Credit Card

Chase Freedom Flex℠ Credit Card Review: 0% APR and Much More!

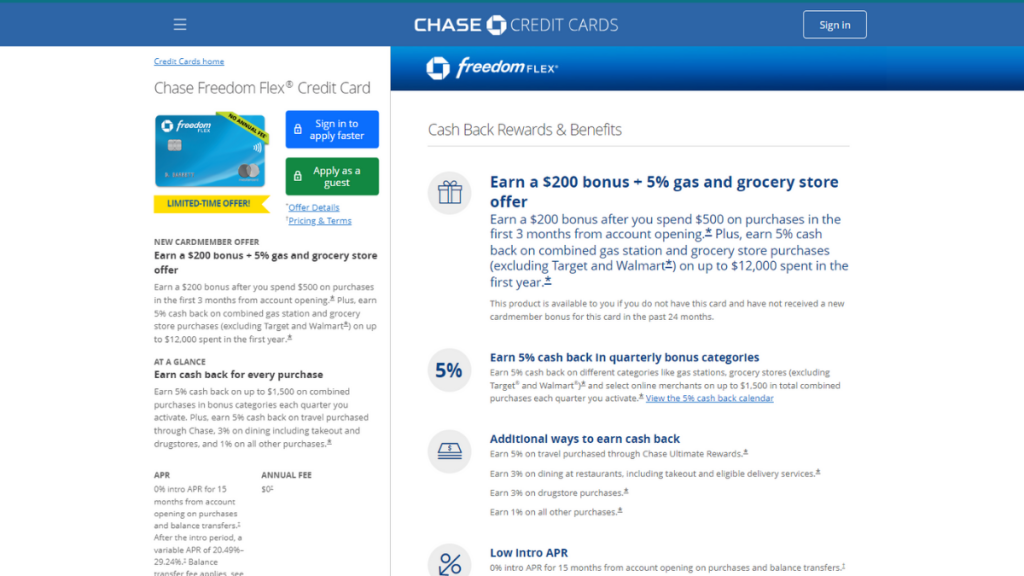

Looking for a versatile credit card? Read our Chase Freedom Flex℠ review! Discover how its generous cash back and 0% intro APR offer can transform your everyday spending into rewarding experiences.

Advertisement

Boost your savings potential with the Chase Freedom Flex℠ – rewarding you at every step

Explore the benefits of the Chase Freedom Flex℠ Credit Card in our detailed review.

Apply for the Chase Freedom Flex℠ Credit Card

Learn how to apply for the Chase Freedom Flex℠ Credit Card to enjoy a $200 welcome bonus and grand cash back on rotating categories.

Uncover the advantages of the Chase Freedom Flex℠, featuring dynamic bonuses and enhanced security measures.

| Credit Score | Best suited for people with a robust credit rating. |

| Annual Fee | Zero yearly cost for endless benefits. |

| Purchase APR | Enjoy 0% interest for the first 15 months, followed by a variable rate of 20.49%–29.24%, dependent on your credit standing. |

| Cash Advance APR | Variable at 29.99%, applicable for immediate cash needs. |

| Welcome Bonus | Earn a swift $200 incentive by spending $500 in the first quarter, an enticing offer for new users. |

| Rewards | 5% cash back in rotating quarterly categories upon activation (terms apply); constant 5% back on travel purchased through Chase’s travel program; daily delights with 3% back on dining and drugstore purchases; a solid 1% return on all other spending; plus special perks like 5% back on Lyft rides through March 2025, and exciting offers with DoorDash and Instacart. |

Chase Freedom Flex℠ Credit Card: All you need to know

Firstly, start with the Chase Freedom Flex℠ and receive a warm welcome in the form of a $200 bonus by spending $500 in the initial 3 months.

Next up, this card turns routine shopping into a reward fest with 5% cash back on ever-changing categories each quarter.

Then, the card sweetens everyday moments with 3% cash back on dining and drugstore purchases, adding value to your daily routines.

Significantly, the Chase Freedom Flex℠ shines with its zero annual fee policy, ensuring your rewards are maximized without extra costs.

Lastly, the card supports your financial goals with a 15-month 0% introductory APR, offering a comfortable window for managing major expenditures.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Chase Freedom Flex℠ Credit Card

This comprehensive review of the Chase Freedom Flex℠ Credit Card now scrutinizes both its positive and negative aspects.

Famed for its generous cash back and user-centric design, the Freedom Flex℠ has aspects that merit careful consideration.

So here’s a breakdown of its strengths and weaknesses:

Pros

- Grab a nice $200 bonus by just spending $500 in your first 3 months.

- Rotate and roll with 5% cash back in different categories every quarter.

- Book your trips through Chase Ultimate Rewards and get 5% back – travel smarter!

- Dining out or going to the drugstore? That’s 3% cash back for you.

- There’s no annual fee to stress over.

- Take advantage of 0% APR on purchases for the first 15 months.

Cons

- Managing rotating categories requires attention and activation.

- Applies a 3% fee on foreign transactions for international purchases.

- Variable APR post-intro period can be high for ongoing balances.

- Cash advances come with high fees, making them expensive.

- The 5% cash back has a cap, limiting the earning potential.

- Suitable mainly for those with good to excellent credit scores.

What credit score do you need to apply?

When applying for the Chase Freedom Flex℠, it’s generally recommended to have a good credit score, ideally above 670, to boost your likelihood of approval.

Remember, though, that credit score isn’t the sole factor. So your entire financial history is important.

Therefore, maintain a strong financial record to improve your chances.

How to easily apply for the Chase Freedom Flex℠ Credit Card?

In summary of our Chase Freedom Flex℠ review, this card stands out for its excellent value through its array of rewards and features

It’s an excellent versatile solution. So, contemplating the Chase Freedom Flex℠ for your wallet?

Then follow the article below to learn how to apply and start enjoying its benefits today. Your financial journey awaits!

Apply for the Chase Freedom Flex℠ Credit Card

Learn how to apply for the Chase Freedom Flex℠ Credit Card to enjoy a $200 welcome bonus and grand cash back on rotating categories.

Trending Topics

GO2bank Secured Visa® Credit Card review: Build credit fast

Explore our GO2bank Secured Visa® Credit Card review and discover a smart way to boost your credit journey - no credit check!

Keep Reading

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep Reading

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep ReadingYou may also like

How to Invest in Mutual Funds: 5 Practical Steps

Learn how to invest in mutual funds with our easy guide. Explore types, smart strategies, fees, and tips for a successful investing journey.

Keep Reading

Apply for the Discover it® Cash Back Credit Card: Extra Perks

Learn the steps to apply for the Discover it® Cash Back Credit Card and enjoy its hefty welcome bonus. Check our quick and simple guide!

Keep Reading

Apply for the Citi Custom Cash® Card: Unlock Elite Perks

Learn how to apply for the Citi Custom Cash® Card to enjoy an extensive low-rate intro, incredible rewards, and flexible redemption options!

Keep Reading