Are you looking for a card with cash back rewards on Walmart purchases?

The Walmart MoneyCard offers up to $75 in cash back a year, and you can use it anywhere Mastercard or Visa are accepted!

Advertisement

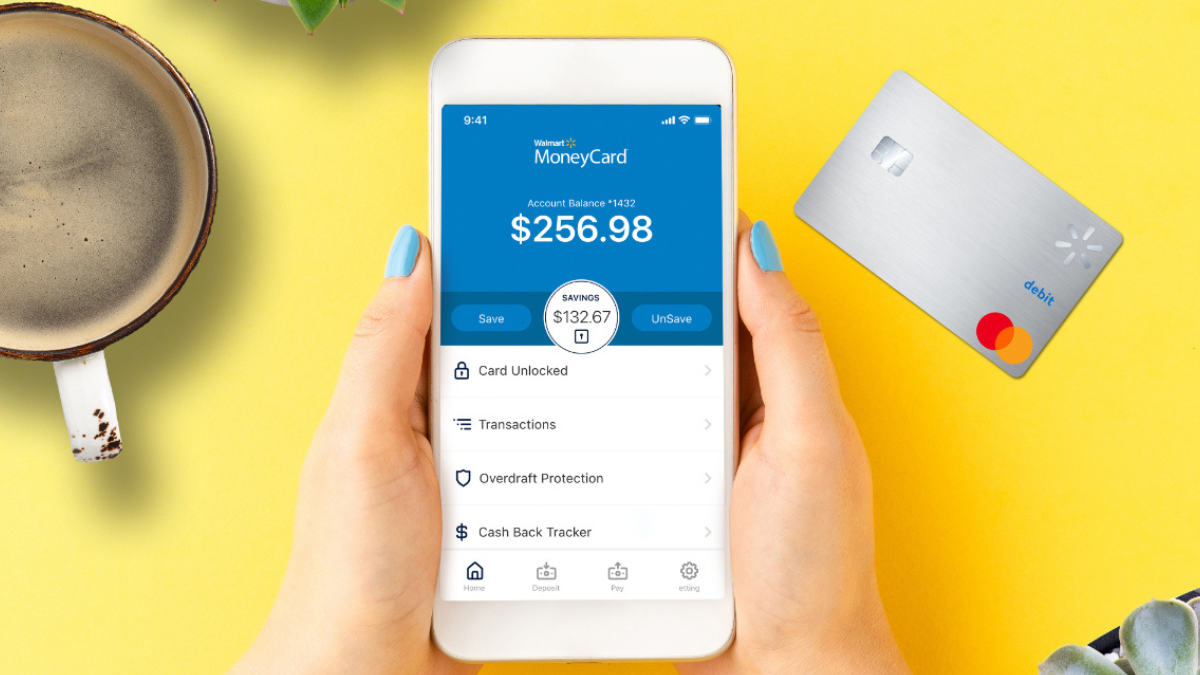

Experience the unmatched convenience of the Walmart MoneyCard—a reloadable prepaid card that empowers you to shop, manage funds, and pay bills easily. Say goodbye to overdraft fees and hello to cash back rewards. Secure, straightforward, and designed with your financial freedom in mind: the MoneyCard is your pocket’s most trusted ally.

Experience the unmatched convenience of the Walmart MoneyCard—a reloadable prepaid card that empowers you to shop, manage funds, and pay bills easily. Say goodbye to overdraft fees and hello to cash back rewards. Secure, straightforward, and designed with your financial freedom in mind: the MoneyCard is your pocket’s most trusted ally.

You will remain in the same website

Learn some of the amazing benefits you get once you start using your Walmart MoneyCard on purchases!

Embark on a seamless financial journey with the Walmart MoneyCard. More than just a shopping companion, this prepaid card revolutionizes the way you manage, spend, and save your money, blending the world of retail and banking like never before.

Advantages and special perks

- No Overdraft Fees: Say goodbye to unexpected overdraft charges. Spend only what you load onto the card, ensuring you stay within your budget.

- Cash-Back Rewards: Elevate your shopping experience! Earn cash-back rewards when you shop at Walmart, amplifying your savings and making every purchase count.

- Free Direct Deposit: Get your paycheck or government benefits faster with free direct deposit, eliminating the wait for checks to clear and providing instant access to your funds.

- Easy Reloading: Whether you’re at a Walmart checkout or using the mobile app, reloading your card is a breeze. Plus, with multiple reload options available, you’re always in charge.

- Walmart Integration: Seamlessly integrate your shopping and financial activities. Check your balance, reload, or even withdraw cash at Walmart stores, making it a one-stop solution.

- Mobile App Features: Track your spending, manage your account, and even order a new card all from the convenience of the Walmart MoneyCard app.

Disadvantages

- Monthly Fee: The Walmart MoneyCard comes with a monthly fee, which might not be suitable for those looking for a no-cost prepaid card option.

- Limited to Walmart for Maximum Benefits: While the card can be used anywhere, the best rewards and benefits are tied to Walmart, which might not appeal to everyone.

- ATM Fees: While withdrawing cash at Walmart is free, using other ATMs can come with fees, making it less convenient for users not near a Walmart.

- No Credit Building: Unlike credit cards, usage of the Walmart MoneyCard doesn’t contribute to building or improving your credit score.

The Walmart MoneyCard stands out as a dynamic prepaid card option, especially for avid Walmart shoppers.

Its unique blend of features ensures convenience at every step. However, potential users should weigh its benefits against its limitations to determine if it’s the right financial tool for their needs.

Activating your Walmart MoneyCard is an easy process that can be completed through a couple of different channels for your convenience. You have the option of visiting the Walmart MoneyCard official website or using the dedicated mobile app, both of which are designed to guide you through a straightforward, step-by-step activation process.

The unique number associated with your Walmart MoneyCard is displayed on the front side of the physical card. This is an important piece of information that you will need for various transactions, but it’s essential to handle it with care. Never disclose your card number or share it through insecure channels.

Registering your Walmart MoneyCard is a simple process designed with user-friendliness in mind. Whether you choose to use the Walmart MoneyCard website or their mobile app, the first step is generally the same: locate and click on the “Activate Your Card” button or link. This will direct you to a form where you will be required to fill in specific details about your card.

There are several ways to check the balance of your Walmart MoneyCard. You can check your balance online by visiting the Walmart MoneyCard website and logging into your account. Alternatively, you can use the Walmart MoneyCard app, call the customer service number located on the back of your card, or through a partnered ATM machine.

There are several options available for making payments. One is to make a payment online by logging into your account on the Walmart MoneyCard website or app. Additionally, you can set up automatic payments, or visit any Walmart store and make a payment at the customer service desk or at a register.

How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide – earn up to 3% cash back on purchases! Read on and learn more!

While the Walmart MoneyCard has its charm, there’s another card worth your time: the Chime Visa® Debit Card.

Chime offers a refreshing approach to banking with no hidden fees and some fantastic features to help you save and manage your money.

Check out the following link for more details about the Chime Visa® Debit Card. We’ll also show you how to easily apply for it!

How to apply for the Chime® Debit Card

Explore our guide on how to apply for the Chime® Debit Card. Simplify your financial journey with our easy-to-follow steps.

Trending Topics

First Progress Platinum Prestige Secured Card review

Explore our First Progress Platinum Prestige Mastercard® Secured Credit Card review to learn how to build up credit and earn rewards!

Keep Reading

Building Credit from Scratch: Best Cards for No Credit History

Discover which are the best credit cards for no credit with our help and set your financial path right from the start.

Keep Reading

First Access Visa® Card review: Earn 1% back on card payments!

Explore our detailed First Access Visa® Card review to learn about its features and benefits. Earn 1% cash back on purchases and more!

Keep ReadingYou may also like

Savings vs. Checking Accounts: A 101 Guide

Learn the differences between savings vs. checking accounts with our guide. Find out which is best for your daily needs and future goals.

Keep Reading

Brink’s Prepaid Mastercard® review: Earn cash back rewards!

Discover insights in our comprehensive Brink's Prepaid Mastercard® review! Enjoy flexible loading options, and cash back rewards.

Keep Reading

PREMIER Bankcard® Mastercard® Credit Card review: build credit

Do you want to build credit fast? Then check out our PREMIER Bankcard® Mastercard® Credit Card full review! Monitor your FICO score easily!

Keep Reading