Debit Card

No hidden fees: How to apply for the Chime® Debit Card

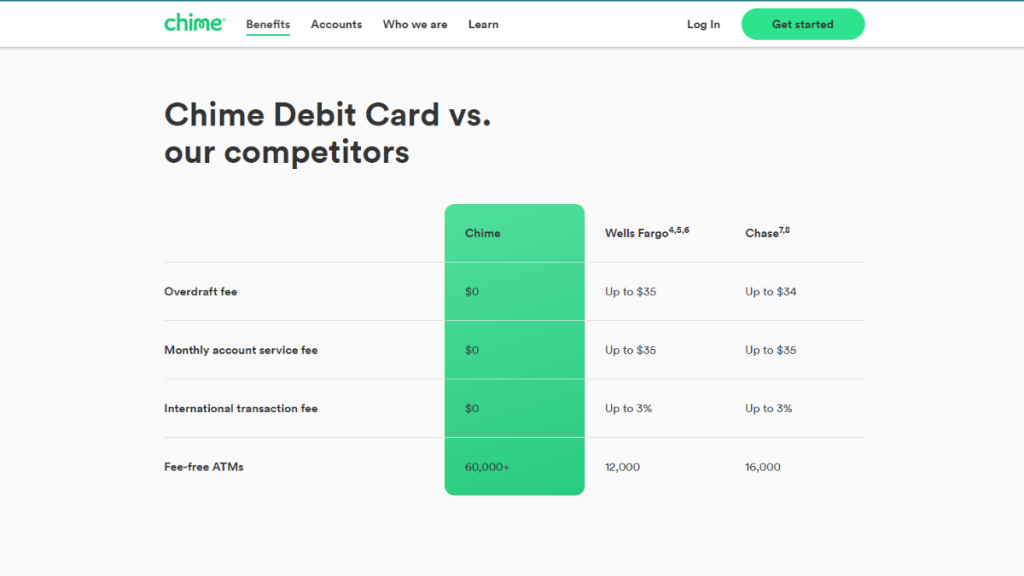

Don't miss out on the convenience and security of using a Chime Visa® Debit Card! Check out our simple guide and learn how to apply today!

Advertisement

No overdraft charges and instant alerts to keep your money safe

Ready to make a financial switch? To apply for the Chime® Debit Card is to embrace banking made simple.

Curious about the details? Then, let’s dive in and uncover the steps to bring the Chime Visa® Debit Card into your wallet.

Online application

To apply for the Chime Visa® Debit Card, you must first create a Chime checking or savings account.

To do so, access their website and hit “get started.” Then, provide all the information that is requested. Remember you must be 18 or older.

Once you open the account, you must set up direct deposit or link an existing bank account to fund your debit card.

Your new Chime Visa® Debit Card usually ships between 7 and 10 business days.

However, you can use a digital card in the app immediately to make purchases.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

You can easily apply for the Chime Visa® Debit Card via Chime’s mobile app, a seamless experience designed for on-the-go individuals.

Begin by downloading and installing the Chime app from your preferred app store. Then, click the “get started” option to create your account.

From here on out, the process is identical to the one described above.

Youyou have to link a bank account or set up direct deposit access to your new card.

Chime® Debit Card or Amazon Rewards Visa Signature Card?

But if you’re not sure whether or not to apply for the Chime® Debit Card, we suggest the Amazon Rewards Visa Signature Card.

While the Amazon alternative is not a debit card, it may offer a more rewarding experience.

Further, check out the comparison table below to learn more about its features and benefits.

Then, explore the following link to learn how to apply for it.

| Chime Visa® Debit Card | Amazon Rewards Visa Signature Card | |

| Credit Score | All credits considered, but you have to open a Chime account; | Good – Excellent; |

| Annual Fee | There are no annual, monthly, or maintenance fees attached to the Chime Visa® Debit; | You don’t have to pay an annual fee for the Amazon Rewards Visa. |

| Purchase APR | Does not apply; | 19.24% to 27.24% (Cardmembers can choose 0% APR for 6-12 months on purchases instead of the 3% cash back at Amazon); |

| Cash Advance APR | Does not apply; | 29.99% variable; |

| Welcome Bonus | There are no welcome offers currently; | $100 Amazon gift card upon approval, loaded into your Amazon account; |

| Rewards | This is not a rewards card. | With this card, you’ll earn 3% back on all Amazon, Whole Foods, and Chase Travel purchases. 2% back at local transit, restaurants, and gas stations. Plus, 1% on everything else. |

Further, learn how to apply for the Amazon Rewards Visa Signature Card! Indeed, their application process is simple and quick!

So keep reading and learn more!

Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Trending Topics

PayPal Prepaid Mastercard® review: Earn Payback Rewards

Dive into our PayPal Prepaid Mastercard® review to learn about its benefits, manage your funds wisely, and spend securely everywhere!

Keep Reading

Simple and quick process: Apply for the Total Visa® Card

Apply for Total Visa® Card today and ensure 1% cash back on purchases and uncomplicated features! Build credit fast with this credit card!

Keep Reading

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep ReadingYou may also like

Apply for the Chase Freedom Flex℠ Credit Card: $200 Bonus

Learn how to apply for the Chase Freedom Flex℠ Credit Card to enjoy a $200 welcome bonus and grand cash back on rotating categories.

Keep Reading

Apply for the First Access Visa® Card: Free credit score access

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

Keep Reading

Apply for the PayPal Prepaid Mastercard®: Hassle-free and online

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

Keep Reading