Credit Card

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

Learn how to apply for the Wells Fargo Active Cash® Card and tap into a world of benefits, from cash back to no annual fees. Read on and learn more!

Advertisement

Your gateway to financial freedom without extra charges

Ready to apply for the Wells Fargo Active Cash® Card? It’s more than just filling out a form; it’s the first step towards harnessing premium perks.

Navigating the application process is easier than you might think. Further, dive into our step-by-step guide below.

Online application

The Wells Fargo Active Cash® Card is within easy reach on the Wells Fargo official website. Start there to unlock a realm of premium card benefits.

Head to the “Credit Cards” section on the site. Spot the Active Cash® Card among the options. You’ll see the “Apply Now” button, signaling your next step.

Thus, upon clicking “Apply Now”, an application form awaits. Indeed, this form is your key to accessing the card’s features.

While filling out the form, ensure all information is precise and accurate. Once you’re satisfied with the provided details, hit “Submit”.

Further, the system will review your application. In a short span, you’ll receive feedback on your application status.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

While the Wells Fargo mobile app offers a plethora of functionalities, currently, you can’t directly apply for the Wells Fargo Active Cash® Card within it.

If you’re already a cardholder, the app makes tracking your Active Cash® Card spending and rewards a breeze.

Furthermore, with a few taps, you can see your cash back accumulate in real time.

Wells Fargo Active Cash® Card or Upgrade Triple Cash Rewards Visa®?

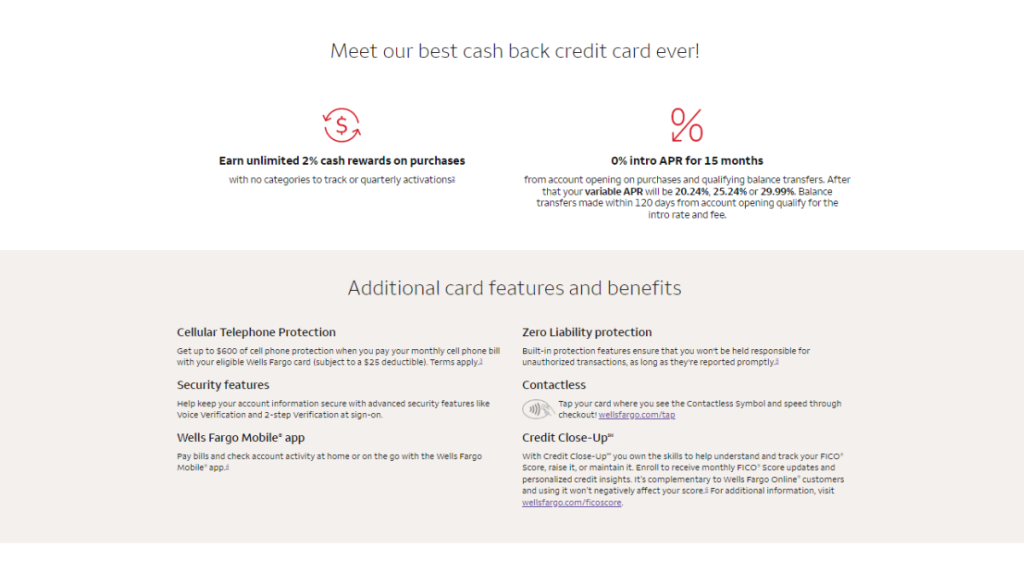

The Wells Fargo Active Cash® Card is a compelling choice for those seeking straightforward rewards and versatile features.

Indeed, its offerings are hard to overlook.

However, variety is the spice of life. The Upgrade Triple Cash Rewards Visa® emerges as another contender, offering its unique set of advantages.

With rewards on utilities, the Upgrade Triple Cash Rewards Visa® might align more closely with certain spending patterns, which deserves consideration.

| Wells Fargo Active Cash® Card | Upgrade Triple Cash Rewards Visa® | |

| Credit Score | You need a good score (700 or higher) to become eligible; | A good to excellent score is required to apply for the card. |

| Annual Fee | No yearly charge to add this card to your wallet; | Cardmembers don’t have to worry about annual fees. |

| Purchase APR | New members can relish on a long low intro APR (0% for 15 months) on purchases and qualifying balance transfers made within the first 120 days of owning the card. Once that period ends, a variable 20.24%, 25.24%, or 29.99% applies; | 14.99% – 29.99% variable. |

| Cash Advance APR | 29.99% variable; | N/A; |

| Welcome Bonus | After spending $500 or more within the first 3 months, new members can enjoy a $200 cash bonus; | New members can enjoy a $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions; |

| Rewards | All purchases offer a 2% rebate with no categories or limitations. | 3% cash back on Home, Auto, and Health payments, and 1% on everything else. |

Interested in this alternative? Dive into the application process for the Upgrade Triple Cash Rewards Visa®. Simply follow the link below to get started!

Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Trending Topics

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep Reading

Credit builder: Apply for First Digital Mastercard® Credit Card

The process to apply for the First Digital Mastercard® Credit Card is simple and quick! Earn 1% cash back on payments and build credit fast!

Keep Reading

Citi Custom Cash® Card Review: Smart Spending Rewarded

Read our Citi Custom Cash® Card review for insights on its fantastic welcome bonus, 5% cash back in select categories, and no annual fee.

Keep ReadingYou may also like

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep Reading