Credit Card

Apply for the Citi Custom Cash® Card: Unlock Elite Perks

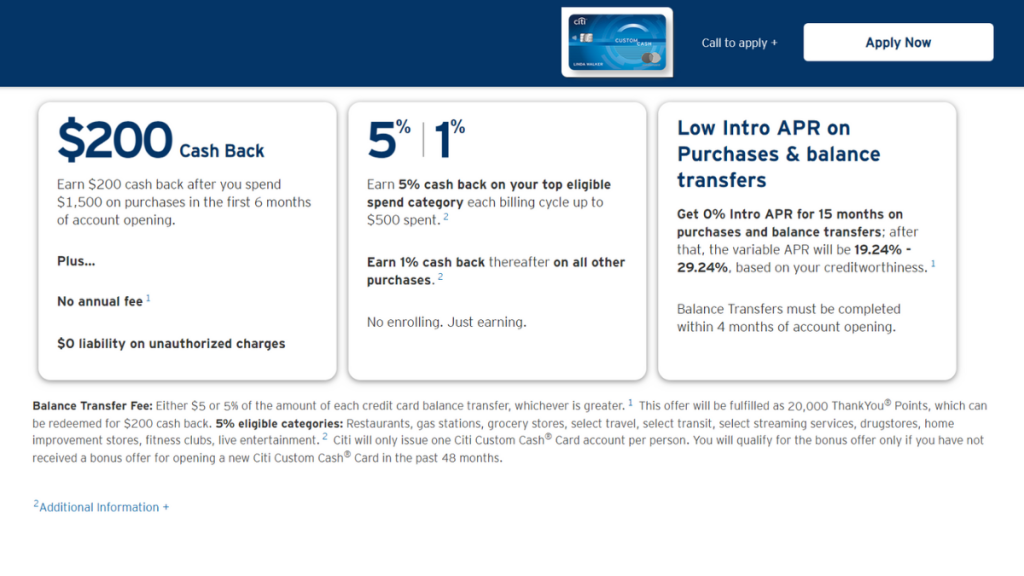

Discover the exclusive rewards when you apply for the Citi Custom Cash® Card. Benefit from a low intro APR and earn generous cash back. Learn more about how to apply and unlock these exciting perks.

Advertisement

Learn how to apply and unveil special offers reserved for cardholders!

Learning how to apply for the Citi Custom Cash® Card opens the door to a world of rewards. With cash back and unique offers, it is a financial game-changer.

If you’re wondering what the first steps are, our guide walks you through the process, making it easy. Dive in to discover how this card works.

Online application

Firstly, to apply for the Citi Custom Cash® Card you need to head to its official site.

Then, locate the ‘Apply Now’ button on the card’s page. Clicking here directs you to the application form.

In the application, you’ll enter personal details like your name, address, and income. After filling in the form, take a moment to review all your inputs.

Citi will now review your application, which includes a credit check. This process may take a few days.

Lastly, as soon as you’re approved and get the card in the mail, you can start enjoying its many perks.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Unfortunately, you can’t apply for the Citi Custom Cash® Card via mobile app. However, the app is an incredible tool for account management.

Undoubtedly, the app’s alert system is a boon. So stay updated on your account balance, due dates, and credit limits.

Furthermore, the app integrates digital wallets, increasing transaction security and ease.

Moreover, this feature becomes invaluable for card usage and online shopping.

Citi Custom Cash® Card or Upgrade Triple Cash Rewards Visa®?

Wrapping up our discussion on the Citi Custom Cash® Card, it stands out as a top choice for those who appreciate diverse cash back options and the freedom to spend.

On the other hand, the Upgrade Triple Cash Rewards Visa® emerges as a strong contender.

Indeed, it provides steady cash back on every purchase without being bound by specific categories.

Additionally, the Upgrade card excels with its unlimited 3% cash back on home, auto, and health expenditures, and the bonus of no annual fees.

| Citi Custom Cash® Card | Upgrade Triple Cash Rewards Visa® | |

| Credit Score | Ideal for Good to Excellent credit, this card opens doors to greater financial freedom. | Good to excellent. |

| Annual Fee | Revel in annual fee-free perks, a smart choice for cost-conscious spenders. | You can enjoy the card’s features and benefits without the burden of an annual fee. |

| Purchase APR | Enjoy an initial 0% rate for 15 months, then a variable rate of 19.24% – 29.24%. Intro rate applies to balance transfers within the first 4 months. | 14.99% – 29.99% variable. |

| Cash Advance APR | Be mindful of the 29.99% variable rate for cash needs. | Not disclosed. |

| Welcome Bonus | Spend $1,500 in 6 months to earn a $200 cash back, a great boost for new users. | Get a $200 bonus when you open a Reward Checking account and make three debit card purchases. |

| Rewards | Customize rewards with 5% cash back in top spending categories each cycle, up to $500, plus 1% on all else. | Receive 3% cash back on specific home, auto, and health brands, and enjoy 1% back on all other buys. |

So, intrigued by the Upgrade Triple Cash Rewards Visa®?

Then follow the link below to learn more and find out how to apply, seamlessly integrating it into your financial toolkit.

Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Trending Topics

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Keep Reading

Make Money Online: 10 Proven Ways

There are many ways to make money online, and one of these will certainly fit you. Put your pajamas back on and check our list!

Keep Reading

Apply for the Best Egg Personal Loans: Quick Cash, Zero Hassles!

Ready to transform your finances? Apply for Best Egg Personal Loans easily and embrace convenient, reliable funding for your peace of mind.

Keep ReadingYou may also like

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep Reading

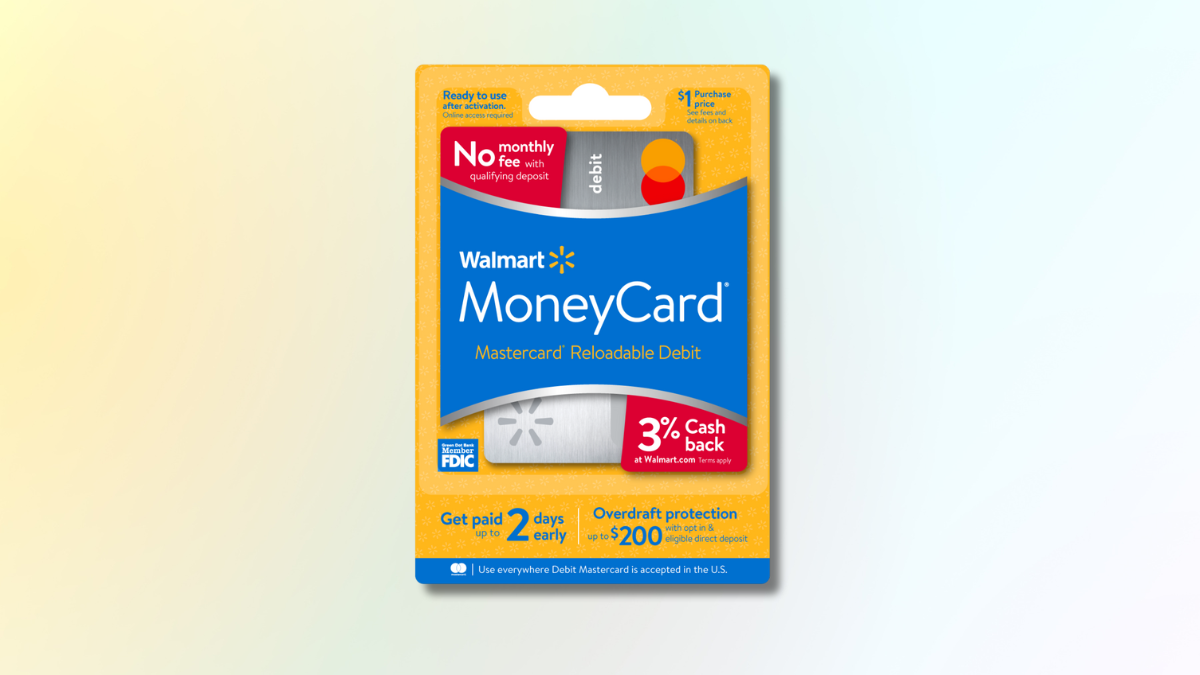

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep Reading

Ensure 1% cash back: Total Visa® Card review

In this Total Visa® Card review, you'll find an excellent solution to build your credit score fast! Access free credit monitoring and more!

Keep Reading