Our recommendation to help you on your credit building journey is the Destiny Mastercard®!

Boost your score with The Destiny Mastercard® credit card. A security deposit isn't required

Advertisement

The Destiny Mastercard® is more than just a credit card. Tailored for those building or rebuilding credit, it consistently reports to major credit bureaus. Accessible even with varied credit histories, a true partner in your financial journey!

Learn more about the many benefits you’ll be able to enjoy once you apply and get approved for the Destiny Mastercard®!

Step into the future of financial responsibility with the Destiny Mastercard®.

Tailored for those charting their path in the credit landscape, this card offers a harmonious blend of flexibility and opportunity, ensuring you’re always in command of your fiscal destiny.

Advantages and special perks

- Inclusive Application Process: Regardless of your credit past, Destiny Mastercard® offers an inclusive application process, opening doors for both seasoned credit users and novices.

- Build or Rebuild Credit: With timely reporting to major credit bureaus, this card provides a genuine platform to build or rebuild your credit score, setting the stage for a brighter financial tomorrow.

- Mastercard Benefits: Being a part of the Mastercard® family, enjoy worldwide acceptance, ensuring hassle-free transactions, whether you’re dining locally or shopping internationally.

- Account Management Tools: Stay updated and in control with user-friendly online tools. Track spending, make payments, and manage your account with ease and convenience.

- Fraud Protection: Sleep easy knowing you’re protected. The card comes with security features that safeguard you against unauthorized transactions, ensuring peace of mind.

Disadvantages

- Annual Fee: The Destiny Mastercard® is not fee-free. An annual fee is associated with this card, which might be a deterrent for some potential users.

- Higher APR: Users should be cautious with carrying balances, as the card comes with a relatively high annual percentage rate, which could lead to increased interest charges.

- No Rewards Program: Unlike some of its counterparts, this card does not offer a rewards program, meaning no cash back, points, or miles for your spending.

- Potential Additional Fees: Some users might encounter additional fees, such as for late payments or returned payments, which can add to the cost of using the card.

The Destiny Mastercard® emerges as a steadfast companion for those eager to navigate the credit seas.

Its robust features offer a strong foundation for credit growth, but it’s essential to be mindful of its costs.

As with any financial instrument, a careful examination of its pros and cons will determine if it’s the right match for your unique fiscal journey.

Yes, absolutely. The Destiny Mastercard® is a genuine credit card that is backed by one of the world’s leading financial services companies. This means that the card benefits from the wide acceptance and you can easily use it to make both online and in-person purchases.

No. For account management, including checking balances, viewing transaction history, and making payments, you have to use their official website. To access your account information, you’ll need to use your login credentials, which you create when you first set up your online account.

The Destiny Mastercard® is issued by First Electronic Bank. As the issuer of the card, First Electronic Bank is responsible for all aspects of account management and customer service, including the approval process, interest rates, fees, and anything else that may come with the card.

Yes, First Electronic Bank is insured by the Federal Deposit Insurance Corporation (FDIC), which is an independent agency created by the U.S. government. The FDIC provides deposit insurance, guaranteeing the safety of a depositor’s accounts in FDIC-insured banks up to $250,000.

How to apply for the Destiny Mastercard®

Ready to shape your financial future? Learn how to apply for the Destiny Mastercard® today and step forward with confidence!

Much like the Destiny card, the FIT® Platinum is designed with credit-building in mind, coupled with its unique benefits that cater to your needs.

If you’re curious about the FIT® Platinum Mastercard®, check out the following link. We’ll look over its top features and guide you through the application process.

Apply for the FIT® Platinum Mastercard®

Thinking to boost your credit? See how to apply for the FIT® Platinum Mastercard® and embark on a journey to financial growth.

Trending Topics

US Bank Visa® Platinum Card Review: Zero Annual Fees!

Explore our in-depth US Bank Visa® Platinum Card review to learn about its extensive 0% APR into, no annual fee, and exclusive benefits.

Keep Reading

Discover it® Cash Back Credit Card Review: Boost Earnings

Explore our Discover it® Cash Back Credit Card review to uncover exclusive benefits, including a generous cash back and zero annual fees.

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep ReadingYou may also like

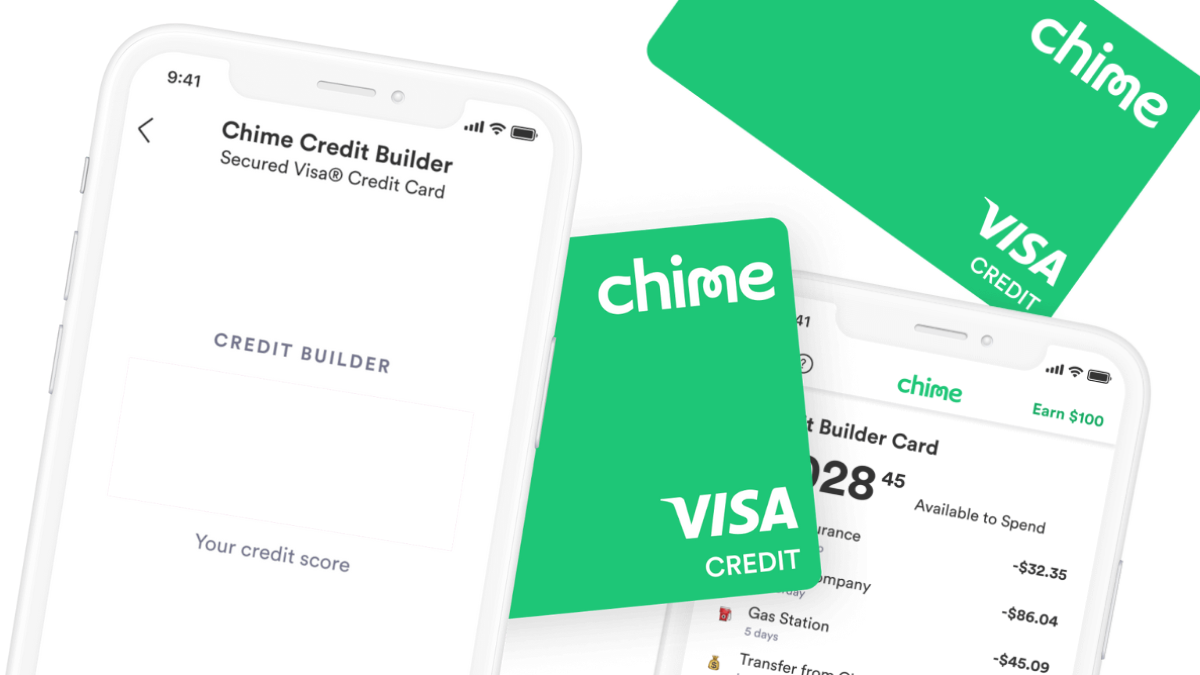

$0 annual fee: Chime Credit Builder Secured Visa® Card review

Looking for a new credit card with no credit check and no interest? Then read our Chime Credit Builder Secured Visa® Card full review!

Keep Reading

Maximized earnings: Apply the Capital One Walmart Rewards® Card

Looking to apply for the Capital One Walmart Rewards® Card? We've got you covered! Read on and discover how to earn unlimited cash back!

Keep Reading

Citi Custom Cash® Card Review: Smart Spending Rewarded

Read our Citi Custom Cash® Card review for insights on its fantastic welcome bonus, 5% cash back in select categories, and no annual fee.

Keep Reading