Credit Card

Apply for the First Access Visa® Card: Free credit score access

Looking to apply for the First Access Visa® Card? Walk through our step-by-step guide - earn 1% cash back on purchases and more!

Advertisement

Learn how the application process works and secure your unsecured credit line!

When you apply for the First Access Visa® Card, you’re opening the door to a world of credit and rebuilding your financial profile.

Curious about the application process? Keep reading as we’ll walk you through each step, making it easier than ever to embark on your credit journey.

Online application

You can apply for the First Access Visa® Card online by visiting their official website. The process is simple, and you’ll get an instant response.

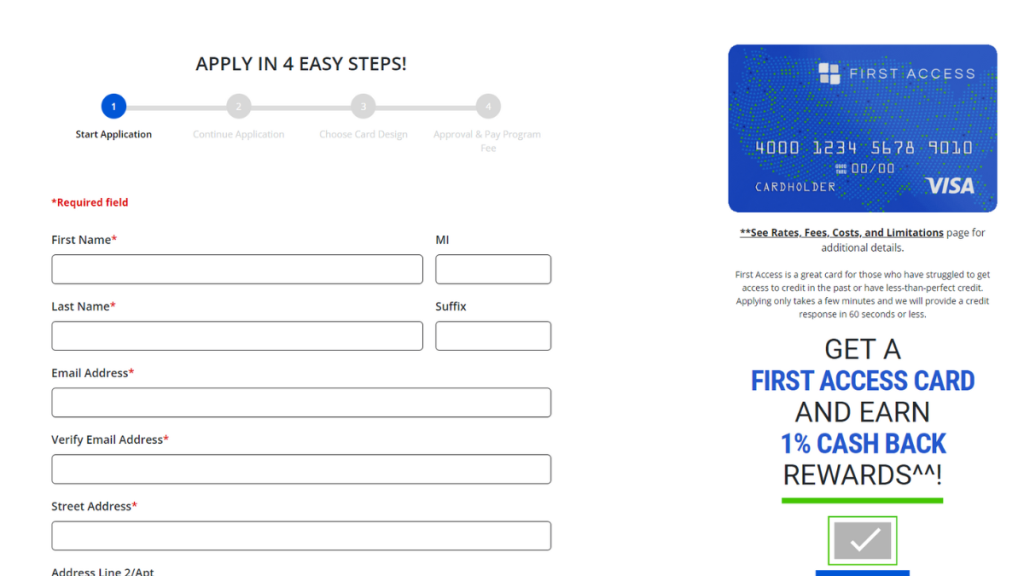

There are four steps, and the first one is an online form in which you must write down your info, contact details, and address.

The next step is about your finances and employment details. Make sure to review your application to make sure everything is correct.

In the third step, you can choose your card’s design and make it match your personality.

Finally, submit your application and wait for a response. If approved, You must pay your one-time program fee to open your account.

The card will arrive at your address within a few days, and you can either activate it online or using the First Access Visa® Card mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

While the First Access Visa® Card offers a user-friendly mobile app, you cannot apply for a credit card.

Once you’re done with you’re online application through their website, you can download the app and activate the card.

Then, you can use the app to manage your account, check your balance, pay your monthly bill, and more.

First Access Visa® Card or Mission Lane Visa® Credit Card?

Both the First Access Visa® Card and the Mission Lane Visa® Credit Card are designed with individuals looking to build or rebuild their credit in mind.

However, key differences might make one better suited for your needs than the other.

The First Access offers an unsecured line, making it a favorable choice if you’re wary of deposits.

The Mission Lane comes with transparent terms and competitive rates, providing features encouraging responsible credit usage.

While both cards serve similar purposes, their offerings can significantly differ based on individual needs. So, compare their features below.

| First Access Visa® Card | Mission Lane Visa® Credit Card | |

| Credit Score | You can request the card even with a bad score; | You can apply even with a fair score or limited credit history; |

| Annual Fee | $75 during your first year, then $48 after; | $0 – $59 according to your creditworthiness; |

| Purchase APR | 35.99%; | 26.99% – 29.99% variable; |

| Cash Advance APR | 35.99%; | 29.99% variable; |

| Welcome Bonus | There are none currently; | None; |

| Rewards | You can earn 1% back on your balance payments. | There are no rewards programs available currently. |

And if you want to learn more about the Mission Lane Visa® Credit Card, dive into the following article!

We’ll also show how simple it is to apply for it.

Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Trending Topics

Upgrade Triple Cash Rewards Visa® review: earn $200 bonus

Find out about the main features of this card in this Upgrade Triple Cash Rewards Visa® review. Earn up to 3% unlimited cash back!

Keep Reading

Earn up to 5% back: Capital One Walmart Rewards® Card review

Looking for a card with great rewards and no $0 annual fee? Learn how to with this Capital One Walmart Rewards® Card review!

Keep ReadingYou may also like

Apply for the Wells Fargo Reflect® Card: Pay no annual fee!

Discover how to apply for the Wells Fargo Reflect® Card in our concise guide and enjoy no annual fees with an extensive low APR intro.

Keep Reading

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep Reading

First Digital Mastercard® Credit Card review: 1% cash back

Discover the main features of this card in our First Digital Mastercard® Credit Card review! Start building credit today! Read on!

Keep Reading