Credit Card

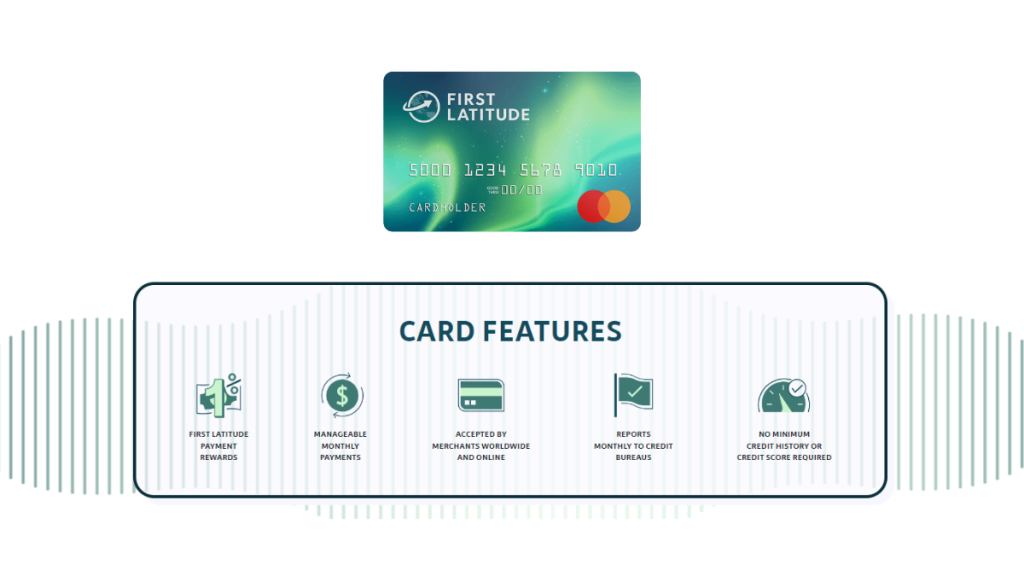

First Latitude Secured Mastercard® Credit Card review: 1% back

Unlock a world of financial possibilities with First Latitude Secured Mastercard®. Build credit fast and earn more! Read on and learn!

Advertisement

Earn as you spend! Enjoy cash back on every card payment

Explore the First Latitude Secured Mastercard® in our review! A card designed to empower your spending while enhancing your credit journey.

Apply for First Latitude Secured Mastercard®

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Dive deeper with us and uncover all its features, fees, benefits, and more. Will this be your financial game-changer? Keep reading our review below!

| Credit Score | There are no score requirements to apply. |

| Annual Fee | $25 during your first year as a member, then $35 annually after. |

| Purchase APR | 24.29% variable. |

| Cash Advance APR | 29.49% variable. |

| Welcome Bonus | There are none, currently. |

| Rewards | 1% on payments. |

First Latitude Secured Mastercard® Credit Card: All you need to know

Unlock financial empowerment with the First Latitude Secured Mastercard® Card! A pathway designed especially for those on a credit-building journey.

With a modest minimum security deposit of $100, it offers a low entry barrier, opening doors for anyone who’s looking to upgrade their credit profile.

Enjoy 1% cash back on all card payments, a rewarding feature that puts money back into your pocket while you spend and build credit at the same time.

Your payments are reported to all major credit bureaus. That is a crucial step to positively building and reflecting your credit behavior on your credit report.

However, be mindful of the fees. There’s a $19.95 account opening fee and an annual fee of $25 in the first year, escalating to $35 thereafter.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the First Latitude Secured Mastercard® Credit Card

Step further into our First Latitude Secured Mastercard® review below, where we’ll take a closer look at the pros and cons.

Pros

- Designed specifically to help users build or rebuild their credit.

- Offers a low entry point with a minimum deposit of just $100.

- Regularly reports payment activities to major credit bureaus.

- Provides 1% cash back on card payments, rewarding responsible usage.

- Open to individuals regardless of their current credit score.

Cons

- Charges annual fees and a one-time account opening fee.

- Lacks the premium benefits or rewards that other cards might offer.

- Charges foreign currency conversion fees.

What credit score do you need to apply?

The beauty of the First Latitude Secured Mastercard® Credit Card lies in its accessibility. Curiously, there’s no minimum credit score required to apply.

That fact opens the doors for a wide range of individuals.

Whether you’re building or rebuilding, this card offers a viable route to improve your credit journey.

So all you need is proof that you’re 18+, verify your identity with a Social Security Number, and not have a prior bankruptcy to your name.

How to easily apply for the First Latitude Secured Mastercard® Credit Card?

Applying for the First Latitude Secured Mastercard® is simple and user-friendly, designed to be accessible for all who wish to build their credit effectively.

Ready to take the next step? Learn the straightforward application process in our detailed step-by-step guide on the following link.

Further, let’s navigate your path to better credit together!

Apply for First Latitude Secured Mastercard®

Apply First Latitude Secured Mastercard® Credit Card to earn 1% back on card payments while you boost your score to new heights.

Trending Topics

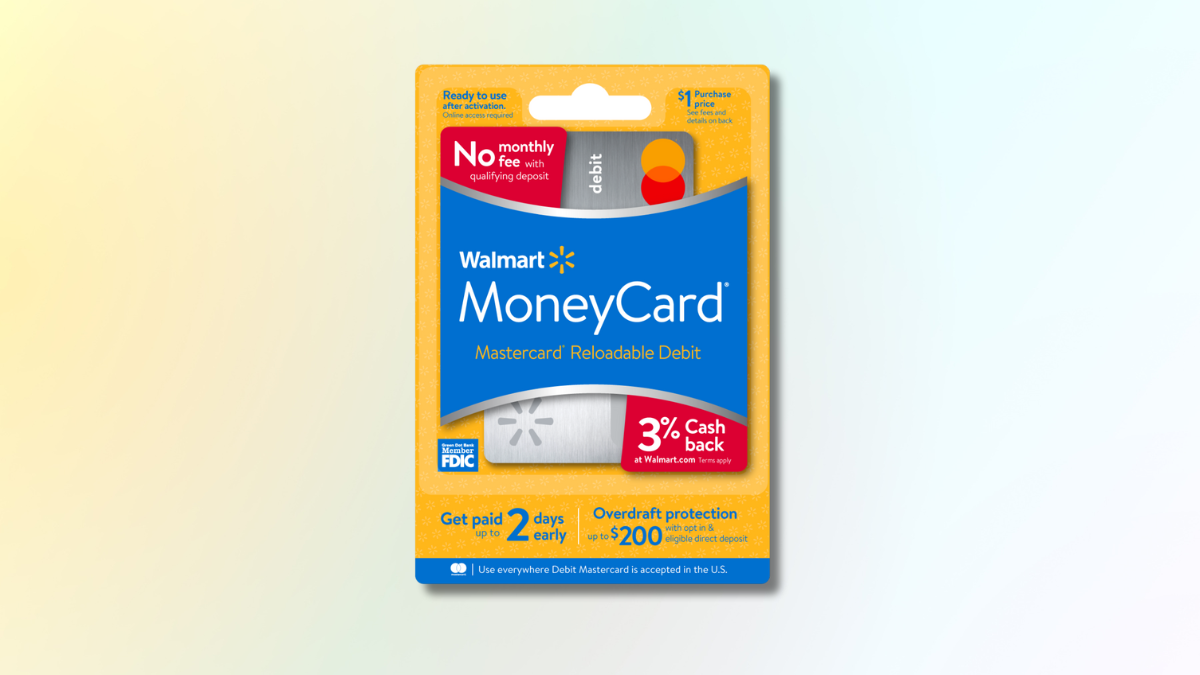

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep Reading

Instant decision: Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Keep Reading

Wells Fargo Reflect® Card review: Extensive 0% APR Period

Dive into our Wells Fargo Reflect® Card review to uncover its unique benefits and features. Experience 0% intro APR today!

Keep ReadingYou may also like

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard® today and earn a mile for every dollar spent! Sign-up bonus of 50K miles!

Keep Reading

Rebuild Your Credit Score: Choose the Perfect Cards for Bad Credit

Discover the best credit cards for bad credit. Boost your financial journey and improve your score with our trusted options.

Keep Reading

Transunion vs. Equifax: the credit reporting giants

Transunion vs. Equifax are different credit report agencies that provide your credit score! But how do they differ? Keep reading and learn!

Keep Reading