Credit Card

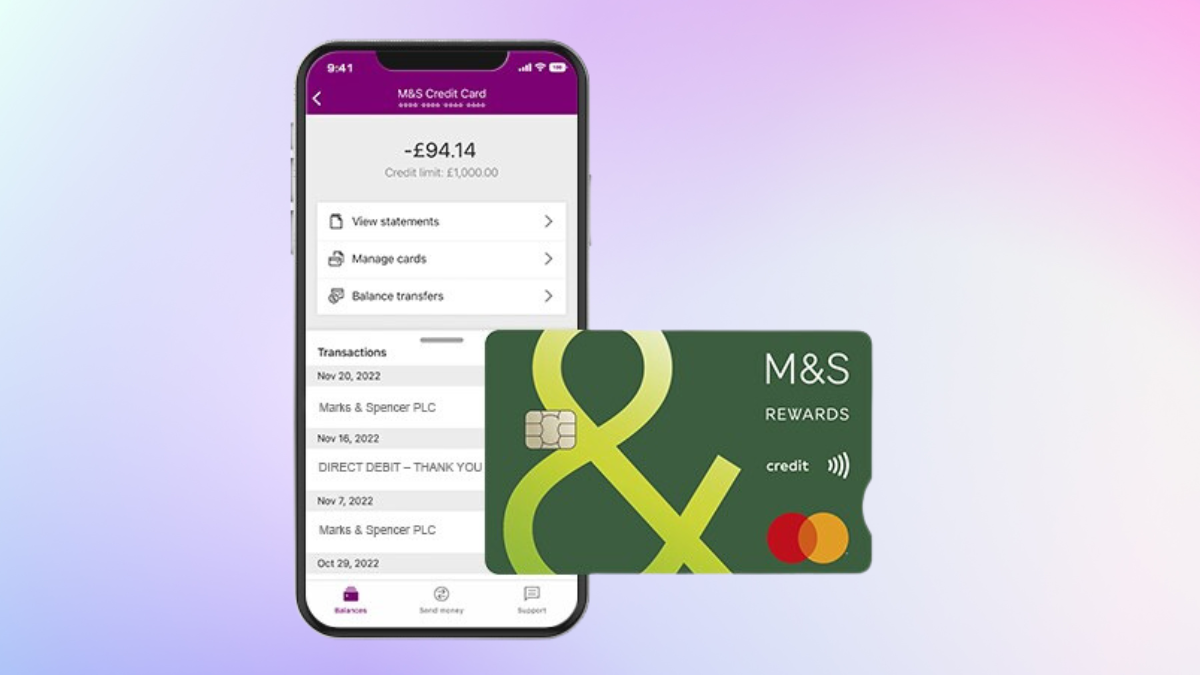

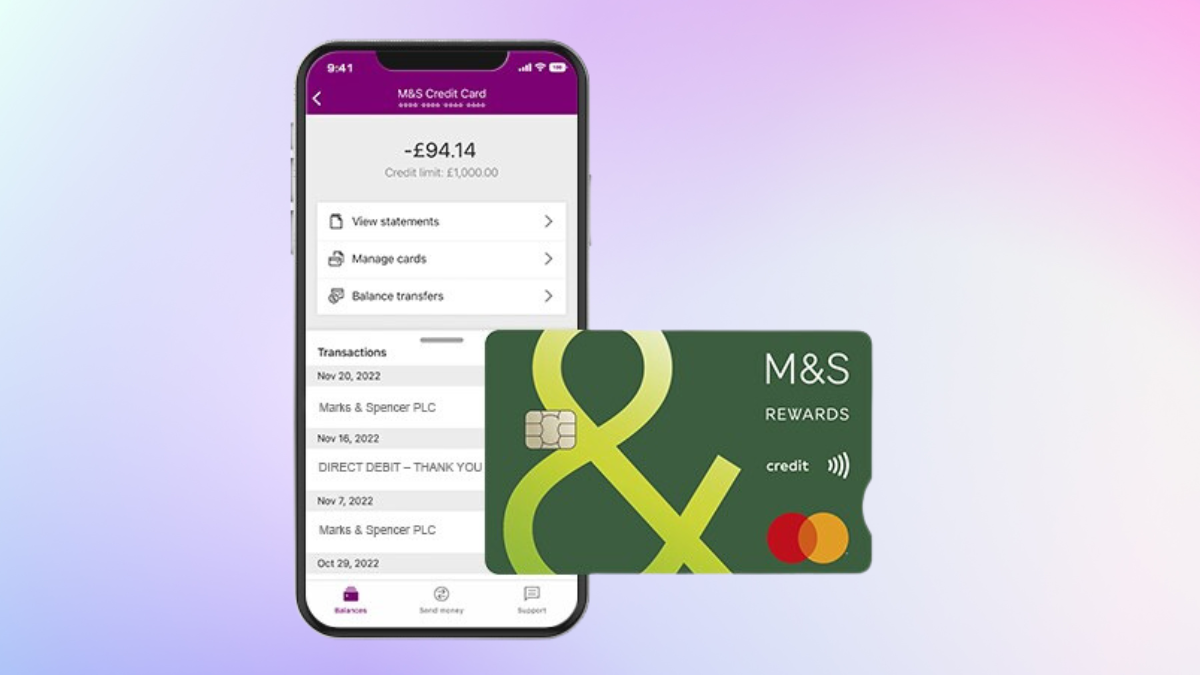

M&S Credit Card Shopping Plus review: earn points on purchases!

M&S Credit Card Shopping Plus is a great option for those looking for a reward card! 15 months of 0% interest on balance transfers and more!

Advertisement

Enjoy 0% interest on purchases for 18 months!

Getting a rewarding credit experience doesn’t have to be difficult! That’s why we bring this M&S Credit Card Shopping Plus review!

Apply for the M&S Credit Card Shopping Plus

Keep reading and learn how to apply for the M&S Credit Card Shopping Plus! This card offers a great reward program and charges no annual fee!

This card greatly benefits those who want to maximize their spending! So read our article and learn more about this product!

| Credit Score | Good; |

| Annual Fee | £0; |

| Purchase APR | 0% interest for 18 months; 23.9% variable purchase rate after; |

| Cash Advance APR | 29.9%; |

| Welcome Bonus | N/A; |

| Rewards | Earn 1 point per £1 spent in M&S. Earn 1 point per £5 spent elsewhere. |

M&S Credit Card Shopping Plus: All you need to know

The M&S Credit Card Shopping Plus has it all when it comes to offering rewards and an excellent customer experience!

Firstly, it comes with 0% interest on purchases for 18 months! Also, customers can enjoy 15 months of 0% interest on balance transfers!

Cardholders can count on a reward program that allows them to earn 1 point for each buck spent in M&S and 1 point per £5 on all other purchases!

M&S also delivers an extra security system that helps you confidently manage your card and shop!

Additionally, if you’re wondering if there is an additional cost, know that this card charges no annual fee!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the M&S Credit Card Shopping Plus

The M&S Credit Card Shopping Plus is an excellent credit card for those who want to save money!

No doubt that it offers some excellent benefits! Still, you might want to consider its drawbacks before deciding!

So keep reading to compare the pros and cons that come with this credit card and make an informed decision!

Pros

- Ensure an interest-free period on purchases and balance transfers;

- It charges no annual fee;

- Earn reward points for everything your make purchases;

- Manage your card online through its user-friendly mobile app;

- Enjoy a credit limit of up to £1,200.

Cons

- This card charges a foreign transaction fee.

What credit score do you need to apply?

As you can see in our M&S Credit Card Shopping Plus full review, this card brings multiple benefits to cardholders!

As a result, applicants must have a good credit score to qualify for this credit card!

However, M&S also considers other requirements. It includes being a UK resident, aged 18. Also, applicants must earn at least £6,800 annually!

How to easily apply for the M&S Credit Card Shopping Plus?

Are you wondering how to apply for this credit card? Wonder no longer!

Further, learn how the application process works! So keep reading and find out more!

Apply for the M&S Credit Card Shopping Plus

Keep reading and learn how to apply for the M&S Credit Card Shopping Plus! This card offers a great reward program and charges no annual fee!

About the author / Luis Felipe Xavier

Trending Topics

$0 annual fee: Bank of America® Customized Cash Rewards Credit Card review

Looking for cash-back, benefits, and more? Get into this review of the Bank of America® Customized Cash Rewards Credit Card and discover!

Keep Reading

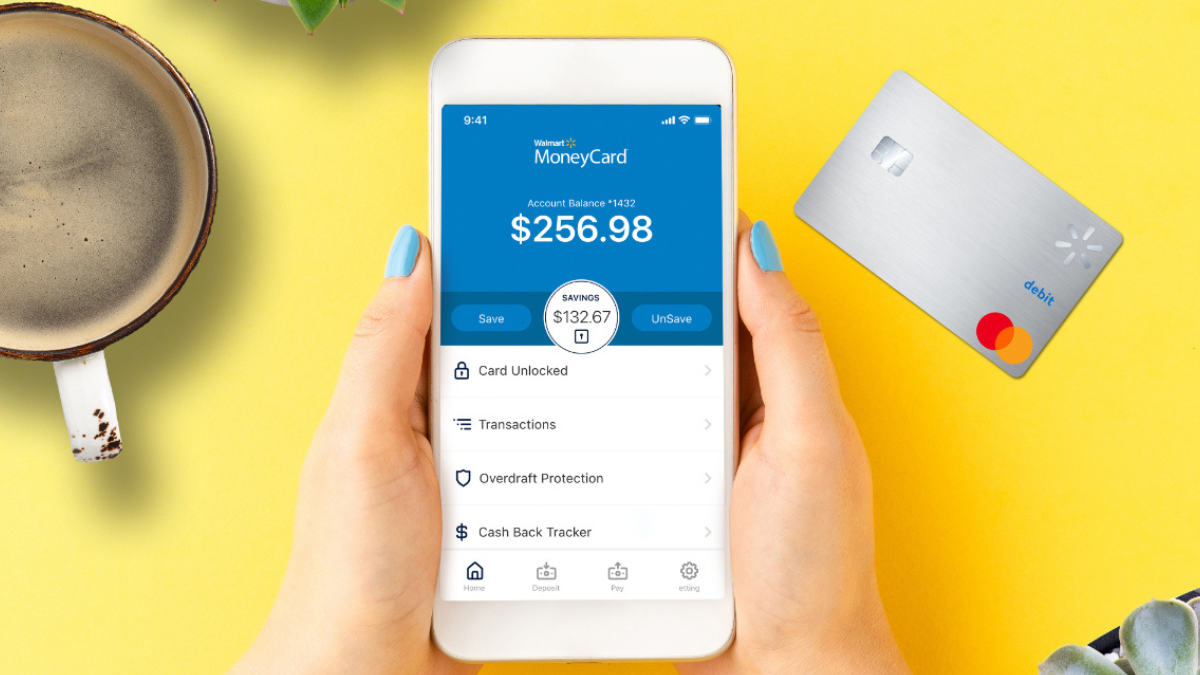

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading

Apply for the Upstart Personal Loans: Get Funds Fast!

See how to apply for Upstart Personal Loans and unlock amounts up to $50,000 with terms to match your unique financial situation.

Keep ReadingYou may also like

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep Reading

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep Reading

No hidden fees: How to apply for the Chime® Debit Card

Explore our guide on how to apply for the Chime® Debit Card. Simplify your financial journey with our easy-to-follow steps.

Keep Reading