Finances

Make Smart Choices: Discover the Top Cards for Poor Credit

Are you struggling with poor credit? Don't worry! We've done the research to bring you a guide to the best credit cards tailored for your situation.

Advertisement

Select the best card for poor credit and improve your financial standing

Credit cards designed for individuals with poor credit can be a powerful tool for financial recovery and stability.

By making on-time payments and managing your credit wisely, you can gradually improve your credit rating and open doors to better financial opportunities.

Are you looking for a reliable way to boost your score? Then dive into our list of the best credit cards for poor credit and reach healthier finances.

Choose the right credit card

Are you looking for a new credit card? Then you're in the right place! Pick a credit card option based on your financial needs! Read on!

Get tips on how to navigate your credit-building path, and don’t miss the chance to take control of your financial journey.

What are credit cards for poor credit?

Credit cards for poor credit are specialized financial tools designed to help individuals with low credit scores access credit lines.

These cards often have lower approval requirements and can be a lifeline for those seeking to rebuild their credit history.

Interest rates may be higher, but responsible use can lead to improved credit scores over time, opening up better financial opportunities.

Secured and unsecured options exist, with secured cards requiring a deposit while unsecured cards do not.

When used wisely, credit cards for poor credit can be stepping stones to better financial health and a brighter future.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Does using a card for poor credit help improve your score?

Using a card for poor credit can boost your score. Timely payments and responsible management show creditors your commitment to improving it.

Regular, on-time payments and keeping balances low are key. These positive behaviors help counter the negative impact of past credit issues.

Conversely, late payments or maxing out the card can hurt your score. So, use it wisely and stay within your means.

You can also monitor your credit report to track your building progress. Positive changes will be reflected as you work towards a better credit score.

In conclusion, a card for poor credit, when used responsibly, can be a valuable tool for rebuilding your credit and achieving financial stability.

How do credit cards for poor credit work?

Cards for poor credit are financial tools designed to help individuals with low credit scores access credit lines and rebuild their financial standing.

Here’s a breakdown of how they work and their key aspects:

Benefits

- Credit Building: They are a valuable tool for establishing positive credit. Good use can make it easier to qualify for better financial opportunities later on.

- Access to Credit: Credit cards for poor credit are more accessible, providing you with a chance to access credit when you need it.

- Financial Flexibility: These cards work similarly to regular credit cards. You can use them to make purchases, pay bills, and cover unexpected expenses.

- Improved Financial Options: As your score improves through the responsible use of these cards, you’ll likely qualify for better terms on a range of financial products.

Drawbacks

- Higher Interest Rates: Many credit cards for poor credit come with higher annual percentage rates (APRs) compared to standard credit cards.

- Lower Credit Limits: Initially, these cards may offer lower credit limits than you’d prefer. However, responsible use may help increase your limit over time.

- Fees: Be aware of potential fees associated with these cards. Understanding the fee structure is essential to managing your card effectively.

- Limited Perks: Unlike premium credit cards, you may not receive cashback, points, or travel perks. The primary focus is on rebuilding credit rather than earning rewards.

Requirements to qualify

- Low Credit Score: Credit cards for poor credit are designed for individuals with poor or no credit history.

- Proof of Income: Lenders may request proof of a steady income or employment to ensure you have the means to repay any charges you make on the card.

- Minimum Age: To apply for a credit card, you must typically be at least 18 years old, as this is the legal age for entering into a financial contract.

- Security Deposit (for secured cards): Secured credit cards require a security deposit, which serves as collateral in case you default on your payments.

Fees

- Annual Fee: Some cards charge an annual fee, which can vary in amount. This fee is typically charged regardless of whether you use the card regularly.

- Late Payment Fee: Failing to make at least the minimum payment by the due date can result in a late payment fee, adding to your overall card expenses.

- Foreign Transaction Fee: If you use your card for international purchases, you may encounter foreign transaction fees.

- Cash Advance Fee: Taking out a cash advance using your credit card often incurs a fee, and the interest rate on cash advances can be higher than on regular purchases.

- Program Fees: Certain credit cards for poor credit may require you to pay a program fee when opening the account. This fee is usually a one-time charge.

- Monthly Maintenance Fees: Some cards may impose monthly maintenance fees to keep the account active. These fees are ongoing and can add to your card expenses.

Choose the right credit card

Are you looking for a new credit card? Then you're in the right place! Pick a credit card option based on your financial needs! Read on!

How to choose the right credit card for you?

There are plenty of credit cards for poor credit available, and selecting the right one to align with your needs is essential.

Here are some strategies to guide you in making the right choice.

Assessing Your Credit Needs

When choosing a credit card for poor credit, start by assessing your specific financial situation.

Understand your credit score, as it will dictate which cards are available to you.

If you’re rebuilding credit, focus on cards designed for this purpose. If you need access to credit, look for options with lower approval requirements.

Comparing Secured and Unsecured Cards

Credit cards for poor credit often come in two main types: secured and unsecured.

Secured cards require a security deposit, while unsecured cards do not. Consider your ability to provide a deposit and how that impacts your credit limit.

Secured cards are excellent for rebuilding credit, as they provide a safety net for lenders.

Unsecured cards may be more convenient if you can qualify for one without a deposit.

Interest Rates and Fees

Carefully evaluate the interest rates and fees associated with each card.

Interest rates on credit cards for poor credit tend to be higher than average, so compare the APRs.

If you anticipate carrying a balance, prioritize a card with a lower APR.

Additionally, be aware of fees such as annual fees, late payment fees, and foreign transaction fees.

Credit Score Requirements

Different cards have varying credit score requirements. Some are accessible with lower credit scores, while others demand slightly better credit histories.

If you have a very low credit score or a limited credit history, consider cards explicitly designed for individuals in these situations.

Checking for Credit-Building Features

Look for credit-building features that can help you improve your credit score.

Some cards offer tools like free credit score monitoring, which can be valuable in tracking your progress.

Additionally, inquire about the possibility of upgrading to a better card in the future as your credit improves.

This can be an important factor for long-term planning.

Reading Reviews and Comparing Offers

Take advantage of online resources and reviews specific to credit cards for poor credit.

Read feedback from other cardholders to understand their experiences.

Use comparison websites to compare card features, fees, and benefits side by side.

This will help you make an informed decision based on your priorities and needs.

Applying Responsibly

Once you’ve chosen a card, apply responsibly.

Complete the application accurately, provide the necessary information, and be prepared for the approval process.

Avoid applying for multiple cards at once, as this can negatively impact your credit score.

Instead, focus on a card that aligns with your needs and financial situation.

Want to build credit fast? Try the FIT® Platinum Mastercard®!

Consider the FIT® Platinum Mastercard® if you’re looking to build or rebuild your credit.

It offers an unsecured credit line of $400, which can potentially double with responsible use.

One of its key benefits is that it reports your payment history to the major credit bureaus, helping you improve your credit score over time.

Ready to take the first step toward better credit?

Explore the FIT® Platinum Mastercard® today by following the link below and start your journey to improved financial health.

FIT® Platinum Mastercard® review

Our FIT® Platinum Mastercard® review breaks down the features of this credit builder credit card. Read on and learn more!

Trending Topics

Apply for the Upgrade Loans: Borrow Up to $50,000

Learn how to apply for Upgrade Loans and benefit from low-interest rates and flexible terms with our step-by-step guidance.

Keep Reading

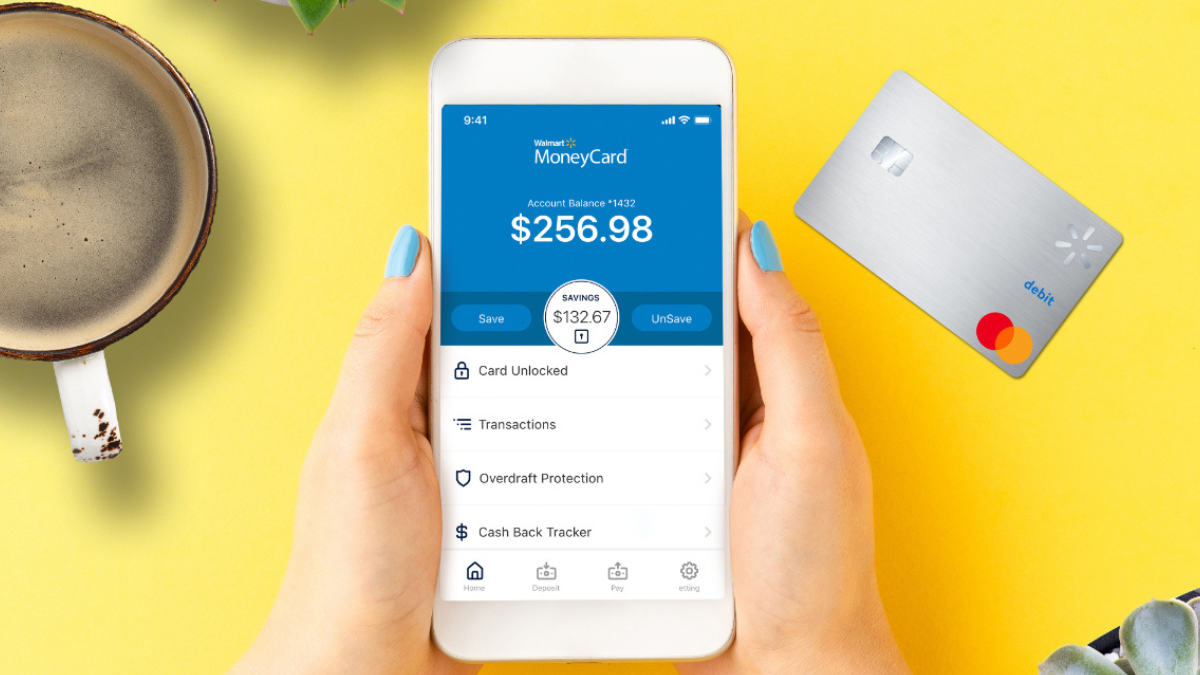

Walmart MoneyCard review: Earn cash back at Walmart

Explore our Walmart MoneyCard review to uncover features and how it can redefine your shopping experience today - earn 2% APY on savings.

Keep Reading

Up to 3% back: Amazon Rewards Visa Signature Card review

This Amazon Rewards Visa Signature Card review offers Amazon lovers an excellent card option! $0 annual or foreign transaction fees!

Keep ReadingYou may also like

Things that might happen if you don’t use your credit card!

Have you ever wondered what happens if you don't use your credit card? Don't worry! We'll explain everything your need here! Keep reading!

Keep Reading

Hassle-free: Apply for Chime Credit Builder Secured Visa® Card

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Keep Reading

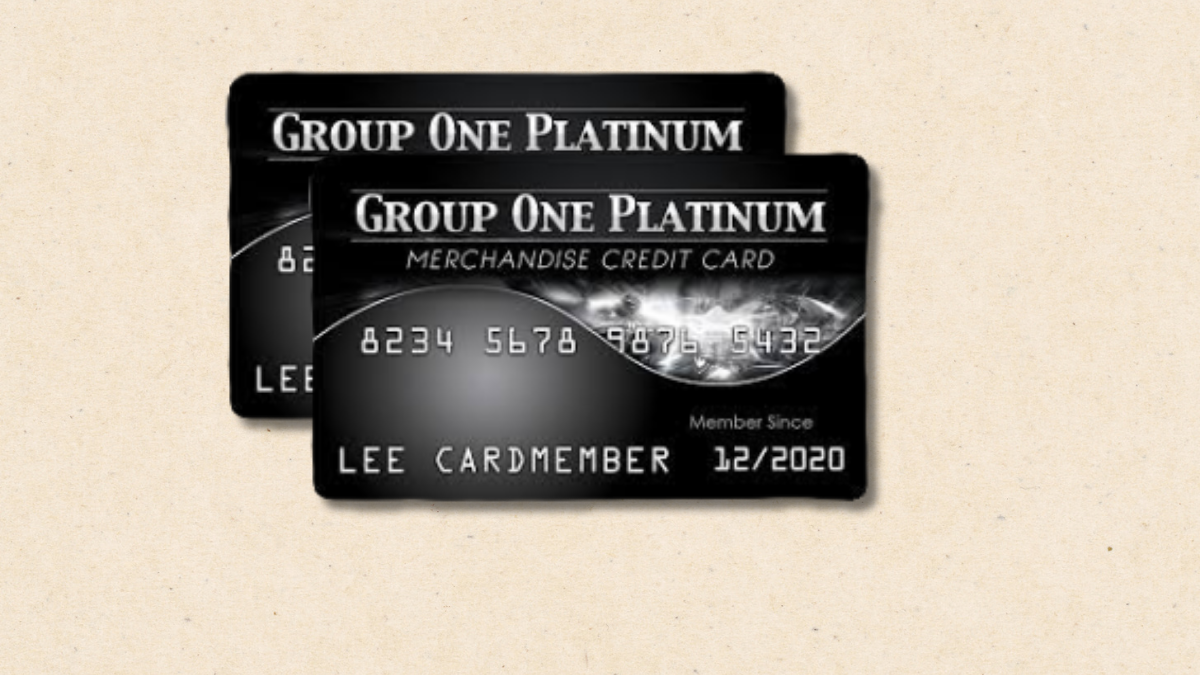

Group One Platinum Card Review: Easy $750 Credit Boost

Read our Group One Platinum Card review to learn how to get a $750 credit line with no credit check and increase your purchasing power.

Keep Reading