Do you want a card to help build or rebuild your financial future with minimal hassle?

The First Progress Platinum Prestige Mastercard® Secured Credit Card stands out as a prime pick for effectively reaching your credit milestones!

Advertisement

Take your credit aspirations higher with the First Progress Platinum Prestige Mastercard® Secured Credit Card. Whether you’re building or rebuilding, its proactive reporting keeps you on track. Benefit from flexible deposits tailored to your needs, manage effortlessly online, and enjoy competitive interest rates. Plus, with 1% cash back on balance payments, each step feels like a reward.

Take your credit aspirations higher with the First Progress Platinum Prestige Mastercard® Secured Credit Card. Whether you’re building or rebuilding, its proactive reporting keeps you on track. Benefit from flexible deposits tailored to your needs, manage effortlessly online, and enjoy competitive interest rates. Plus, with 1% cash back on balance payments, each step feels like a reward.

You will remain in the same website

Uncover the distinct advantages of the First Progress Platinum Prestige Mastercard®. See below for all the special insights!

Welcome to the world of distinguished credit opportunities with the First Progress Platinum Prestige Mastercard® Secured Credit Card.

A beacon for those aiming to elevate their financial stature, this card combines the prestige of platinum with the assurance of security, setting you on a path to credit excellence.

Advantages and special perks

- Credit Reporting Excellence: Regular reporting to the three primary credit bureaus ensures that your responsible card usage contributes positively to your credit profile, paving the way for enhanced financial opportunities.

- All Credit Types Welcome: Whether you’re a credit newcomer or looking to mend past credit missteps, this card’s inclusive approach ensures that your credit journey is never hindered.

- Determined by Your Deposit: Your credit limit is defined by your security deposit, offering a customizable approach to credit management based on your comfort and capacity.

- Mastercard Privileges: Experience the global appeal and seamless transaction experience that comes with a Mastercard®. Accepted worldwide, your purchasing power knows no bounds.

- Digital Account Management: Access, monitor, and manage your account effortlessly with online tools, ensuring that you’re always in the know about your card’s activities and status.

Disadvantages

- Annual Fee Consideration: The First Progress Platinum Prestige Mastercard® does come with an annual fee, which might not align with the preferences of those seeking a fee-free card.

- Secured Card Deposit: The requirement of an upfront security deposit might be a potential barrier for some, especially those with limited immediate funds.

- Higher APR Concerns: A relatively elevated annual percentage rate means users should prioritize timely full payments to avoid accruing high interest.

- Lack of Reward Features: If you’re on the hunt for reward points, cash back, or similar incentives, this card might fall short, as it doesn’t offer such perks.

The First Progress Platinum Prestige Mastercard® Secured Credit Card serves as a distinguished tool for those keen on progressing their credit journey.

While it boasts several commendable features, it’s vital to align its offerings with your personal and financial aspirations to ensure it’s the best fit for your unique credit voyage.

The security deposit plays a pivotal role in the dynamics of the First Progress Platinum Prestige Mastercard® Secured Credit Card. It serves a dual purpose: first, it establishes your credit limit, meaning if you deposit $500, you typically get a $500 credit limit. Second, it acts as a form of assurance for the card issuer. In the event of any defaults, this deposit can cover the owed amounts. Importantly, when you maintain a good account standing, your deposit is fully refundable.

The First Progress Platinum Prestige card’s affiliation with Mastercard® grants it global prestige. Accepted by countless merchants across the globe, this card seamlessly supports you whether you’re enjoying a meal in Rome or making an online purchase from overseas. Its reach presents a fantastic advantage for globe-trotters and those fond of international shopping. It’s essential to note, though, that all international transactions carry a fee.

To monitor your First Progress Platinum Prestige Card activities, head over to the official First Progress website. Once there, you’ll find a designated “Login” or “Account Access” section prominently displayed on the homepage. By entering your unique username and password in the provided fields, you’ll gain access to a comprehensive dashboard. This dashboard provides a clear view of your balances, recent transactions, payment history, and more, all designed for easy navigation and clarity.

Though the First Progress Platinum Prestige Mastercard® boasts impressive perks, the GO2bank Secured Visa® Credit Card stands out as an impressive alternative.

Apply for First Progress Platinum Prestige Secured

Learn how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and benefit from low APR rates.

With its user-friendly platform, the GO2bank card simplifies credit-building for many, providing flexibility and excellent customer support.

Interested in reshaping your credit journey with an intuitive choice? Learn how to apply for the GO2bank Secured Visa® Credit Card in the following link.

Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Trending Topics

Ensure 1% cash back: Total Visa® Card review

In this Total Visa® Card review, you'll find an excellent solution to build your credit score fast! Access free credit monitoring and more!

Keep Reading

Apply for the Best Egg Personal Loans: Quick Cash, Zero Hassles!

Ready to transform your finances? Apply for Best Egg Personal Loans easily and embrace convenient, reliable funding for your peace of mind.

Keep ReadingYou may also like

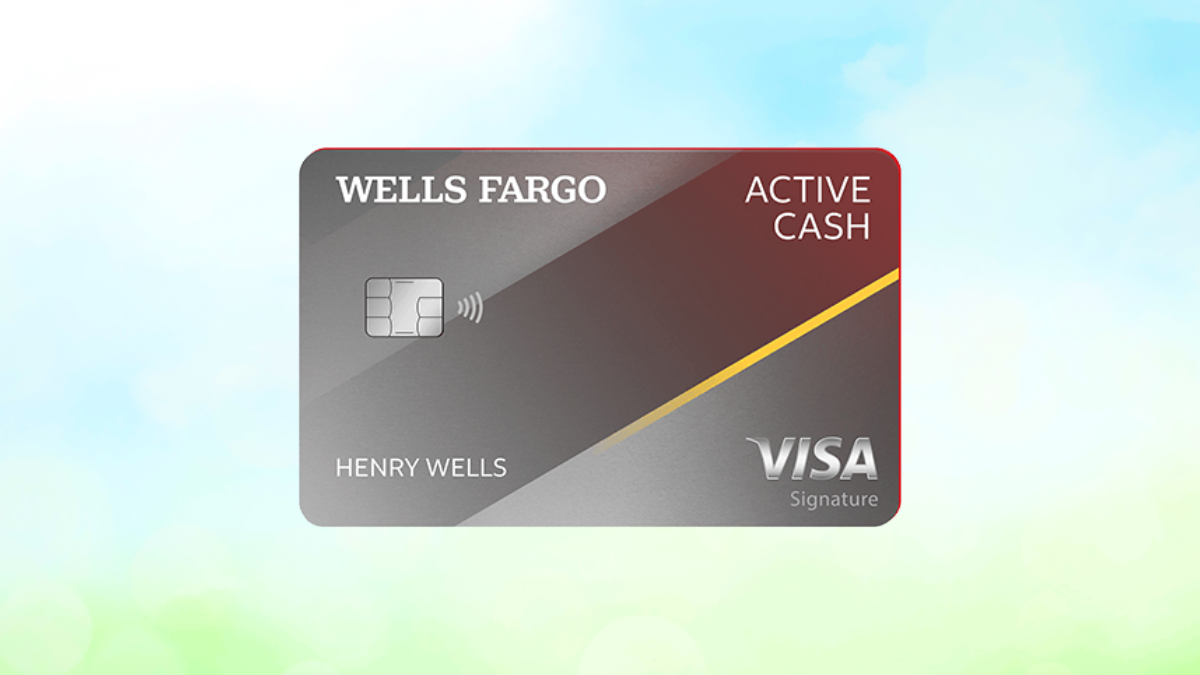

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Keep Reading

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep Reading

Apply for the Chase Freedom Flex℠ Credit Card: $200 Bonus

Learn how to apply for the Chase Freedom Flex℠ Credit Card to enjoy a $200 welcome bonus and grand cash back on rotating categories.

Keep Reading