Credit Card

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

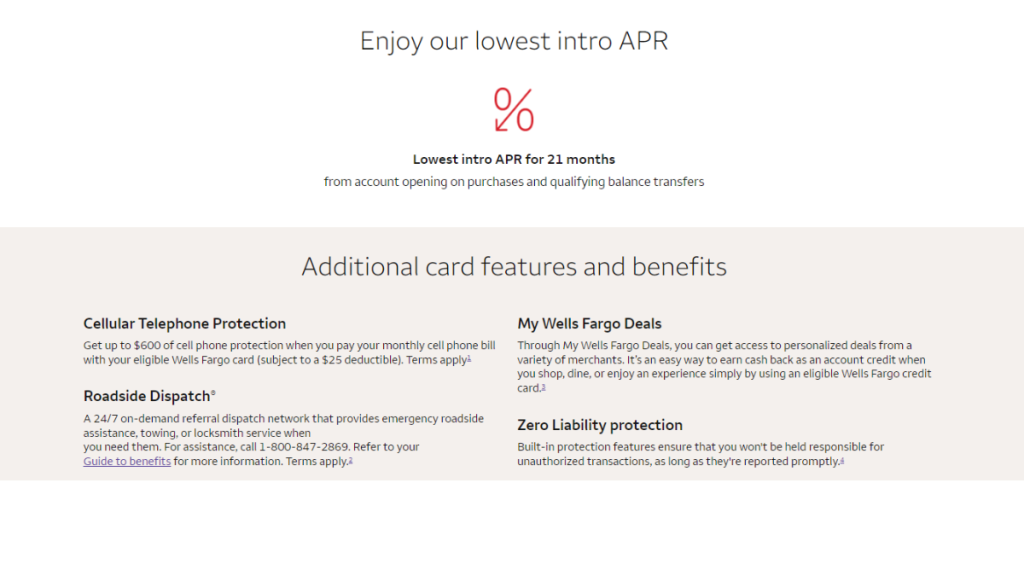

Looking to apply for the Wells Fargo Reflect® Card? Our guide breaks down the process. Ensure $0 annual fee and an extensive 0% intro APR.

Advertisement

Seamless application, zero yearly charges: the Wells Fargo Reflect® Card advantage

Choosing to apply for the Wells Fargo Reflect® Card can be a game-changer in your financial journey, packed with unique benefits.

Want to embark on this financial adventure? Explore the article below to learn precisely how to apply and get started with your card.

Online application

To apply for the Wells Fargo Reflect® Card, start by navigating to the Wells Fargo official website.

After reviewing the card’s specifics, locate and click the “Apply Now” button prominently on the card’s information page.

Then, you’ll have to put down your personal and financial information. The form may also inquire about your current employment and income.

Ensure you provide accurate details to avoid any complications in the application process. Finally, submit your application and wait for a response.

Furthermore, if approved, Wells Fargo will contact you to provide your new card details and issue the physical card to your address.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

The Wells Fargo app prioritizes your data’s safety.

Therefore, to ensure the highest security standards, you can’t directly apply for the Wells Fargo Reflect® Card through it.

But the app is far from basic! Indeed, with a Wells Fargo account, you can track balances, view transactions, and set alerts efficiently.

Wells Fargo Reflect® Card or Bank of America® Customized Cash Rewards Credit Card?

A promising choice for discerning spenders, the Wells Fargo Reflect® Card offers a unique blend of benefits tailored for its users.

But if you are still considering alternatives, the Bank of America® Customized Cash Rewards Card might pique your interest.

Not only that but with the Bank of America® Customized Cash Rewards Credit Card, you also have access to an extensive low intro APR period.

Further, check the comparison below:

| Wells Fargo Reflect® Card | Bank of America® Customized Cash Rewards Credit Card | |

| Credit Score | A good score is the minimum requirement for this card; | You need a good to excellent score to add this card to your wallet; |

| Annual Fee | Holding this credit card won’t cost you an annual charge; | There’s no annual fee; |

| Purchase APR | For those new to the card, there’s an enticing introductory offer of 0% APR for 21 months on both purchases and eligible balance transfers. After this introductory phase, the APR adjusts variably, landing at either 18.24%, 24.74%, or 29.99%; | New members are in for a treat with a 0% introductory APR for 15 billing cycles. 18.24% to 28.24% after; |

| Cash Advance APR | 29.99% variable based on Prime Rate; | 21.24% – 29.24% (direct deposit and check cash advances);29.24% (bank cash advances); |

| Welcome Bonus | There are no welcome bonuses currently; | Newcomers can bag a $200 cash reward by spending over $1,000 in their initial 90 days of membership; |

| Rewards | Currently, there are no rewards attached to this card. | 3% cash back on two personalized categories, 2% on groceries and wholesale clubs, and 1% on all other purchases. |

Intrigued by the perks of the Bank of America® card? Explore its features and advantages, and learn how to apply today by following the link below.

Apply for Bank of America® Customized Cash Rewards

Discover how to apply for a Bank of America® Customized Cash Rewards Credit Card today! Ensure 0% intro APR for 15 months and more! Read on!

Trending Topics

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep ReadingYou may also like

Transunion vs. Equifax: the credit reporting giants

Transunion vs. Equifax are different credit report agencies that provide your credit score! But how do they differ? Keep reading and learn!

Keep Reading

Credit Report Repair Involves Goodwill And Friendliness

Unlock financial freedom with credit report repair. Our tips will help you improve your credit score and secure your financial future.

Keep Reading

Find your perfect match: Choose the right credit card

Choose the right credit card for your finances and unlock your real potential! Keep reading and learn what you need to know!

Keep Reading