Credit Card

Apply for the Group One Platinum Card: No Credit Checks

Find out how to apply for the Group One Platinum Card, get approved easily without credit hurdles, and get a substantial $750 merchandise credit line.

Advertisement

Embrace a new shopping experience tailored for your convenience

So, are you excited to apply for the Group One Platinum Card? Further, we’ll walk you through the simple steps to get started!

Discover how to get this card hassle-free, and unlock the benefits it offers. Learn how to get started by checking out the full article below.

Online application

Firstly, if you want to easily apply for the Group One Platinum Card, you need to visit their website to begin.

Then, on the homepage, keep an eye out for the ‘Apply Now’ button. This button is your key to accessing this exclusive online shopping tool.

Moreover, when you click ‘Apply Now,’ you’ll kickstart the application process. You’ll be prompted to provide some essential personal info to complete the form.

Before hitting that submission button, take a moment to review your application thoroughly. Ensuring accuracy is vital for a smooth approval process.

Lastly, once you’ve submitted your application, you’ll receive clear instructions for the next steps.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Unfortunately, Group One Platinum Card enthusiasts won’t find a mobile app available for application. However, there is good news!

Their official website is optimized for mobile use.

So, even though there’s no app, you can still apply for the Group One Platinum Card with ease on your smartphone.

Whether you’re on your computer or your mobile device, getting your very own Group One Platinum Card is just a click away!

Group One Platinum Card or FIT® Platinum Mastercard®?

In conclusion, the Group One Platinum Card offers unique shopping benefits for people of all credit levels who are looking for a reliable merchandise line.

However, if you’re seeking a credit-building option, consider the FIT® Platinum Mastercard®.

This credit card assists in credit rebuilding, offering users a valuable financial tool.

The FIT® Platinum Mastercard® stands out with features like credit reporting, credit limit increases, and access to exclusive Mastercard benefits.

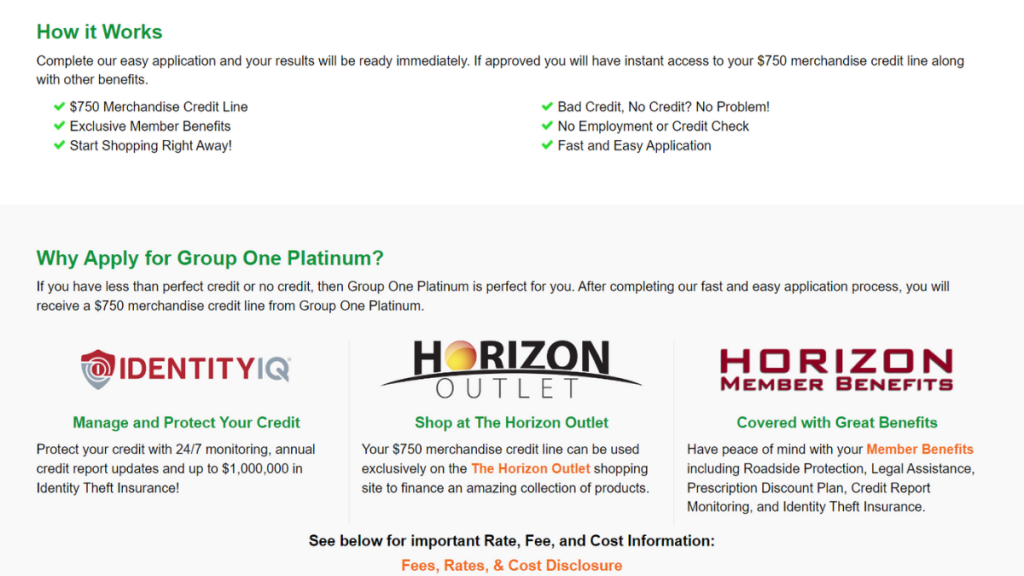

| Group One Platinum Card | FIT® Platinum Mastercard® | |

| Credit Score | Credit checks aren’t a part of the approval process. | Open to applicants with any credit rating. |

| Annual Fee | This card incurs an annual cost of $177.24, which can be paid monthly at $14.77. | Please refer to the terms for details. |

| Purchase APR | Since it’s not a conventional credit card, the purchase APR is not applicable. | Stands at a fixed 29.99%. |

| Cash Advance APR | Cash advances are not a feature of this card. | Also 29.99%. |

| Welcome Bonus | Currently, no welcome promotions are available. | There are no welcome bonuses available at this time. |

| Rewards | This card doesn’t include a rewards scheme. | Rewards are not applicable for this card. |

Ready to take the next step with the FIT® Platinum Mastercard®?

Then explore the following link for more information and guidance on how you can get this versatile card.

Apply for the FIT® Platinum Mastercard®

Thinking to boost your credit? See how to apply for the FIT® Platinum Mastercard® and embark on a journey to financial growth.

Trending Topics

$0 annual fee: Petal® 1 “No Annual Fee” Visa® Credit Card review

Review Petal® 1 “No Annual Fee” Visa® Credit Card main features and learn how it works. Earn up to 10% cash back on select merchants!

Keep Reading

Apply for the Upgrade Loans: Borrow Up to $50,000

Learn how to apply for Upgrade Loans and benefit from low-interest rates and flexible terms with our step-by-step guidance.

Keep Reading

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Keep ReadingYou may also like

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep Reading

How to Invest in Mutual Funds: 5 Practical Steps

Learn how to invest in mutual funds with our easy guide. Explore types, smart strategies, fees, and tips for a successful investing journey.

Keep Reading

Upgrade Loans review: Quick Approvals, Easy Process

Check our Upgrade Loans review to explore low rates and flexible terms that cater to your financial needs. Unlock smarter borrowing

Keep Reading