Credit Card

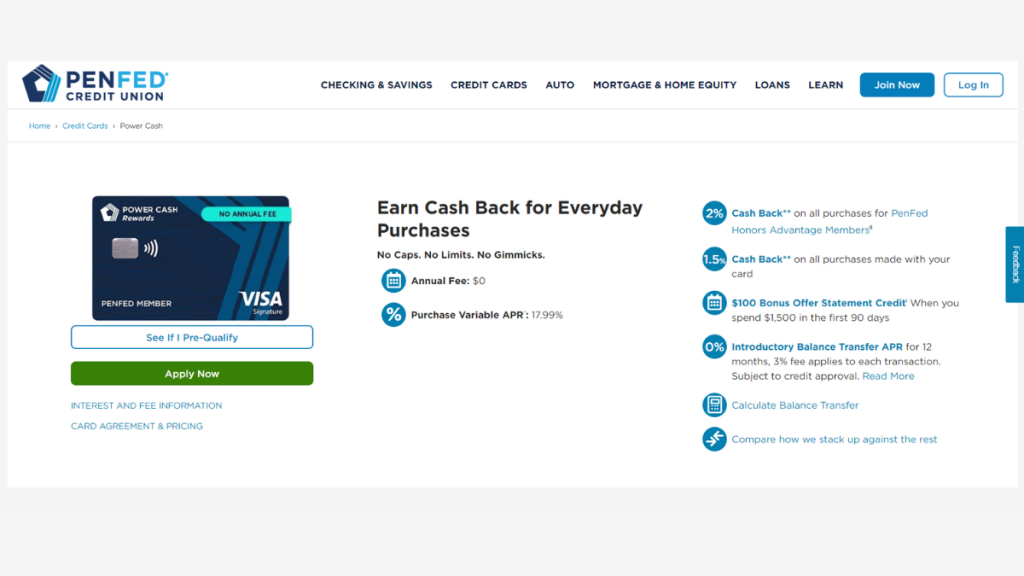

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

PenFed Power Cash Rewards Visa Signature® Card will maximize your earnings! 0% intro APR on balance transfers and no annual fee! Read on!

Advertisement

Up to 2% cash back on purchases!

Are you ready to unlock your credit potential? Then read our PenFed Power Cash Rewards Visa Signature® Card full review!

Apply for PenFed Power Cash Rewards Visa Signature

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

This credit card will help you earn cash back while offering exclusive benefits! So stick with us and learn more!

| Credit Score | Good to excellent; |

| Annual Fee | $0 annual fee; |

| Purchase APR | 17.99% variable APR; |

| Cash Advance APR | 17.99%; |

| Welcome Bonus | Earn a $100 bonus in statement credit after spending $1,500 in the first 90 days from account opening; |

| Rewards | Earn 2% cash back if you are a PenFed Honors Advantage Member; earn 1.5% cash back on all other purchases. |

PenFed Power Cash Rewards Visa Signature® Card: All you need to know

PenFed Power Cash Rewards Visa Signature® Card was designed to help you maximize your spending.

It starts by offering $0 annual or foreign transaction fees! In addition, cardholders can enjoy 0% intro APR on balance transfers for 12 months!

If you’re a PenFed Honors Advantage Member, you can earn 2% cash back on purchases! If not, you’ll earn 1.5% cash back!

Not to mention is a $100 bonus offer! You’ll earn a statement credit after spending $1,500 in the first 90 days from account opening!

PenFed offers some amazing security perks, such as 24/7 fraud monitoring, a mobile wallet, and secure remote commerce.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the PenFed Power Cash Rewards Visa Signature® Card

No doubt that this credit card offers several benefits to customers! It is a great product from the intro APR on balance transfers to its cash-back offer.

Are you ready to review PenFed Power Cash Rewards Visa Signature® Card’s pros and cons? After all, you don’t want to make the wrong decision!

So keep reading and find out below!

Pros

- No annual fee;

- No foreign transaction fee;

- Up to 2% cash back on purchases;

- $100 bonus offer in statement credit;

- 0% intro APR on balance transfers;

- 24/7 fraud monitoring.

Cons

- No intro APR on purchases;

- Requires enrollment at the PenFed Honors Advantage Members to maximize rewards.

What credit score do you need to apply?

Indeed, this credit card offers several features for cardholders! As a result, it requires a good to excellent credit score to qualify for it!

How to easily apply for the PenFed Power Cash Rewards Visa Signature® Card?

PenFed Power Cash Rewards Visa Signature® Card provides a simple and fast application process! It can be completed online!

Further, discover how to application process works! Then keep reading our following article!

Apply for PenFed Power Cash Rewards Visa Signature

Apply for the PenFed Power Cash Rewards Visa Signature® Card today and earn up to 2% cash back! $0 annual fee! Read on and learn more!

About the author / Luis Felipe Xavier

Trending Topics

OneMain Financial Personal Loans Review: Borrow up to 20k!

Explore our OneMain Financial Personal Loans review – a lifeline for those with low credit, offering unique flexibility in payments.

Keep Reading

Tailored Solutions for Limited Credit: Best Credit Cards

Explore our top picks for credit cards tailored for limited credit. Boost your credit score and start your financial journey confidently!

Keep Reading

First Digital Mastercard® Credit Card review: 1% cash back

Discover the main features of this card in our First Digital Mastercard® Credit Card review! Start building credit today! Read on!

Keep ReadingYou may also like

Apply for the First Latitude Secured Mastercard® Credit Card

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Keep Reading

How to apply for the Destiny Mastercard®: Response in 60 seconds

Ready to shape your financial future? Learn how to apply for the Destiny Mastercard® today and step forward with confidence!

Keep Reading

Savings vs. Checking Accounts: A 101 Guide

Learn the differences between savings vs. checking accounts with our guide. Find out which is best for your daily needs and future goals.

Keep Reading