Credit Card

Apply for the US Bank Visa® Platinum Card: Long Intro APR!

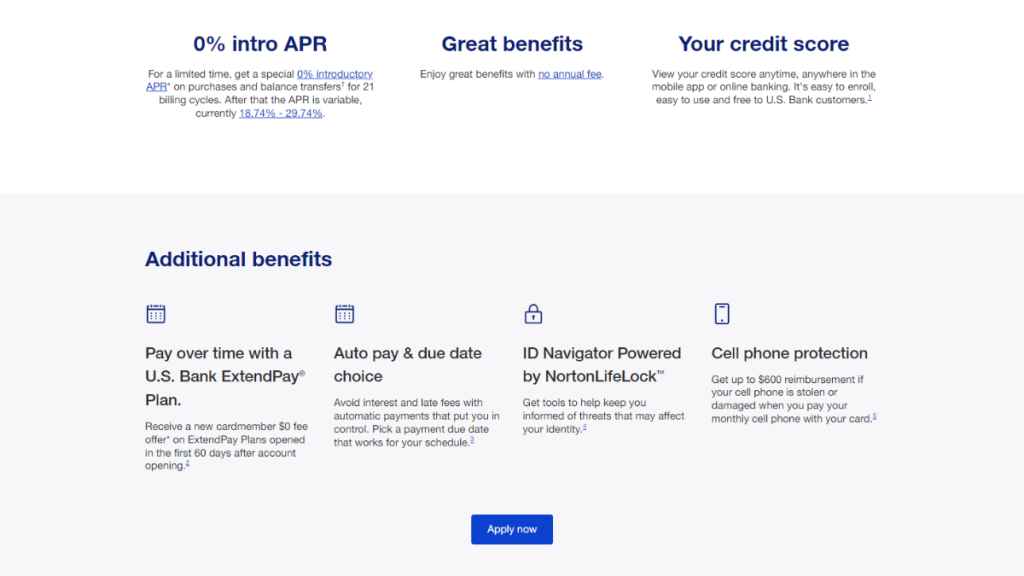

Applying for the US Bank Visa® Platinum Card is straightforward. Our guide explains the process so you can take advantage of its many perks—a smart choice for savvy spenders!

Advertisement

Check the seamless application process with added perks like cell phone protection!

Eager to apply for the US Bank Visa® Platinum Card? Our guide simplifies the process, making it straightforward and stress-free.

So uncover the key steps in our full article, designed to navigate you smoothly through the application journey. Stay tuned!

Online application

Firstly, the process to apply for the US Bank Visa® Platinum Card is effortless. To begin, head to the US Bank website.

After reviewing the card’s features, hit on the ‘Apply Now’ button. This action will redirect you to the application page.

Then, fill in the application form. It requires basic info such as your name, address, income details, and SSN. Be accurate and truthful.

Subsequently, review your application thoroughly. Double-check all entered information. Finally, submit your application.

Once done, you’ll receive a confirmation, and US Bank will begin processing your application. Await their response for your credit journey’s next steps.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

While you can’t directly apply for the US Bank Visa® Platinum Card through their mobile app, there are other valuable features.

Firstly, the app allows you to check balances on the go. This real-time access is crucial for keeping track of your spending and staying financially responsible.

Additionally, the app provides the ability to make payments and set up account alerts.

Also, these features ensure you stay on top of due dates and monitor account activity effectively.

Importantly, if you’re looking to apply, the US Bank website is mobile-friendly. While the app doesn’t support applications, the website on a mobile device offers a seamless experience.

US Bank Visa® Platinum Card or Wells Fargo Reflect® Card?

In summary, the U.S. Bank Visa® Platinum Card stands out for its long intro APR and no annual fee, ideal for those with good credit.

However, as an alternative, consider the Wells Fargo Reflect® Card. Indeed, it offers unique features that might better suit your financial needs.

The Wells Fargo Reflect® Card boasts an extended intro APR on purchases and balance transfers, plus no annual fee, catering to budget-conscious users.

| US Bank Visa® Platinum Card | Wells Fargo Reflect® Card | |

| Credit Score | Aimed at users with a shining credit report, falling in the good to excellent bracket. | A good credit score is essential for eligibility; this card is tailored for financially responsible individuals. |

| Annual Fee | Embrace a life without annual fees. | Enjoy the privilege of holding this card without the burden of an annual fee. |

| Purchase APR | Enjoy 21 billing cycles at 0% APR for purchases, shifting to a variable 18.74% – 29.74% thereafter. | New cardholders are welcomed with a 0% APR for 21 months on purchases and balance transfers, after which the APR shifts to a variable rate of 18.24%, 24.74%, or 29.99%. |

| Cash Advance APR | Cash advances come at a variable APR of 29.99%, pegged to the Prime Rate. | The cash advance APR is set at a variable 29.99%, influenced by the Prime Rate. |

| Welcome Bonus | This card skips the usual welcome bonus parade. | Currently, the card does not offer a welcome bonus. |

| Rewards | A path less trodden, with no rewards program in sight. | The card operates without a rewards program, focusing on its other financial benefits. |

To dive deeper into the Wells Fargo Reflect® Card and explore its application process, check out the detailed guide in the link below.

Don’t miss out!

Apply for the Wells Fargo Reflect® Card

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Trending Topics

750 credit score: is it good?

A credit score is an essential factor in our financial lives! But is a 750 credit score a good thing? Find out in our full article!

Keep Reading

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard® today and earn a mile for every dollar spent! Sign-up bonus of 50K miles!

Keep Reading

Hassle-free: Apply for Chime Credit Builder Secured Visa® Card

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Keep ReadingYou may also like

FIT® Platinum Mastercard® review: Your Gateway to Better Credit

Dive into our FIT® Platinum Mastercard® review to discover how this credit builder card can elevate your financial journey. Learn more!

Keep Reading

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading