Loans

Apply for the Upgrade Loans: Borrow Up to $50,000

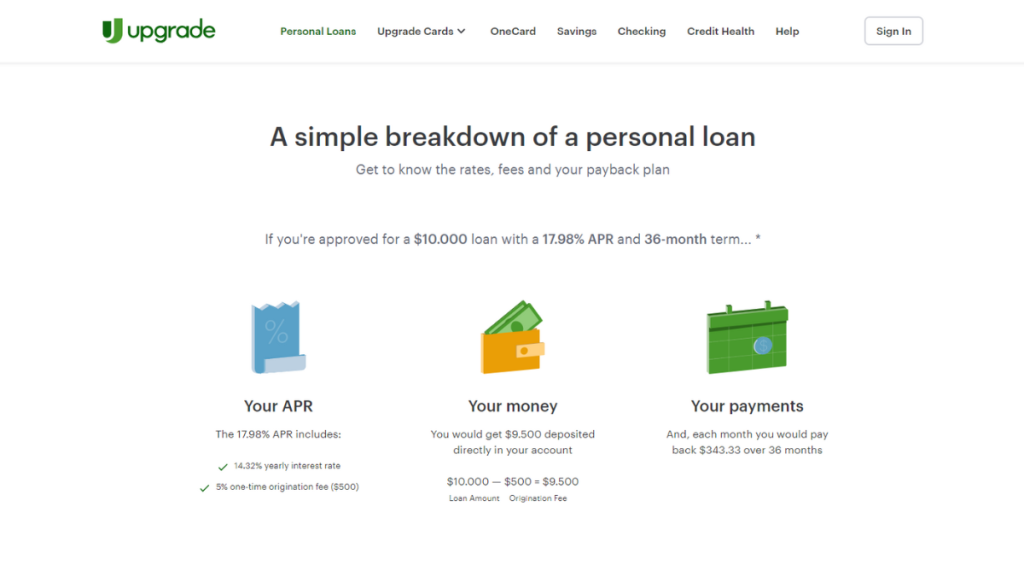

Applying for Upgrade Personal Loans is straightforward and user-friendly. Dive into our guide to explore the easy application process, transparent fees, and speedy approvals.

Advertisement

Achieve financial freedom and reach your goals faster with Upgrade’s flexible amounts!

Want to apply for the Upgrade Loans but feel lost in the process? We’ve got you!

Further, you’ll find a simple path to navigate through your Upgrade loan application. No complexity, just a straightforward walkthrough.

How to apply online?

Begin by visiting Upgrade’s official website – it’s straightforward and user-friendly. Navigate through the site to discover your potential options.

Then, find and select the ‘Check Your Rate’ button. Further, simply put your loan amount and purpose to start.

Indeed, after checking your rate, you can proceed with the application. So hit ‘Apply’ and you’ll be directed to an application form.

Furthermore, fill out the form with all the required info and submit it.

So upon approval, you’ll be presented with various loan options. Carefully review the terms, select your preferred loan, and finalize the agreement.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

- You need to be a US resident, permanent resident, or hold a visa.

- The minimum age requirement is 18 years old in most states.

- You also need a bank account to your name and a working email address.

- Your score will determine your rates, and a minimum 560 is expected.

- Upgrade requires at least one active credit account to your name.

- You need a minimum credit history of two years to qualify.

- Your maximum debt-to-income ratio should be 75% or lower.

How to apply using the app?

Upgrade prioritizes security and detailed evaluation, so, unfortunately, you can’t apply for the Upgrade Personal Loans using their intuitive mobile app.

However, the app provides plenty of other features that ensure user convenience and secure financial management.

Moreover, you can manage your account and make payments from anywhere.

Upgrade Personal Loans or Avant Personal Loans?

Upgrade Personal Loans stand out for their transparent fees and flexibility in managing finances.

Indeed, you can count on exclusive perks, and funds that go up to $50,000.

Considering alternatives? Avant Personal Loans is a notable option.

With a wide range of loan amounts and competitive interest rates, they cater to all monetary needs and situations.

Further, check the comparison table and compare both loans’ features. That way you’ll know you’re making the best choice for your financial future.

| Upgrade Personal Loans | Avant Personal Loans | |

| APR | Loans feature a rate between 8.49%-35.99%. | Rates vary between 9.95% – 35.99%. |

| Loan Amounts | Borrowers can request amounts between $1,000 and $50,000. | Borrowers can apply for amounts ranging from $2,000 to $35,000. |

| Credit Needed | There’s a minimum score requirement of 560. | The minimum requirement is 550 or more. |

| Terms | Usually 3 to 5 years, with a 7-year availability for higher amounts. | Between 1 and 5 years. |

| Origination Fee | Between 1.85% and 9.99%. | Can go from 0% to 4.75% according to your credit standing. |

| Late Fee | $10. | $25. |

| Early Payoff Penalty | You can settle your loan anytime without penalties. | None. You can repay your loan anytime without incurring a fee. |

Intrigued by Avant’s offerings? Then your path to financial empowerment could be just a click away.

So explore more about Avant and learn how to apply by visiting the link below.

Apply for the Avant Personal Loans

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Trending Topics

$0 annual fee: Petal® 1 “No Annual Fee” Visa® Credit Card review

Review Petal® 1 “No Annual Fee” Visa® Credit Card main features and learn how it works. Earn up to 10% cash back on select merchants!

Keep Reading

Apply for First Progress Platinum Elite Mastercard® Secured fast

See how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card and get a flexible credit limit of up to $2,000.

Keep Reading

Rebuild Your Credit Score: Choose the Perfect Cards for Bad Credit

Discover the best credit cards for bad credit. Boost your financial journey and improve your score with our trusted options.

Keep ReadingYou may also like

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading

Apply for the First Access Visa® Card: Free credit score access

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading