Loans

Apply for the OneMain Financial Personal Loans: Fast Funding!

Ready for a financial boost? Learn how to apply for OneMain Financial Personal Loans and experience swift funding, alongside the comfort of branch access.

Advertisement

Get quick cash in hand with OneMain Financial’s speedy loan process

So, are you ready to apply for the OneMain Financial Personal Loans? It’s a decision that could reshape your financial landscape.

So dive in, uncover the easy-to-follow steps, and see just how simple securing your financial future can be with OneMain Financial.

How to apply online?

Starting your journey to apply for the OneMain Financial Personal Loans begins online. Firstly, visit their site, where you’ll find an intuitive interface.

Secondly, in the application process is providing your personal information. Accuracy is key here, ensuring your application sails through without a hitch.

Once submitted, the wait isn’t long. OneMain Financial reviews your application swiftly, often providing instant conditional decisions.

If you receive approval, the subsequent step is verification. Then you might be asked to submit documents for validation.

Finally, after your information is verified, you’re on the home stretch. Read through the terms carefully, and then seal the deal.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

- A valid Social Security number or individual taxpayer identification number;

- Ensure you live in a state where OneMain operates;

- You must be at least 18 years old (19 in some states);

- Show you have a stable income (job, benefits, alimony, etc.);

- While there’s no minimum, a healthy credit background helps.

- Bank account details for the direct disbursement of funds.

How to apply using the app?

You can’t apply for the OneMain Financial Personal Loans via a dedicated app because they simply don’t have one.

However, this isn’t a setback. OneMain has prioritized making their website remarkably mobile-friendly.

So, even if you’re on the go, applying is seamless on any device.

OneMain Financial Personal Loans or Rocket Personal Loans?

OneMain Financial Personal Loans stand out for their accessibility and flexibility. They’re a solid choice, especially for those rebuilding credit.

Yet, if you’re seeking alternatives, Rocket Personal Loans might catch your eye.

They’re known for swift processes and varied options. See the comparison below!

| OneMain Financial Personal Loans | Rocket Personal Loans | |

| APR | 18.00% – 35.99%, tailored to your story; | 9.116% to 29.99%, catering to various financial profiles; |

| Loan Amounts | Embrace opportunities with loans from $1,500 to $20,000; | Borrowers have the freedom to request loan amounts ranging from $2,000 to $45,000; |

| Credit Needed | All credit levels welcome, there’s no minimum score threshold; | A minimum credit score of 640 is required, ensuring responsible borrowing practices; |

| Terms | Comfortable 2-5 year repayment terms; | Choose between flexible 3 or 5-year terms to tailor your loan repayment to your financial goals; |

| Origination Fee | Between 1% and 10%; | Expect an origination fee between 1.49% to 8.48% of the loan amount, factored into your loan; |

| Late Fee | Late payments incur a 1.5% to 15% charge of the payment amount; | Late fees amount to $15, reinforcing the importance of punctual repayments; |

| Early Payoff Penalty | None. You have freedom to settle your loan anytime. | Rocket allows early loan payoff without incurring any penalties, giving borrowers financial freedom. |

Ready to explore Rocket’s potential? Dive deeper by checking the following link. Indeed, a world of financial solutions awaits!

Apply for the Rocket Personal Loans

Take a leap forward when you apply for the Rocket Personal Loans. Featuring instant decisions and hassle-free online application.

Trending Topics

Apply for the US Bank Visa® Platinum Card: Long Intro APR!

Find out how to apply for the US Bank Visa® Platinum Card and benefit from no annual fees with our simple step-by-step guide.

Keep Reading

Mission Lane Visa® Credit Card review: Simplify your finances

Discover the Mission Lane Visa® Credit Card: A credit card that simplifies your life. With global acceptance. Check out!

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep ReadingYou may also like

Apply for the Group One Platinum Card: No Credit Checks

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Keep Reading

Can an Overdraft Affect Your Credit Score?

Does overdraft affect your credit score? Learn facts and tips to protect your financial health and credit rating. Stay informed and secure.

Keep Reading

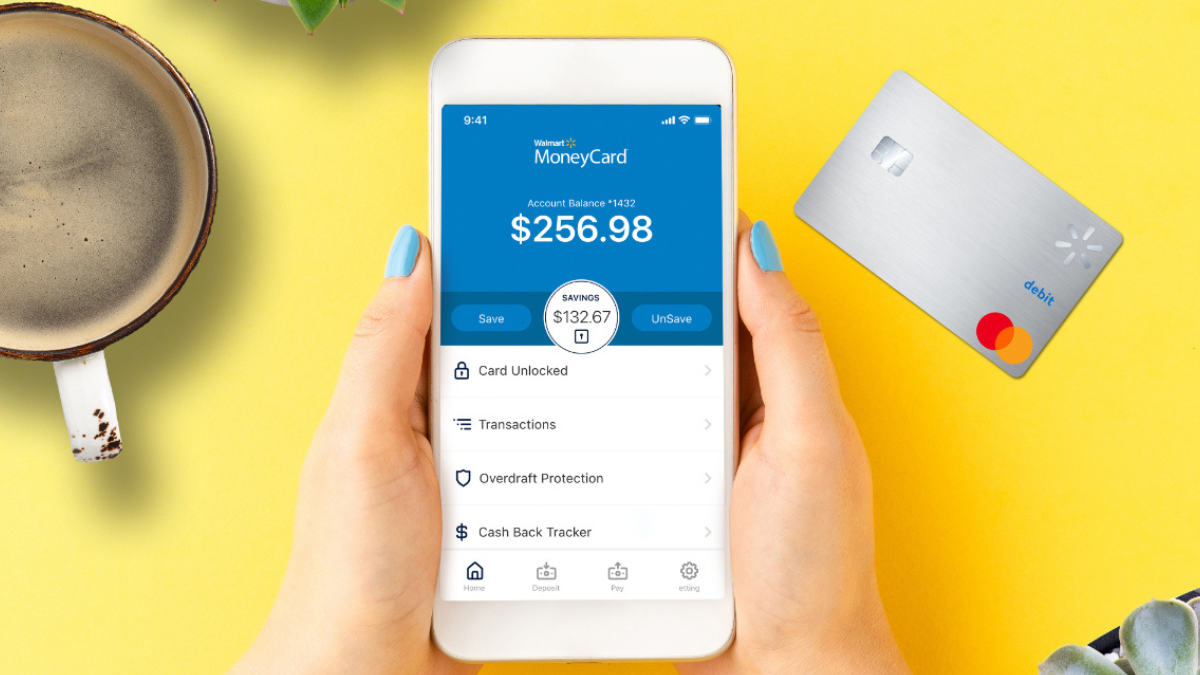

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading