Credit Card

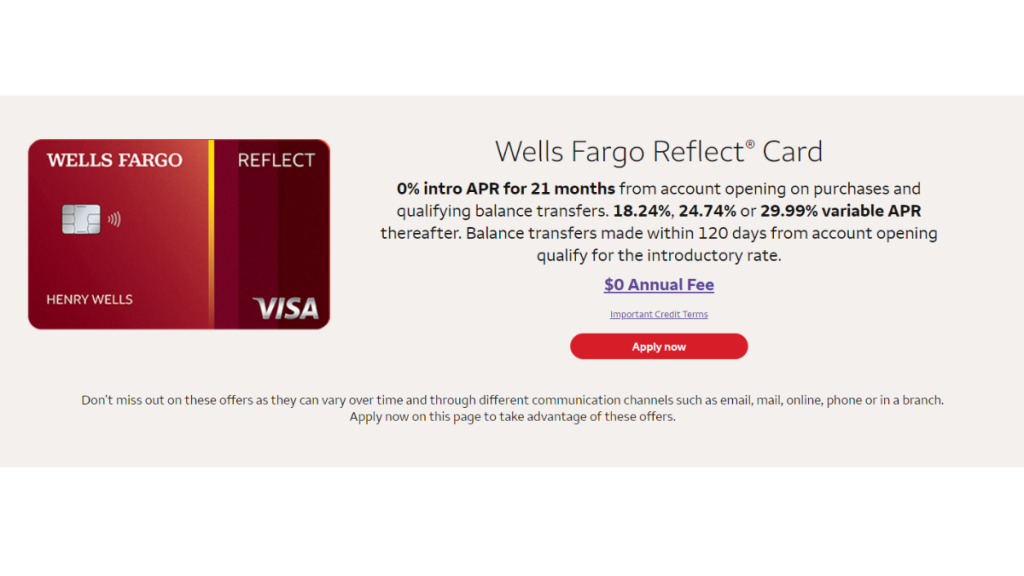

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Maximize your spending with the Wells Fargo Reflect® Card. Featuring an extended 0% intro APR period and security features. Read on and learn more!

Advertisement

Experience seamless transactions and unmatched security with the Wells Fargo Reflect® Card

In the ever-evolving world of credit solutions, our Wells Fargo Reflect® Card review stands as a guide to one of the market’s standout choices.

Apply for the Wells Fargo Reflect® Card

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Ready to explore its benefits and distinctive qualities? Then read on to learn more.

| Credit Score | A good score is the minimum requirement for this card; |

| Annual Fee | Holding this credit card won’t cost you an annual charge; |

| Purchase APR | For those new to the card, there’s an enticing introductory offer of 0% APR for 21 months on both purchases and eligible balance transfers. After this introductory phase, the APR adjusts variably, landing at either 18.24%, 24.74%, or 29.99%; |

| Cash Advance APR | 29.99% variable based on Prime Rate; |

| Welcome Bonus | There are no welcome bonuses currently; |

| Rewards | Currently there are no rewards attached to this card. |

Wells Fargo Reflect® Card: All you need to know

The Wells Fargo Reflect® Card stands out prominently in the card landscape, ensuring that quality doesn’t have to come at a price.

For those seeking relief from high interest, it comes with 0% APR on purchases and select balance transfers for impressive 21 months.

In an age of costly smartphones, the Reflect® Card steps up. Offering cell phone protection up to $600.

Cardholders can also get exclusive access to the My Wells Fargo Deals program. Plus, with zero fraud liability, your security is always a priority.

However, while the card is filled with benefits, it’s essential to note it charges foreign transaction fees. So factor this in when traveling.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Wells Fargo Reflect® Card

Continue with our Wells Fargo Reflect® Card review to get a better understanding of what it can do for you.

From its perks to drawbacks, further, we cover it all.

Pros

- No Annual Fee, which keeps costs low for cardholders;

- 0% on purchases for a generous 21 months (terms apply);

- Cell Phone Protection which provides coverage up to $600;

- Zero Fraud Liability, offering peace of mind against unauthorized transactions;

- Special offers and deals for cardholders with My Wells Fargo Deals.

Cons

- No rewards or points programs for cardholders;

- Charges a 3% foreign currency conversion;

- Rates can go up to 29.99% after the intro period.

What credit score do you need to apply?

To apply for the Wells Fargo Reflect® Card, it’s typically recommended to have a good to excellent credit score.

A higher score not only increases your chances of approval but might also qualify you for better interest rates and terms.

But while a good credit score can enhance your odds, it’s not the only factor considered.

Wells Fargo also evaluates other aspects of your financial history to determine eligibility.

How to easily apply for the Wells Fargo Reflect® Card?

Considering moving forward with the Wells Fargo Reflect®? The application process is more straightforward than you’d expect.

Explore the following link for a detailed walkthrough.

Having gone through our Wells Fargo Reflect® Card review, now it’s time to transform that information into a practical step.

So embark on your financial path confidently today!

Apply for the Wells Fargo Reflect® Card

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Trending Topics

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading

Instant decision: Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Keep ReadingYou may also like

Apply for the Group One Platinum Card: No Credit Checks

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Keep Reading

Credit Report Repair Involves Goodwill And Friendliness

Unlock financial freedom with credit report repair. Our tips will help you improve your credit score and secure your financial future.

Keep Reading