Credit Card

Chase Freedom Unlimited® Credit Card Review: Earn Big!

Unlock the full potential of spending with Chase Freedom Unlimited® Credit Card. Learn about its cash back rewards, 0% intro APR, and more.

Advertisement

Discover how to maximize rewards and savings with this comprehensive guide

Dive into the world of smart spending with our captivating Chase Freedom Unlimited® Credit Card review. Uncover the secrets of this solid card option!

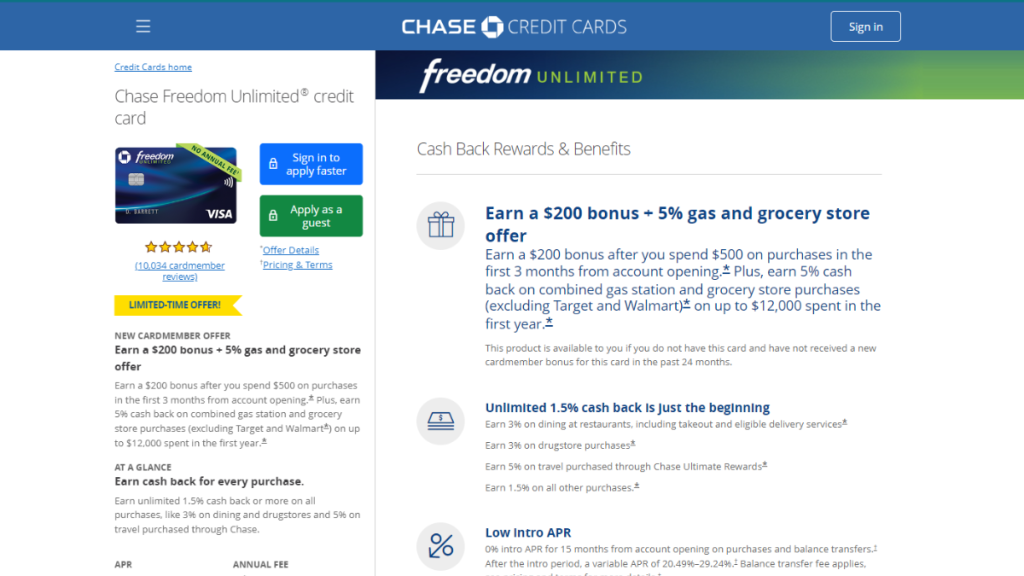

Apply for Chase Freedom Unlimited® Credit Card

Learn how to apply for the Chase Freedom Unlimited® Credit Card and explore its benefits – maximize rewards and savings effortlessly!

Get the inside scoop on its versatile cash back and a host of other perks. So stay with us on this journey to see if this card is the perfect match for you!

| Credit Score | Ideal for individuals with a good to excellent credit score range, typically between 690-850. |

| Annual Fee | Get all the benefits with no annual fee, making this card a smart pick for your everyday spending. |

| Purchase APR | Enjoy 0% APR for the first 15 months for more spending freedom. After that, the APR changes to a variable rate between 20.49% and 29.24%. |

| Cash Advance APR | 29.99% varying in line with market rates. |

| Welcome Bonus | Earn a $200 bonus and a 5% rebate on gas stations and grocery stores (up to $12k within a year) after spending $500 on purchases within the first 3 months, a lucrative start for new users. |

| Rewards | Rack up 5% rewards on travel through Chase Ultimate Rewards®, enjoy 3% back on dining and drugstore purchases, and accumulate 1.5% on all your other spending. |

Chase Freedom Unlimited® Credit Card: All you need to know

Firstly, the Chase Freedom Unlimited® emerges as a prime destination for hefty rewards. Also, with no annual fee, it’s solid option for your daily expenses.

Additionally, the card introduces a tempting 0% introductory APR for the first 15 months on purchases and balance transfers.

Further enhancing its appeal, it offers a chance to earn a substantial $200 bonus by just spending $500 in the initial three months.

Enjoy a 5% return on travel through Chase Ultimate Rewards®, and 3% back on dining and drugstore buys.

Also, the card brings convenience with a steady 1.5% cash back on all other purchases, allowing your rewards to grow swiftly.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Chase Freedom Unlimited® Credit Card

Further, dive deeper into our Chase Freedom Unlimited® Credit Card review and unravel the pros and cons, offering crystal-clear insights.

Pros

- No annual fee, making it a cost-effective choice.

- Alluring $200 welcome bonus achievable with minimal initial expenditure.

- Benefit from a low introductory APR for 15 months on purchases and transfers.

- Uncomplicated 1.5% cash back on all other purchases.

- Additional benefits include purchase protection and extended warranty.

Cons

- Increased APR post-introductory period.

- Incurring foreign transaction fees, reducing its appeal for global use.

- Dining and drugstore purchases are capped at 3% cash back.

- Requires a good to excellent credit score, which might restrict its reach.

What credit score do you need to apply?

So if you’re considering the Chase Freedom Unlimited® Credit Card, typically above 690, is necessary for approval.

Moreover, this requirement is in place to ensure that applicants have demonstrated financial responsibility in the past.

So it’s a key factor in determining your eligibility for this valuable card.

How to easily apply for the Chase Freedom Unlimited® Credit Card?

Indeed, our review of the Chase Freedom Unlimited® Card underscores its impressive rewards and convenient features, making it an ideal choice.

Following this, to learn about the application process for the card and begin reaping its perks, check the guide provided in the article below.

Apply for Chase Freedom Unlimited® Credit Card

Learn how to apply for the Chase Freedom Unlimited® Credit Card and explore its benefits – maximize rewards and savings effortlessly!

Trending Topics

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading

Avant Personal Loans Review: Quick Cash, Your Way!

Explore our Avant Personal Loans review and see how to get fast funding with loans up to $35,000! Dive into rates, terms, and more.

Keep ReadingYou may also like

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep Reading

How to make $5k a month: The ultimate blueprint for success

Are you wondering how to make $5k a month? Then you're in the right place! Keep reading and find out our top-notch tips to make extra money!

Keep Reading

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep Reading