for the First Progress Platinum Elite Mastercard® Secured by heading to the official First Progress website.

Here, you’ll find detailed information about the card and its benefits. Next, look for the “apply” button.

In the form, you’ll need to provide personal information and employment details. Be accurate and honest.

If approved, you’ll have to fund your security deposit. Moreover, you can choose between $200 and $,2000, which is refundable.

Finally, your new Platinum Elite Mastercard® should arrive within a few days . Manage it wisely to build credit, and explore online account features.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

The First Progress app serves as a convenient platform for managing your account on the go.

So you can review transactions and more, simplifying your financial management.

However, it’s important to note that unfortunately you cannot apply for the First Progress Platinum Elite Mastercard® Secured using it.

Also, the application process involves sensitive data and verification steps that are securely handled through the website.

So while the app is excellent for account management and staying informed on your credit-building journey, visiting the website is how you apply for the card.

First Progress Platinum Elite Mastercard® Secured Credit Card or First Progress Platinum Prestige Mastercard® Secured Credit Card?

Indeed, the First Progress Platinum Elite offers a fresh and simple approach for credit improvement.

It’s a solid choice for those looking to enhance their financial standing with minimum fees.

But if you’re still looking for different options, maybe the First Progress Platinum Prestige Mastercard® Secured Credit Card might suit you best.

This credit-building tool, also from First Progress, offers distinct features that might align better with your individual financial goals and preferences.

So dive into our detailed comparison below to make an informed decision and find the perfect match for your credit-building journey!

| First Progress Platinum Elite Mastercard® Secured Credit Card | First Progress Platinum Prestige Mastercard® Secured Credit Card | |

| Credit Score | There are no minimum score requirements. | All credit levels are welcome to apply. |

| Annual Fee | A wallet-friendly fee of $29. | A modest $49. |

| Purchase APR | 25.24% variable. | 15.24% variable. |

| Cash Advance APR | 30.24% variable. | 24.24% variable. |

| Welcome Bonus | There are none. | There are none, currently. |

| Rewards | The main focus here is credit building, not rewards. | You can earn 1% back on balance payments. |

If you believe that the Platinum Prestige is better suited for your needs, then explore the following link to learn more about it!

Apply for First Progress Platinum Prestige Secured

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

Trending Topics

First Progress Platinum Select Mastercard® Secured Credit Card review

Check our First Progress Platinum Select Mastercard® Secured Credit Card review and begin the path to building credit!

Keep Reading

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading

How to apply for the First Progress Platinum Select Mastercard® Secured

Learn how to apply for the First Progress Platinum Select Mastercard® Secured Credit Card and build your credit while earning rewards!

Keep ReadingYou may also like

Apply for the Best Egg Personal Loans: Quick Cash, Zero Hassles!

Ready to transform your finances? Apply for Best Egg Personal Loans easily and embrace convenient, reliable funding for your peace of mind.

Keep Reading

Build credit: Apply Petal® 1 “No Annual Fee” Visa® Credit Card

Wondering how to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card? Then read on! Earn up to 10% cash back on purchases!

Keep Reading

Get paid early: How to apply for the Brink’s Prepaid Mastercard®

Learn how to apply for the Brink's Prepaid Mastercard® and waive all monthly fees with direct deposit. Elevate your banking experience!

Keep Reading