Loans

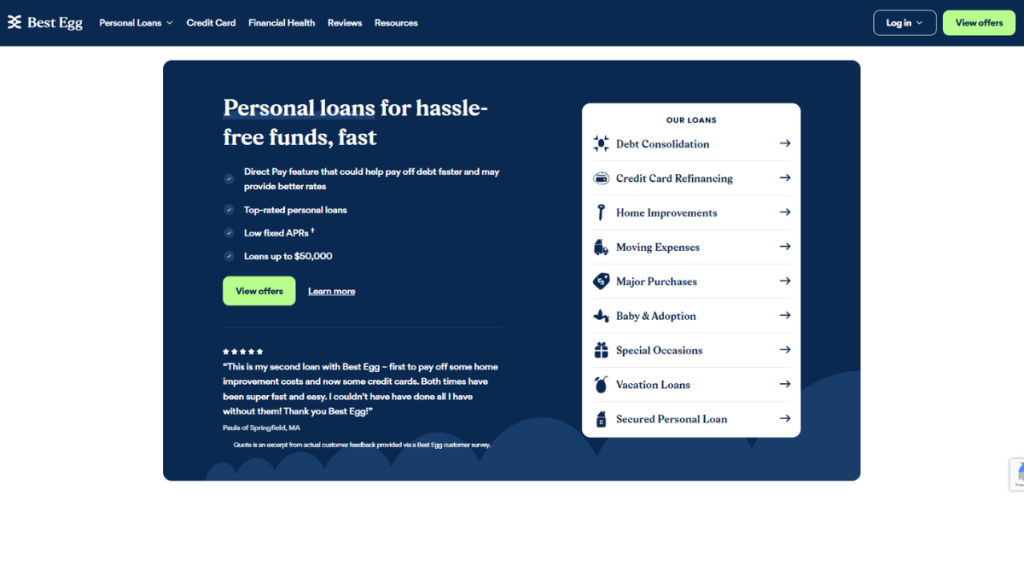

Apply for the Best Egg Personal Loans: Quick Cash, Zero Hassles!

Take control of your financial journey when you apply for Best Egg Personal Loans. Experience tailored plans, swift approvals, and the freedom!

Advertisement

Embrace financial freedom with fast and reliable Best Egg Loan approvals

Looking for a simple way to apply for the Best Egg Personal Loans? It’s a seamless process, designed for quick and efficient application.

Furthermore, uncover the essentials and insider tips to enhance your application experience. Moreover, your financial aspirations are within reach!

How to apply online?

Starting your journey is as easy as heading to the Best Egg website. Thus, explore their offerings to see if they match your goals!

Then comes the pre-approval, an essential phase requiring a soft credit inquiry. Thus, it does shed light on potential loan choices.

Got the green light? Now, you’ll choose the amount and its purpose. Honesty is crucial here as clarity about your needs can streamline the borrowing journey.

Subsequently, it’s time to get personal, offering up details like income and social security number. If all is in order, they’ll send over a loan agreement.

Upon approval, you can expect the funds to reflect in your account within a single business day. Indeed, your financial boost is just around the corner!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

- Best Egg’s baseline credit score is 600. but better scores mean improved terms.

- Applicants should have a minimum credit history of two years.

- The minimum annual income is usually around $35,000.

- A ratio of 40% is typically the highest allowed to qualify.

- Valid personal identification, proof of residence, and sometimes proof of employment.

- Applicants need to be 18+ (19 in certain states) and reside in the U.S.

- A valid U.S. bank account, since Best Egg deposits the funds directly into it.

How to apply using the app?

Navigating the digital world, you’d expect to conduct your finances at your fingertips, especially when opting for online lenders.

However, if you’re looking to apply for the Best Egg Personal Loans, you might be surprised to learn that there isn’t a dedicated mobile app available.

While the convenience of an app might be missed, their online application process through their website remains straightforward and user-friendly.

Best Egg Personal Loans or Upstart Personal Loans?

Best Egg Personal Loans offer a solid financial solution with diverse loan options to meet various needs, making money worries a thing of the past.

But if you’re looking up alternatives, Upstart Personal Loans stand out with unique approval criteria, possibly turning your financial luck around!

Further, see the comparison below.

| Best Egg Personal Loans | Upstart Personal Loans | |

| APR | Expect rates between 8.99% and 35.99%. | Borrowers have a fixed monthly rate that varies between 5.2% and 35.99%. |

| Loan Amounts | Funds between $2,000 and $50,000 are available. | Loan amounts between $1,000 and $50,000 are available. |

| Credit Needed | The minimum threshold is 600. | All credit types are welcome to apply for a loan. |

| Terms | You can repay your loan between 3 and 5 years. | Borrowers can choose to repay their loan in 3 or 5 years. |

| Origination Fee | 0.99% to 8.99% depending on your current credit standing. | There may be an origination fee up to 12%. |

| Late Fee | There are zero late fees for Best Egg. | Either 5% or $15; whichever is greater. |

| Early Payoff Penalty | Repay your loan any time without any extra charges. | None. Settle your loan at any time without extra charges. |

Eager for more? Dive into Upstart’s offerings. Check the following link to learn about their benefits and see how simple applying can be.

Apply for the Upstart Personal Loans

See how to apply for Upstart Personal Loans and unlock amounts up to $50,000 with terms to match your unique financial situation.

Trending Topics

Chase Freedom Unlimited® Credit Card Review: Earn Big!

Explore our Chase Freedom Unlimited® Credit Card review to uncover its cash back perks and 0% intro APR. Maximize your spending efficiency.

Keep Reading

PREMIER Bankcard® Mastercard® Credit Card review: build credit

Do you want to build credit fast? Then check out our PREMIER Bankcard® Mastercard® Credit Card full review! Monitor your FICO score easily!

Keep Reading

Apply for the Group One Platinum Card: No Credit Checks

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Keep ReadingYou may also like

Apply for the Rocket Personal Loans: Easy Online Process!

Take a leap forward when you apply for the Rocket Personal Loans. It features instant decisions and a hassle-free online application.

Keep Reading

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading

Apply for the Avant Personal Loans: Fund Your Dreams Fast!

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Keep Reading