Loans

Apply for the Upstart Personal Loans: Get Funds Fast!

Take the next step in financial planning and apply for Upstart Personal Loans. Access substantial loan amounts and extensive terms! Read on and learn more!

Advertisement

Experience quick cash with Upstart – your gateway to financial freedom

When you apply for Upstart Personal Loans, you’re taking a step towards funding solutions designed with you in mind.

The application process, though simple, has its nuances. Want to get it right the first time? Then let’s guide you through.

How to apply online?

The journey to apply for Upstart Personal Loans begins online, marking your first step towards financial freedom.

Further, head to their website, and you’ll find a clear starting point: a prompt to check your rate, which doesn’t affect your credit score.

This step requires you to enter some personal information, and accuracy is key here. Upstart’s quick review provides loan options that suit your profile.

After selecting your preferred loan terms, you’ll proceed to the final review. This stage might involve uploading documents for verification.

So upon final approval, the funds could hit your bank account within a day. From start to finish, Upstart streamlines the daunting task of securing a loan.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

- Hold citizenship or permanent residency in the U.S.

- In many states, you need to be 18 or older.

- Possess a legitimate email ID along with a Social Security number.

- Either be currently employed full-time or anticipate starting a job in the next half-year.

- Have an active bank account with a routing number in a recognized financial institution.

- Ensure there’s no record of bankruptcy in the past year.

- Your credit reports should be free from any delinquent accounts.

- A credit history with fewer than six significant inquiries over the past six months, but this doesn’t count towards inquiries from student, auto, or mortgage loans.

How to apply using the app?

Unfortunately, you can’t apply for the Upstart Personal Loans via mobile app because the company does not have one currently available.

However, you can use your mobile device to apply through their website by following the methods we described on the topic above.

Upstart Personal Loans or Avant Personal Loans?

Upstart Personal Loans stands out with its fair, comprehensive evaluation, giving borrowers a flexible financial tool.

Thus, their approach considers real people, real dreams, and real plans.

Alternatively, Avant Personal Loans offers another path for financial support.

Indeed, known for its transparency and accommodating terms, Avant is a strong contender in personal lending.

| Upstart Personal Loans | Avant Personal Loans | |

| APR | Borrowers have a fixed monthly rate that varies between 5.2% and 35.99%. | Rates are based on your creditworthiness and can vary between 9.95 and 35.99%. |

| Loan Amounts | Loan amounts between $1,000 and $50,000 are available. | Avant offers loan amounts between $2,000 and $35,000. |

| Credit Needed | All credit types are welcome to apply for a loan. | Your credit score should meet a 550 threshold. |

| Terms | Borrowers can choose to repay their loan in 3 or 5 years. | You’re able to repay your loan between 1 and 5 years. |

| Origination Fee | There may be an origination fee up to 12%. | Could be 0%, or it could go as high as 4.75%. |

| Late Fee | Either 5% or $15; whichever is greater. | You’ll have to pay a $25 fee for late payments. |

| Early Payoff Penalty | None. Settle your loan at any time without extra charges. | Settle your loan anytime without paying extra charges. |

Curious about Avant? Then there’s more to discover!

Learn about their application and tailored loan solutions by following the link below. Thus, your journey to financial confidence begins here!

Apply for the Avant Personal Loans

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Trending Topics

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading

Wells Fargo Active Cash® Card review: unleashing top rewards

Dive into our Wells Fargo Active Cash® Card review and learn how to make the most of your spending with 2% cash back on every purchase.

Keep ReadingYou may also like

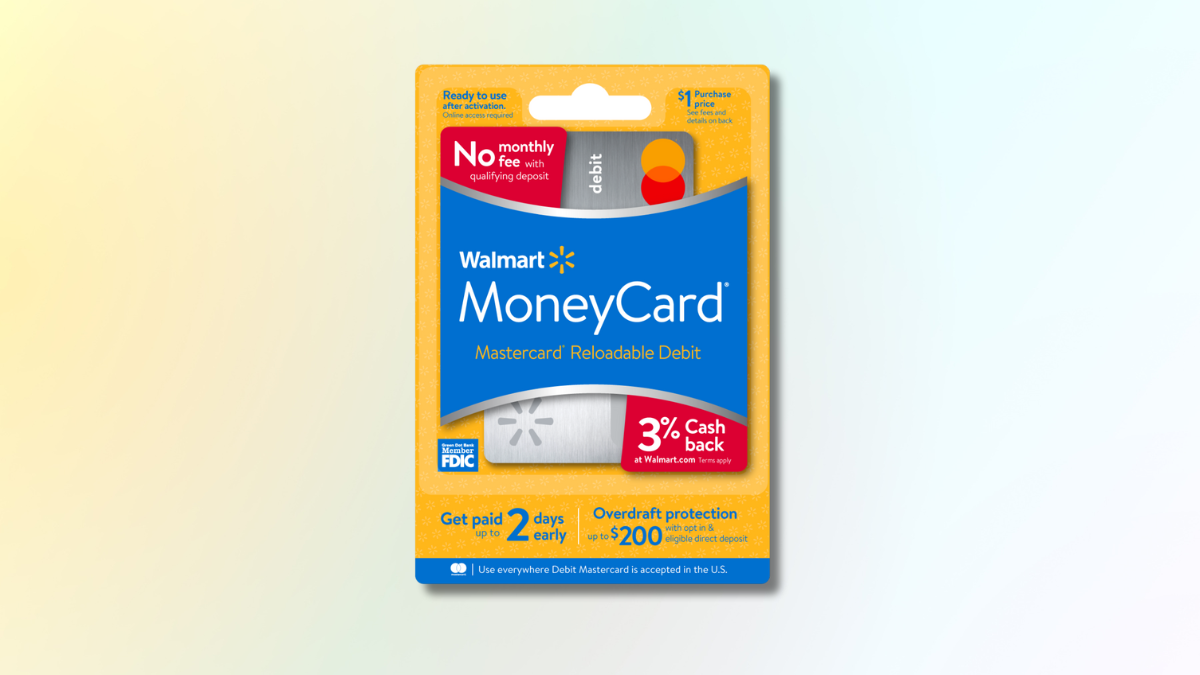

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep Reading