Debit Card

Walmart MoneyCard review: Earn cash back at Walmart

Get to know the Walmart MoneyCard in-depth with our comprehensive review. From cash-back rewards to user-friendly controls! Read on!

Advertisement

Enhance your Walmart experience with rewards and exclusive perks!

Are you a Walmart shopper looking to make the most out of your money? In this Walmart MoneyCard review, we’ll introduce you to a valuable tool.

How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide – earn up to 3% cash back on purchases! Read on and learn more!

Want to know more about its features and benefits? Then explore our Walmart MoneyCard review to learn everything this card has to offer.

| Credit Score | All credit levels are welcome; |

| Annual Fee | $5.94 monthly fee. You can waive this fee with a $500+ direct deposit in the previous statement period; |

| Purchase APR | It does not apply since it’s a prepaid card; |

| Cash Advance APR | It does not apply; |

| Welcome Bonus | There are no welcome offers currently; |

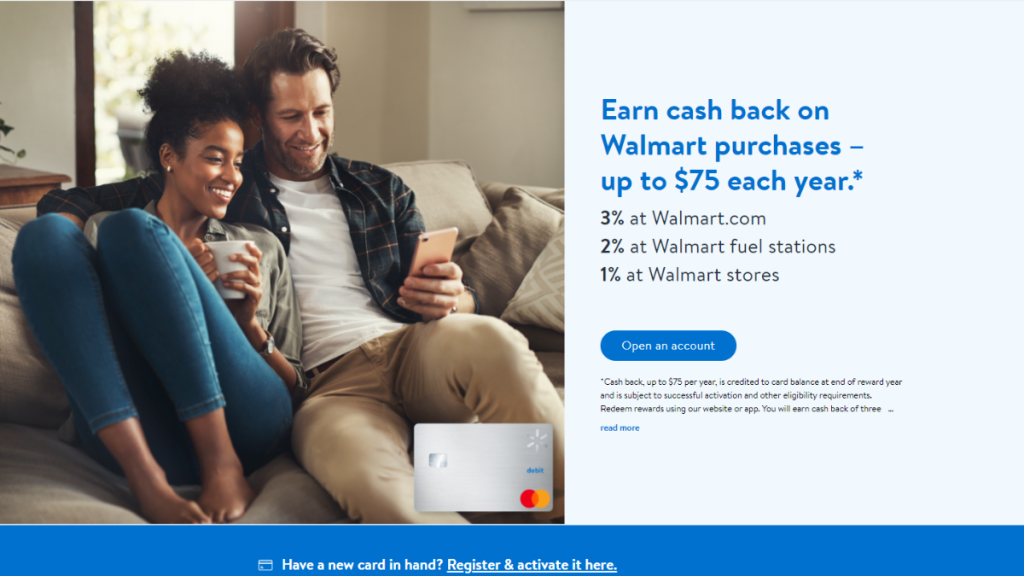

| Rewards | You can earn up to $75 cash back a year. 3% back at Walmart’s online store, 2% back at Walmart fuel stations, and 1% back at physical Walmart stores. |

Walmart MoneyCard: All you need to know

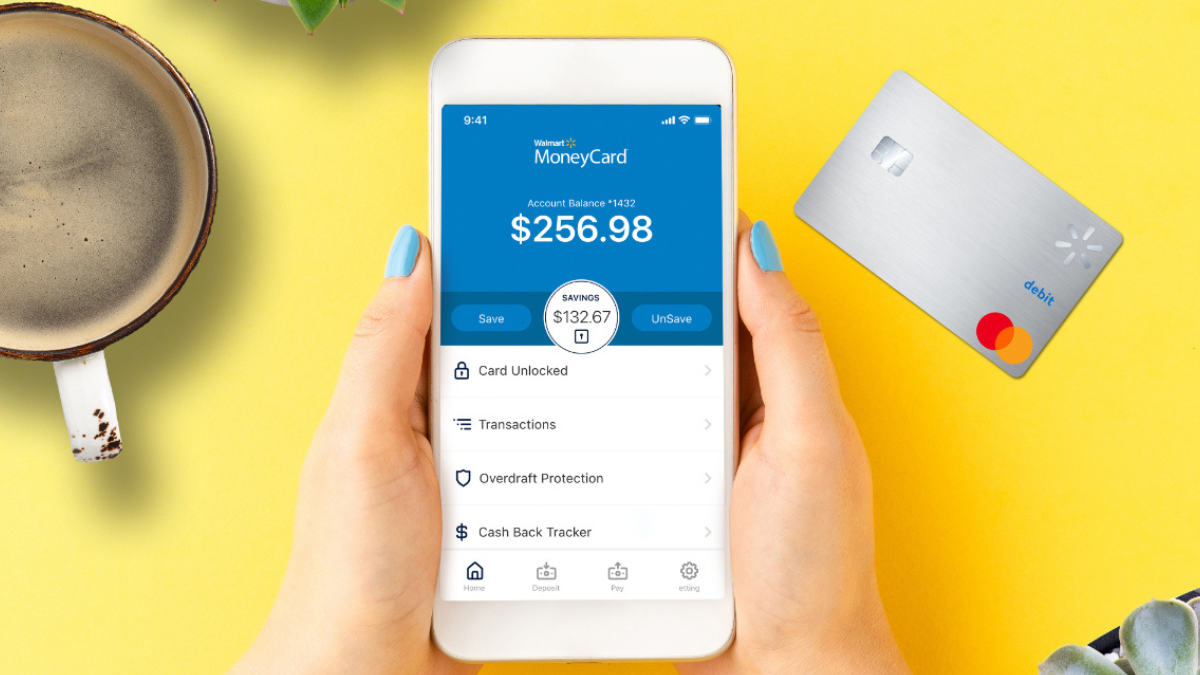

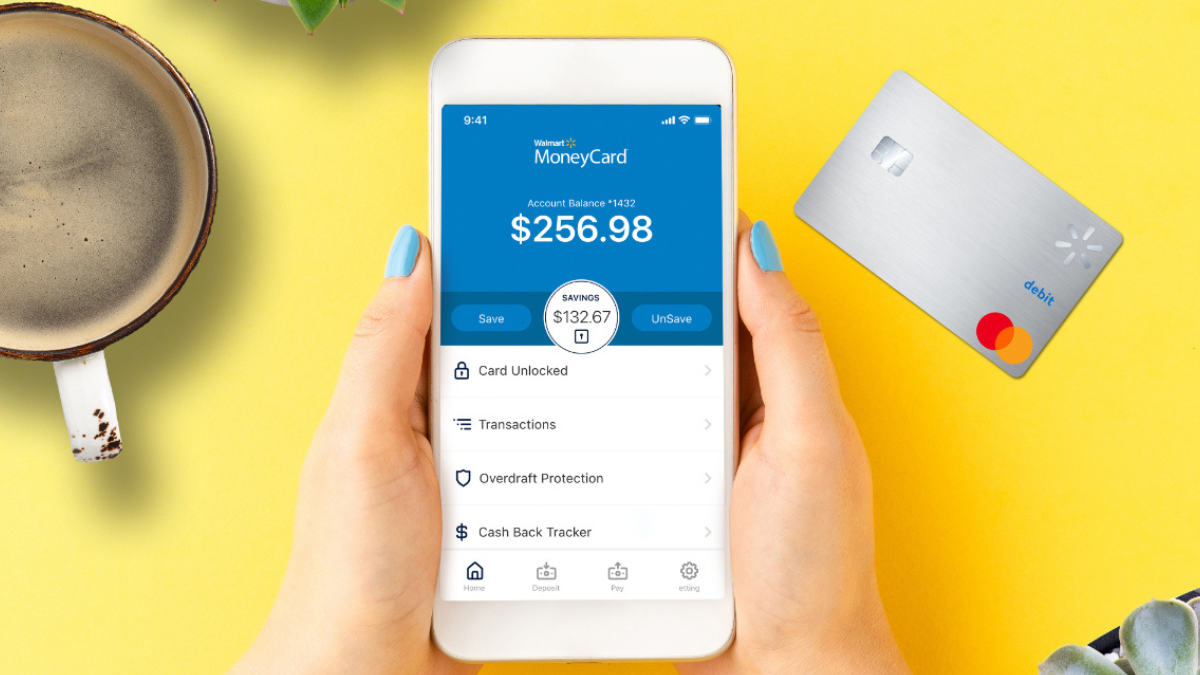

Indeed, the Walmart MoneyCard is a prepaid debit card that can be easily loaded with funds. Unlike a regular card, you spend what you load.

This card is not just limited to Walmart. It can be used anywhere Visa or MasterCard is accepted, giving you the flexibility to shop in-store and online.

So one of its distinct features is the cash back rewards on Walmart purchases. This means you can earn a little extra every time you shop.

Furthermore, the Walmart MoneyCard is a straightforward, user-friendly option for those looking for a no-fuss financial tool.

So whether you’re budgeting or just prefer the ease of prepaid cards, this card has plenty to offer.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Walmart MoneyCard

Are you considering the Walmart MoneyCard for your financial needs?

Before you decide, dive into the following bit to explore its pros and cons, so you can make an informed choice.

Pros

- Can be used anywhere Visa or MasterCard is accepted in the U.S., not just at Walmart;

- You can earn cash back for Walmart purchases up to $75 a year, putting money back in your pocket;

- You can get overdraft protection up to $200. (terms apply);

- There’s a possibility to waive your monthly fee.

Cons

- Some activities, like ATM withdrawals or reloading the card at certain locations, may come with fees;

- Since it’s a prepaid card, using it doesn’t help build or repair credit history;

- While it offers some banking-like features, it doesn’t replace a traditional bank account.

What credit score do you need to apply?

The Walmart MoneyCard is a prepaid debit card, which means that there is no credit check required when applying for it.

Indeed, this makes it a convenient option for those who might have challenges with credit or are looking for a tool to manage their spending.

How to easily apply for the Walmart MoneyCard?

If you’ve enjoyed our Walmart MoneyCard review, don’t miss our upcoming article.

Further, we’ll guide you step by step on how to apply for this versatile card. So read on for more!

How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide – earn up to 3% cash back on purchases! Read on and learn more!

Trending Topics

Best Egg Personal Loans Review: Better Financial Flexibility!

Uncover financial freedom with our Best Egg Personal Loans review. Experience lightning-fast approval for stress-free money management!

Keep ReadingYou may also like

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep Reading

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading