Credit Card

Wells Fargo Active Cash® Card review: unleashing top rewards

In our comprehensive Wells Fargo Active Cash® Card review, we explore its series benefits. From cash back to security perks, discover more.

Advertisement

Optimize your financial journey with every purchase

Step into our Wells Fargo Active Cash® Card review to learn why this financial tool isn’t just another contender in the credit card arena.

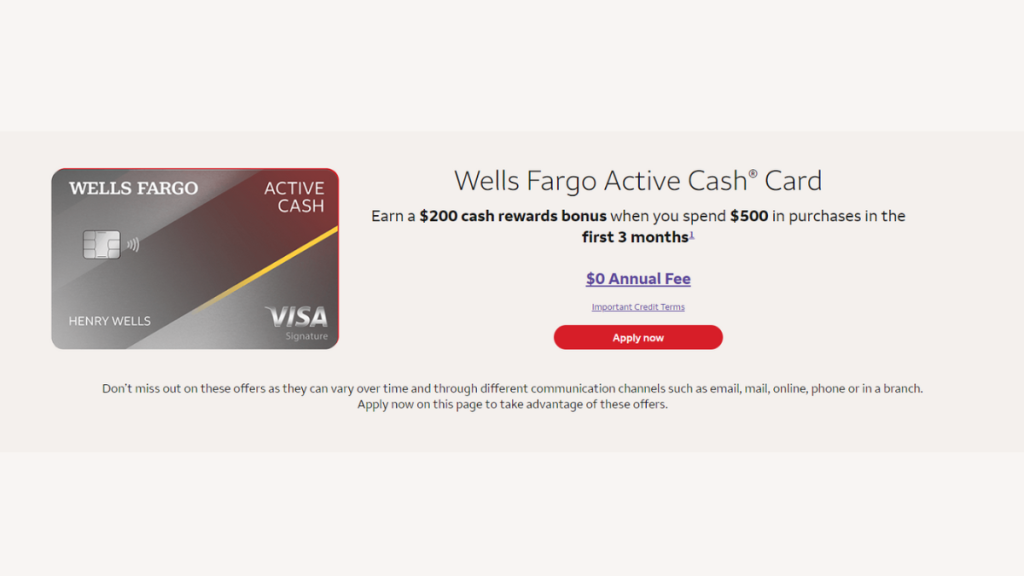

Apply for the Wells Fargo Active Cash® Card

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Wondering about its perks and potential pitfalls? So stay with us as we delve deeper, presenting all you need to know about this incredible credit card below.

| Credit Score | You need a good score (700 or higher) to become eligible; |

| Annual Fee | No yearly charge to add this card to your wallet; |

| Purchase APR | New members can relish on a long low intro APR (0% for 15 months) on purchases and qualifying balance transfers made within the first 120 days of owning the card. Once that period ends, a variable 20.24%, 25.24% or 29.99% applies; |

| Cash Advance APR | 29.99% variable; |

| Welcome Bonus | After spending $500 or more within the first 3 months, new members can enjoy a $200 cash bonus; |

| Rewards | All purchases offer a 2% rebate, with no categories or limitations. |

Wells Fargo Active Cash® Card: All you need to know

Right off the bat, this card sets itself apart by eliminating annual fees. That means every year, you get to enjoy its perks without any added cost.

Also, new cardholders are in for a treat. A modest spend of $500 in the first three months unlocks a welcoming $200 cash bonus.

Indeed, with 2% cash back on all your expenses, rewards rack up quickly. And when it’s time to enjoy them, redeeming is as smooth as earning.

And those early purchases? They’re cushioned with a 0% intro APR for 15 months, transitioning to a variable APR between 20.24% to 29.99% afterward.

Equipped with powerful security features, including zero liability protection, Wells Fargo makes sure that your credit card is always looked after.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Wells Fargo Active Cash® Card

Furthermore, are you curious about what makes this credit card tick?

Dive further into our Wells Fargo Active Cash® Card review below to uncover its advantages and drawbacks.

Pros

- Zero yearly charges – wallet-friendly feature that’s always a win;

- Bag a $200 welcome bonus after a mere $500 spend in 3 months.

- A straightforward 2% cash back on everything, every time;

- 0% APR for 15 months on purchases and select balance transfers;

- Guard your gadget with up to $600 in cell phone coverage;

- No hoops, no hurdles, just easy rewards redemption;

- Rest easy with top-tier protection, including zero liability.

Cons

- Post the introductory period, expect rates between 20.24% and 29.99%;

- Extra fees kick in for purchases made abroad;

- If you’re looking for points or miles, this isn’t the card for you.

What credit score do you need to apply?

If you’re now thinking about getting the Wells Fargo Active Cash® Card, then aim for a good to excellent credit score.

However, keep in mind that while score matters, other financial details play a part in your eligibility too.

How to easily apply for the Wells Fargo Active Cash® Card?

Taking the leap with the Wells Fargo Active Cash® Card can be a game-changer for the way you manage and spend your money.

Feeling the pull? So if you’re interested in applying, we’ve got you covered.

Further, dive into our detailed guide below and smoothly navigate your way through the application process.

Apply for the Wells Fargo Active Cash® Card

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Trending Topics

Apply for the Discover it® Cash Back Credit Card: Extra Perks

Learn the steps to apply for the Discover it® Cash Back Credit Card and enjoy its hefty welcome bonus. Check our quick and simple guide!

Keep Reading

Things that might happen if you don’t use your credit card!

Have you ever wondered what happens if you don't use your credit card? Don't worry! We'll explain everything your need here! Keep reading!

Keep Reading

GO2bank Secured Visa® Credit Card review: Build credit fast

Explore our GO2bank Secured Visa® Credit Card review and discover a smart way to boost your credit journey - no credit check!

Keep ReadingYou may also like

Apply for Chase Freedom Unlimited® Credit Card: $0 annual fee

Learn how to apply for the Chase Freedom Unlimited® Credit Card and explore its benefits - maximize rewards and savings effortlessly!

Keep Reading

Make Smart Choices: Discover the Top Cards for Poor Credit

Discover which are the best credit cards for poor credit – improve your financial future with our expert recommendations and tips today!

Keep Reading