Credit Card

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Applying for the GO2bank Secured Visa® Credit Card is your gateway to building a solid credit foundation - $0 annual fee! Read on and learn more!

Advertisement

Get a fresh start to financial success and peace of mind

Ready to apply for the GO2bank Secured Visa® Credit Card? It’s a decision that can pave the way for financial empowerment.

By the time you’re done reading, you’ll be geared up to get your GO2bank Secured Visa® Credit Card and pave your path to credit success.

Online application

Ready to dive into credit-building? The GO2bank Secured Visa® Credit Card journey starts online!

Begin by setting up your GO2 account and make sure you receive a direct deposit of $100 or more within a month.

Once that’s ticked off, request your GO2bank Secured Visa® Credit Card online.

Activate it, then dance over to transfer $100 or more – that becomes your credit limit.

So, just like that, your new card will glide to your mailbox, ready to join your financial adventures in just a few business days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Embrace the modern way! Apply for the GO2bank Secured Visa® Credit Card with a swift and user-friendly mobile app experience.

Indeed, the process mirrors what we talked about in the previous topic. Set up an account, get that direct deposit, and request your card.

Once that deposit lands, jump into action – apply, activate, and smoothly transfer your security deposit from your GO2 account to fuel your credit limit.

Hold your excitement as your new card flies to you in just a few business days.

Soon, you’ll be ready to swipe it for online or in-store buys wherever a Visa is welcomed.

GO2bank Secured Visa® Credit Card or Chime Credit Builder Secured Visa® Credit Card?

Step into the credit world with the GO2bank Secured Visa® and the Chime Credit Builder Secured Visa®.

They’re both credit-building superheroes, but they have their styles.

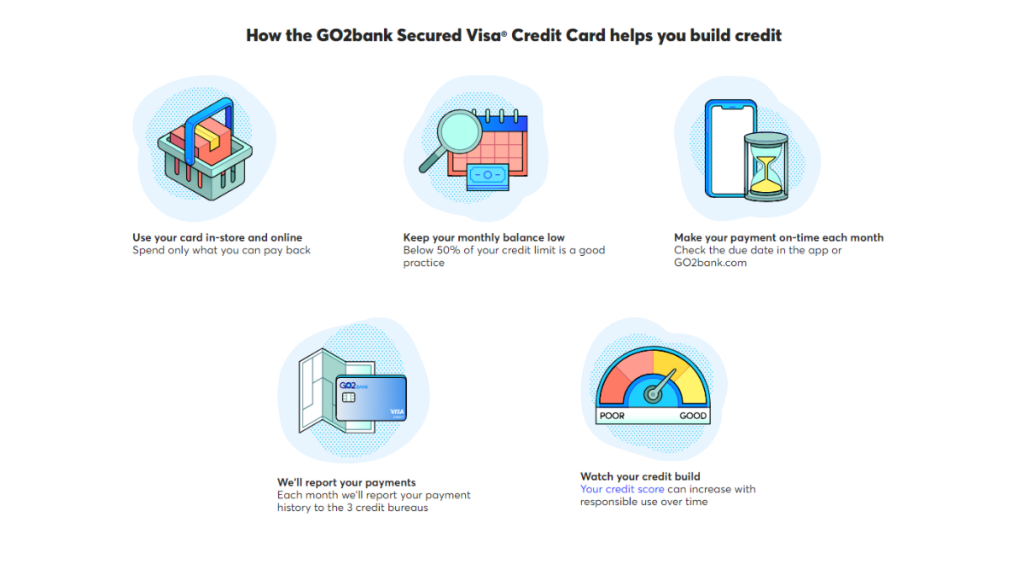

The GO2bank Secured Visa® works like this: You put down a deposit, which becomes your credit limit – like your credit safety net.

On the flip side, the Chime Credit Builder Secured Visa® takes a unique approach.

You move funds to an account to set your limit, giving you a fresh angle to use the card. Further, compare both card’s main features.

| GO2bank Secured Visa® Credit Card | Chime Credit Builder Secured Visa® Credit Card | |

| Credit Score | There are no credit checks on existing account holders, so everyone is welcome to apply; | There are no credit checks involved, so everyone is welcome to apply for the card; |

| Annual Fee | There’s no annual fee for the GO2bank Secured Card; | No annual or monthly maintenance fees; |

| Purchase APR | 22.99%; | 0%; |

| Cash Advance APR | 26.99%; | N/A; |

| Welcome Bonus | There are no welcome offers currently; | N/A; |

| Rewards | This is not a rewards card, so there are none. | There is no reward rate attached to this card. |

Further, if you’re already nodding in agreement, our next post will show you how to make it yours easily.

Apply for the Chime Credit Builder Secured Visa®

Learn how to apply for Chime Credit Builder Secured Visa® Card! Pay $0 annual fee and 0% interest! No credit check is required! Read on!

Trending Topics

First Latitude Secured Mastercard® Credit Card review: 1% back

Explore insights with our First Latitude Secured Mastercard® Credit Card review. Unlock financial freedom and build credit efficiently!

Keep Reading

Destiny Mastercard® review: A Stepping Stone For Good Credit

Unlock the secrets of the Destiny Mastercard® in our comprehensive review to see if it's the right choice for your financial future.

Keep ReadingYou may also like

Apply for First Progress Platinum Elite Mastercard® Secured fast

See how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card and get a flexible credit limit of up to $2,000.

Keep Reading

Make Money Online: 10 Proven Ways

There are many ways to make money online, and one of these will certainly fit you. Put your pajamas back on and check our list!

Keep Reading

Apply for the Group One Platinum Card: No Credit Checks

Discover how to apply for the Group One Platinum Card and enjoy effortless shopping with a significant credit limit and no credit checks.

Keep Reading