Credit Card

Citi Custom Cash® Card Review: Smart Spending Rewarded

Explore the Citi Custom Cash® Card in our review. Exciting rewards and benefits await, without an annual fee. Curious for more? Learn the full details in our comprehensive guide!

Advertisement

Learn about earning big rewards and no annual fee benefits with this card

In our Citi Custom Cash® Card review, we examine a credit card designed for the practical spender, offering a unique blend of rewards and convenience.

Apply for the Citi Custom Cash® Card

Learn how to apply for the Citi Custom Cash® Card to enjoy an extensive low rate intro, incredible rewards, and flexible redemption options!

From its solid welcome bonus to the flexible rewards program, this card packs a punch. So read on and learn more!

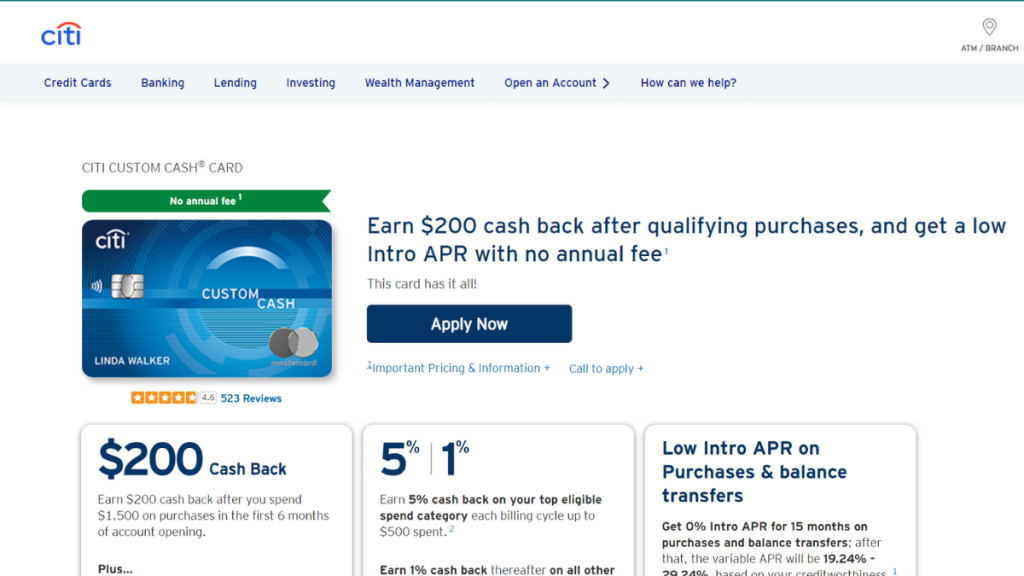

| Credit Score | Best suited for those with Good to Excellent credit scores, paving the way for more financial flexibility. |

| Annual Fee | Enjoy the perks without the burden of yearly charges, making it a cost-effective choice for savvy spenders. |

| Purchase APR | Benefit from a 0% rate for the first 15 months, a great start before transitioning to a variable rate of 19.24% – 29.24%. Intro rate covers purchases and balance transfers, and all balance transfers must be done within the first 4 months. |

| Cash Advance APR | Set at a variable 29.99%, a consideration for those occasional cash needs. |

| Welcome Bonus | Earn a substantial $200 cash back by spending $1,500 in the initial 6 months, a rewarding start for new cardholders. |

| Rewards | Tailor your rewards to your lifestyle with 5% cash back on your highest spending category each billing cycle (up to $500), followed by 1% on all other purchases, making every expense more rewarding. |

Citi Custom Cash® Card: All you need to know

Firstly, the Citi Custom Cash® Card is a standout choice for those who value simplicity and efficiency in a credit card.

Then, the card offers a lucrative $200 cash back bonus as a welcome offer. This initial reward sets the tone for the benefits that follow.

Moreover, the card’s unique feature lies in its 5% cash back on top spend categories each billing cycle.

Additionally, the absence of an annual fee is a major plus. It means more savings and less worry about extra costs.

Notably, this card provides an initial 0% APR for both purchases and balance transfers, extending over a 15-month period. It’s a helpful tool for managing larger expenses.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Citi Custom Cash® Card

Below in our Citi Custom Cash® Card review, we’ll look into the advantages and drawbacks of this popular credit card.

While it offers a range of benefits that appeal to many, it’s also important to consider the potential downsides.

So here’s a straightforward look at the pros and cons:

Pros

- Unlock a rewarding $200 cash bonus upon meeting your first spending goal.

- Revel in a robust cash back rate in your highest spending category every billing cycle, with a generous cap of $500.

- Enjoy all the card’s premium features without worrying about an annual fee.

- Benefit from a welcoming 0% APR on purchases and balance transfers, stretching across the first 15 months.

- Versatile redemption options for your points, including cash back, travel adventures, or an array of gift card choices.

Cons

- The enticing 5% cash back offer is limited to $500 in purchases each billing period.

- Be prepared for a potentially higher APR once the introductory phase concludes.

- Note the 3% fee on purchases made in foreign currencies – a consideration for international spenders.

- This card requires a solid credit history, ranging from good to excellent.

- The 5% cash back benefit applies to select categories, which might not encompass all your spending habits.

What credit score do you need to apply?

To qualify for the Citi Custom Cash®, having a score that falls within the good to excellent range is advised.

This range means a strong credit history and financial responsibility.

While this card is designed for individuals with a solid credit profile, it’s essential to note that other factors, such as income and existing debts, also play a role in the approval process.

How to easily apply for the Citi Custom Cash® Card?

In summary, this review of the Citi Custom Cash® Card highlights its advantages and possible limitations.

Indeed, it’s a versatile choice, offering generous advantages all around.

To grab the opportunities this card presents, learn how to apply for it by following the steps detailed in the article below.

So start maximizing your spending and rewards today!

Apply for the Citi Custom Cash® Card

Learn how to apply for the Citi Custom Cash® Card to enjoy an extensive low rate intro, incredible rewards, and flexible redemption options!

Trending Topics

Upgrade Triple Cash Rewards Visa® review: earn $200 bonus

Find out about the main features of this card in this Upgrade Triple Cash Rewards Visa® review. Earn up to 3% unlimited cash back!

Keep Reading

First Access Visa® Card review: Earn 1% back on card payments!

Explore our detailed First Access Visa® Card review to learn about its features and benefits. Earn 1% cash back on purchases and more!

Keep Reading

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep ReadingYou may also like

$0 annual fee: Petal® 1 “No Annual Fee” Visa® Credit Card review

Review Petal® 1 “No Annual Fee” Visa® Credit Card main features and learn how it works. Earn up to 10% cash back on select merchants!

Keep Reading

First Progress Platinum Select Mastercard® Secured Credit Card review

Check our First Progress Platinum Select Mastercard® Secured Credit Card review and begin the path to building credit!

Keep Reading