Debit Card

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

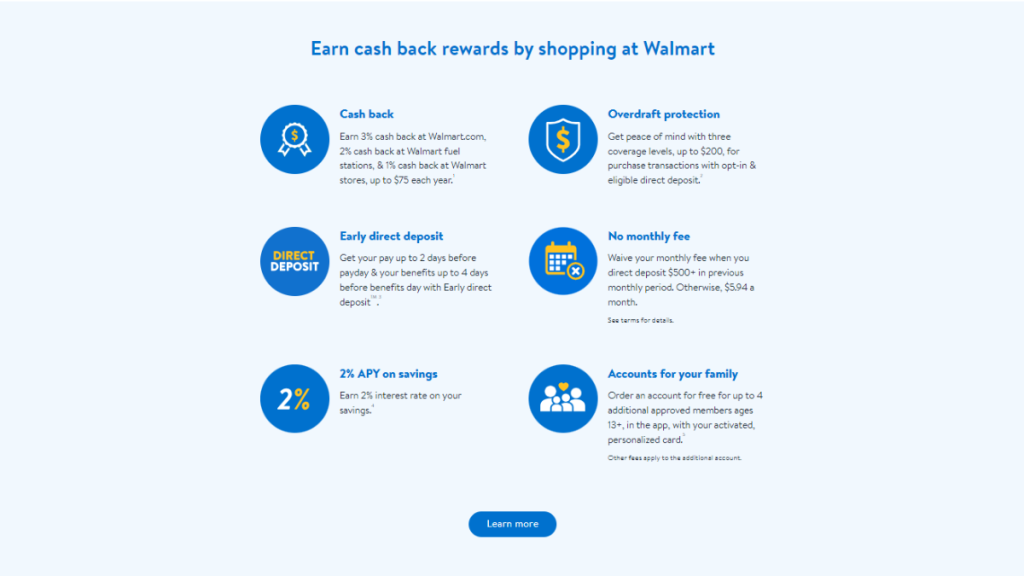

Are you looking for a streamlined way to apply for the Walmart MoneyCard? Our guide breaks down the process! Up to 3% cash back on purchases!

Advertisement

Get overdraft protection and amazing rewards!

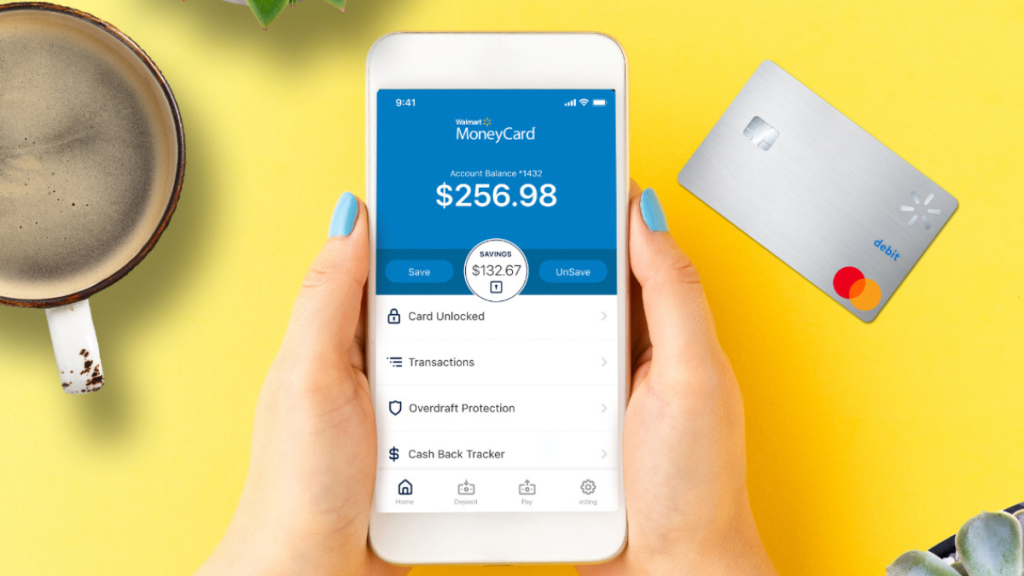

Looking to apply for the Walmart MoneyCard? You’re considering a versatile financial tool designed for convenience and accessibility.

Interested in making the Walmart MoneyCard a part of your financial toolkit? Then, keep reading to explore our step-by-step guide.

Online application

You can apply for the Walmart MoneyCard online in just a few easy steps. Start by heading over to the Walmart MoneyCard website.

Further, you must provide basic details about yourself, like your address and date of birth.

Once you’ve created your account, you can request your Walmart MoneyCard. It typically takes about two weeks for it to arrive at your address.

When you get the card, you’ll have to activate it. You can do it online or using the MoneyCard mobile app. Additional identification might be required.

Then, all you have to do is load the funds to your card so you can start using it. You can opt for direct deposit or use cash at participating stores.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Unfortunately, using their mobile app, you cannot apply for the Walmart MoneyCard.

You can download the app for free once you purchase the card online or at a Walmart Store.

Indeed, the application is available for Android and iOS devices.

Furthermore, it offers a simple and effective way to manage your account, check your balance, and find ATMs in your location.

Walmart MoneyCard or Chime Visa® Debit Card?

The Walmart MoneyCard is a nifty tool for those who often find themselves strolling the aisles of Walmart.

Not only is it convenient, but it also brings with it some cool rewards, making your shopping experience even better.

Now, while the Walmart MoneyCard is great, another card worth your attention is the Chime Visa® Debit Card.

Thus, it offers its blend of benefits, perfect for those seeking a fresh alternative.

From quick transactions to innovative features, the Chime card could be just what you’re searching for. So check out the comparison below.

| Walmart MoneyCard | Chime Visa® Debit Card | |

| Credit Score | All credit levels are welcome; | All credits considered, but you have to open a Chime account; |

| Annual Fee | $5.94 monthly fee, which can be waived with a $500+ direct deposit in the previous monthly statement period; | There are no annual, monthly, or maintenance fees attached to the Chime Visa® Debit; |

| Purchase APR | It does not apply since it’s a prepaid card; | Does not apply; |

| Cash Advance APR | It does not apply; | Does not apply; |

| Welcome Bonus | There are no welcome offers currently; | There are no welcome offers currently; |

| Rewards | You can earn 3% back at Walmart’s online store, 2% at Walmart fuel stations, and 1% at physical stores. Cash back rewards are up to $75 per year. | This is not a rewards card. |

Further, dive into the following link to learn everything there is to know about the Chime Visa® Debit Card and how to apply for it!

How to apply for the Chime® Debit Card

Explore our guide on how to apply for the Chime® Debit Card. Simplify your financial journey with our easy-to-follow steps.

Trending Topics

Apply for the First Latitude Secured Mastercard® Credit Card

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Keep Reading

Apply for Bank of America® Customized Cash Rewards Credit Card

Discover how to apply for a Bank of America® Customized Cash Rewards Credit Card today! Ensure 0% intro APR for 15 months and more! Read on!

Keep Reading

Rebuild Your Credit Score: Choose the Perfect Cards for Bad Credit

Discover the best credit cards for bad credit. Boost your financial journey and improve your score with our trusted options.

Keep ReadingYou may also like

Chase Freedom Flex℠ Credit Card Review: 0% APR and Much More!

Explore our Chase Freedom Flex℠ Credit Card review for exclusive cash back rewards & 0% intro APR benefits. Maximize your spending smartly!

Keep Reading

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep Reading

OneMain Financial Personal Loans Review: Borrow up to 20k!

Explore our OneMain Financial Personal Loans review – a lifeline for those with low credit, offering unique flexibility in payments.

Keep Reading