Debt & Credit Free

Credit Report Repair Involves Goodwill And Friendliness

Discover effective tips for credit report repair and empower your financial future. Learn how to boost your credit score and unlock new opportunities for financial success. Take control of your finances today!

Advertisement

Fostering Financial Well-Being: How to Get Your Credit Report in Good Shape

Navigating the realm of credit report repair can often feel overwhelming. However, a poor credit score is not a life sentence.

There are systematic steps you can follow to mend your credit standing, ensuring better financial opportunities in the future.

This straightforward guide will navigate through the practical steps involved in repairing your credit report.

750 credit score: is it good?

A 750 credit score can help you get some excellent financial deals! Understand how below! We'll explain everything you need to know!

Understanding Your Credit Report

Before diving into credit report repair, it’s essential to know what information your credit report contains.

It includes your personal identifying information, credit history, public records, and inquiries about your creditworthiness.

By understanding each segment, you’ll be better equipped to identify any inaccuracies or areas needing improvement.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Obtain and Review Your Credit Reports

The journey to credit repair begins with obtaining your credit reports. You’re entitled to free copies from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year through AnnualCreditReport.com.

Scrutinize these reports for any discrepancies, outdated information, or incorrect records of your borrowing history.

Dispute Inaccuracies on Your Reports

One of the pivotal steps in credit report repair is disputing any errors. If you find information that you believe is incorrect, immediately dispute it with the credit bureaus.

Write a detailed dispute letter or use online resources provided by the credit bureaus. Ensure you have supporting documents and clearly explain the inaccuracy.

This process can take anywhere from a few weeks to several months.

Negotiate with Creditors

If your credit report contains legitimate negative marks that are accurate but unfortunate, consider negotiating with your creditors.

You can request a “goodwill adjustment” where you admit fault but ask for forgiveness, or settle the account for a lesser amount.

Ensure each agreement is in writing and understand the terms before agreeing.

Establish a Timely Payment History

The most significant factor in credit report repair is your payment history. Work towards making timely payments on all your obligations, as these demonstrate to lenders your reliability as a borrower.

If you’re struggling, contact your lenders to discuss alternative payment arrangements or consider using automatic payment methods to avoid missing deadlines.

Reduce Debt and Keep Low Credit Balances

High credit card balances can severely impact your credit score. Work on a strategy to reduce your debt load, starting with the highest interest cards or loans.

Maintaining low balances shows you’re using your credit responsibly, which can positively influence your credit score.

Seek Professional Advice If Necessary

Sometimes, credit report repair can feel like an uphill battle, and you might not know where to turn next.

In these instances, consider seeking advice from a credit counseling service.

They can offer guidance, budgeting advice, and debt management plans, providing a clearer path to improved credit.

Conclusion:

Credit report repair doesn’t happen overnight, but taking decisive, consistent action can lead to incredible improvements.

By understanding your credit report, disputing errors, negotiating with creditors, and managing your debt wisely, you can gradually enhance your financial standing.

Remember, the journey is ongoing – continue monitoring your credit and understanding your financial behaviors, and over time, you’ll secure the advantages that come with having good credit.

And if you want to learn more about how credit bureaus work, and how they can help you repair your credit report, check the following link!

Transunion vs Equifax: the credit reporting giants

Discover how Transunion and Equifax work and how they calculate your credit score.

Trending Topics

Hassle-free: Apply for Chime Credit Builder Secured Visa® Card

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Keep Reading

Apply for the US Bank Visa® Platinum Card: Long Intro APR!

Find out how to apply for the US Bank Visa® Platinum Card and benefit from no annual fees with our simple step-by-step guide.

Keep Reading

Apply for the Boost Platinum Card: 7-day trial period

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

Keep ReadingYou may also like

Apply for the Avant Personal Loans: Fund Your Dreams Fast!

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Keep Reading

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading

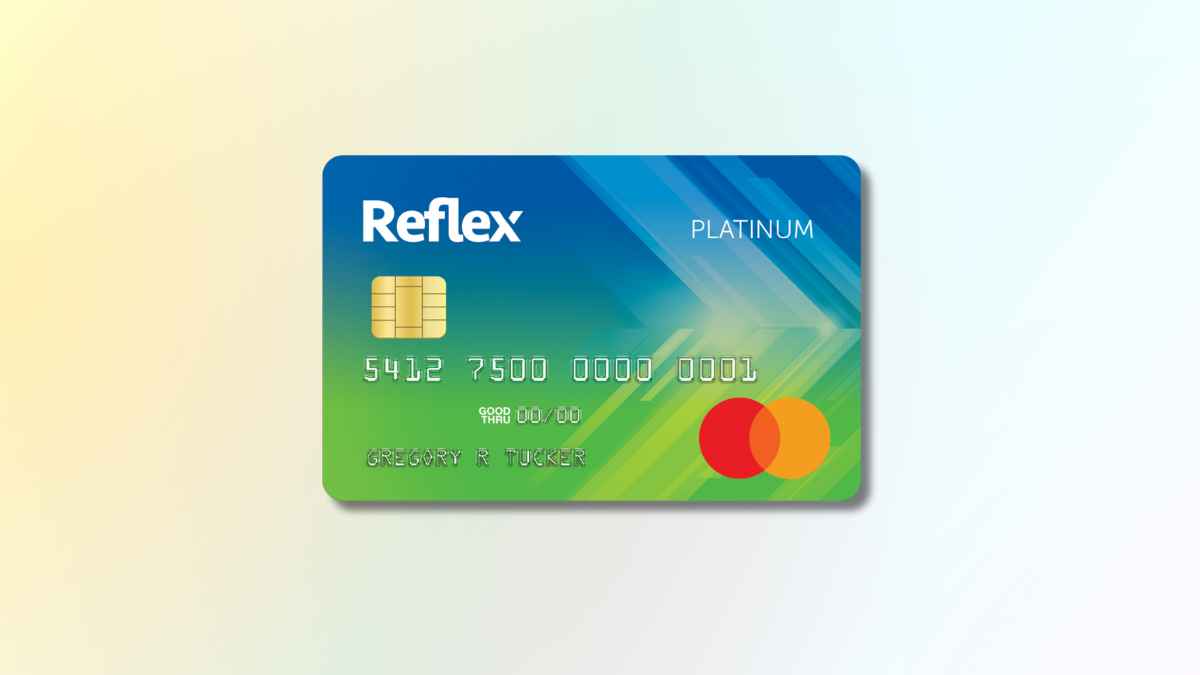

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading