Credit Card

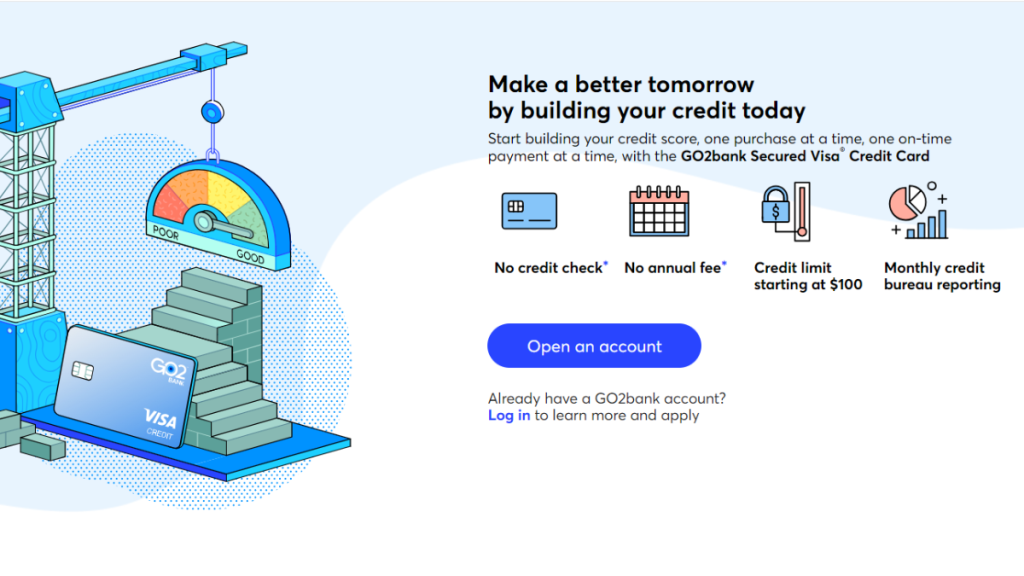

GO2bank Secured Visa® Credit Card review: Build credit fast

Is the GO2bank Secured Visa® Credit Card the right choice for your finances? Read our in-depth review to find out! $0 annual fee and no credit check!

Advertisement

Taking your first step towards a better financial future has never been easier

Establishing strong credit can feel like venturing into unknown territory. Let our GO2bank Secured Visa® Credit Card review guide you!

Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

With clear insights, we’ll guide you through the features of this card tailored for those looking to build a strong credit foundation! So read on and learn more!

| Credit Score | There are no credit checks on existing account holders, so everyone is welcome to apply; |

| Annual Fee | There’s no annual fee for the GO2bank Secured Card; |

| Purchase APR: | 22.99%; |

| Cash Advance APR: | 26.99%; |

| Welcome Bonus: | There are no welcome offers currently; |

| Rewards: | This is not a rewards card, so there are none. |

GO2bank Secured Visa® Credit Card: All you need to know

Are you looking for a trusty sidekick in your credit journey? The GO2bank Secured Visa® might just be the ticket.

This card is like training wheels for your financial bicycle, helping you build credit step by step. However, it is only available for GO2bank account holders with direct deposits.

This means you need to receive at least $100 (which will act as your spending limit) in the previous 30 days to become eligible for the card.

The GO2bank Secured helps you build up your score with monthly reporting to America’s three major credit bureaus.

Plus, you can use it anywhere Visa cards are accepted.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the GO2bank Secured Visa® Credit Card

Before you sign up, let’s look at all the pros and cons of selecting the GO2bank Secured Visa® Credit Card as your go-to financial tool in our review.

Pros

- The GO2bank Secured is designed to help users establish or rebuild their credit;

- Your deposit determines your credit limit, which can help prevent overspending;

- User-friendly app to monitor spending and manage your account;

- Being a Visa, it’s accepted at a multitude of places worldwide;

- GO2bank reports all your account activity to credit bureaus.

Cons

- An upfront deposit is needed, which can be a barrier for some;

- There could be associated fees that users need to be aware of;

- Interest rates might be higher than some traditional credit cards;

- Your initial credit limit is tied to your deposit amount;

- It does not offer substantial rewards or cash back for purchases.

What credit score do you need to apply?

The GO2bank Secured Visa® Credit Card requires a security deposit and is only available for GO2bank existing customers.

Therefore, there’s no credit check on new applications.

Therefore, all credit types are welcome to apply. GO2bank does, however, have other requirements for new applicants.

You need to be at least 18 years old and have a SSN.

How to easily apply for the GO2bank Secured Visa® Credit Card?

Excited to elevate your credit journey with a trusty companion?

Then stay tuned for our next article on the GO2bank Secured Visa® Credit Card application process.

From start to finish, we’ll demystify the steps, making it a breeze. So don’t miss out on unlocking the door to a brighter financial future!

Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Trending Topics

How to apply for the Destiny Mastercard®: Response in 60 seconds

Ready to shape your financial future? Learn how to apply for the Destiny Mastercard® today and step forward with confidence!

Keep Reading

How to Invest in Mutual Funds: 5 Practical Steps

Learn how to invest in mutual funds with our easy guide. Explore types, smart strategies, fees, and tips for a successful investing journey.

Keep Reading

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Keep ReadingYou may also like

Upgrade Loans review: Quick Approvals, Easy Process

Check our Upgrade Loans review to explore low rates and flexible terms that cater to your financial needs. Unlock smarter borrowing

Keep Reading

Apply for the OneMain Financial Personal Loans: Fast Funding!

Secure your financial needs; apply for OneMain Financial Personal Loans for quick funding solutions and accessible branch support near you.

Keep Reading