Ready to boost your credit score with an unsecured line? Earn 1% cash back on purchases!

The First Access Visa® Card offers the opportunity to build credit, making financial growth accessible!

Advertisement

Looking to redefine your credit journey? Then meet the First Access Visa® Card! Tailored for those looking to turn the financial page, it’s more than just a card—it’s your ticket to a brighter financial future. Dive into a world of possibilities and take charge of your credit story with an unsecured credit line and credit bureau reporting.

Looking to redefine your credit journey? Then meet the First Access Visa® Card! Tailored for those looking to turn the financial page, it’s more than just a card—it’s your ticket to a brighter financial future. Dive into a world of possibilities and take charge of your credit story with an unsecured credit line and credit bureau reporting.

You will remain in the same website

Explore the many perks of the First Access Visa® Card and learn what this card can do for you once you apply and get it in your wallet.

Dive into a world of financial empowerment with the First Access Visa® Card. Designed to be more than just a card, it’s a gateway to financial freedom, ensuring that your journey in the realm of credit is both rewarding and enriching.

Advantages and special perks

- A Friend to All Credit Types: Whether you’re taking your first steps into the credit world or seeking a fresh start, the First Access Visa® Card extends a welcoming hand, offering opportunities regardless of credit history.

- Broad Acceptance: Harness the global power of Visa®, ensuring your transactions are smooth and hassle-free, be it at a local diner or an international boutique.

- Robust Online Services: From tracking your expenses to timely bill payments, the card’s online portal ensures you have all the tools needed for efficient financial management.

- Credit Reporting: With consistent reporting to major credit bureaus, the card aids in building or enhancing your credit score, provided you maintain responsible usage.

- Swift Application Process: The streamlined application process is both quick and straightforward, ensuring you can access your financial tool without undue delays.

Disadvantages

- Annual and Monthly Fees: The First Access Visa® Card comes with both an annual fee and potential monthly maintenance fees, which could be a concern for budget-conscious users.

- Higher Interest Rates: The card’s APR is on the higher side, making it crucial for users to avoid carrying a balance to sidestep hefty interest charges.

- Initial Credit Limit Considerations: The initial credit limit might be lower compared to some other cards, and with the deduction of the annual fee, the available limit can be further reduced initially.

- Limited Reward Features: If you have an affinity for cashbacks, points, or travel rewards, this card might not meet those specific expectations.

The First Access Visa® Card emerges as a beacon for those seeking a reliable credit companion. Its suite of features is tailored to provide a comprehensive credit experience.

However, potential users should evaluate the associated costs and benefits meticulously to ensure it aligns perfectly with their financial aspirations and needs.

In today’s digital age, convenience is key. The First Access Visa® Card offers all cardholders a user-friendly and simple credit card app that allows you to monitor your account, make payments, check your balance, and much more on-the-go. It’s designed to give you full control over your account, ensuring you stay on top of your credit journey at all times.

Without a doubt! The First Access Visa® Card aims to provide a lifeline to those with credit hiccups in their past. It recognizes that everyone deserves a second chance. By offering an unsecured credit line, it gives individuals an opportunity to demonstrate financial responsibility, rebuild trust with creditors, and improve their credit scores.

Building or rebuilding credit is a journey, and the First Access Visa® Card is a formidable ally on that path. By providing an unsecured credit opportunity to those with less-than-stellar credit histories, it enables users to show consistent, responsible credit behavior. Every on-time payment and sensible spending decision is reported to major credit bureaus. This consistent positive reporting serves as a foundation to build credit over time.

The First Access Visa® Card offers a chance to pave a fresh financial path. With the added incentives, it not only supports credit building but also rewards responsible usage, creating a balance of opportunity and benefit.

Apply for the First Access Visa® Card: Free credit

Discover how to easily apply for the First Access Visa® Card and make the right credit move with our simple step-by-step guide.

But if you believe that this is not the right card for you, why not look further into the Mission Lane Visa® Credit Card? The card also provides credit-building features and encourages good credit habits.

Ready to explore the features of the Mission Lane Visa® Credit Card? Then dive into the following article. In it, you’ll also find a clear step-by-step guide on how to apply.

Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Trending Topics

Upgrade Triple Cash Rewards Visa® review: earn $200 bonus

Find out about the main features of this card in this Upgrade Triple Cash Rewards Visa® review. Earn up to 3% unlimited cash back!

Keep Reading

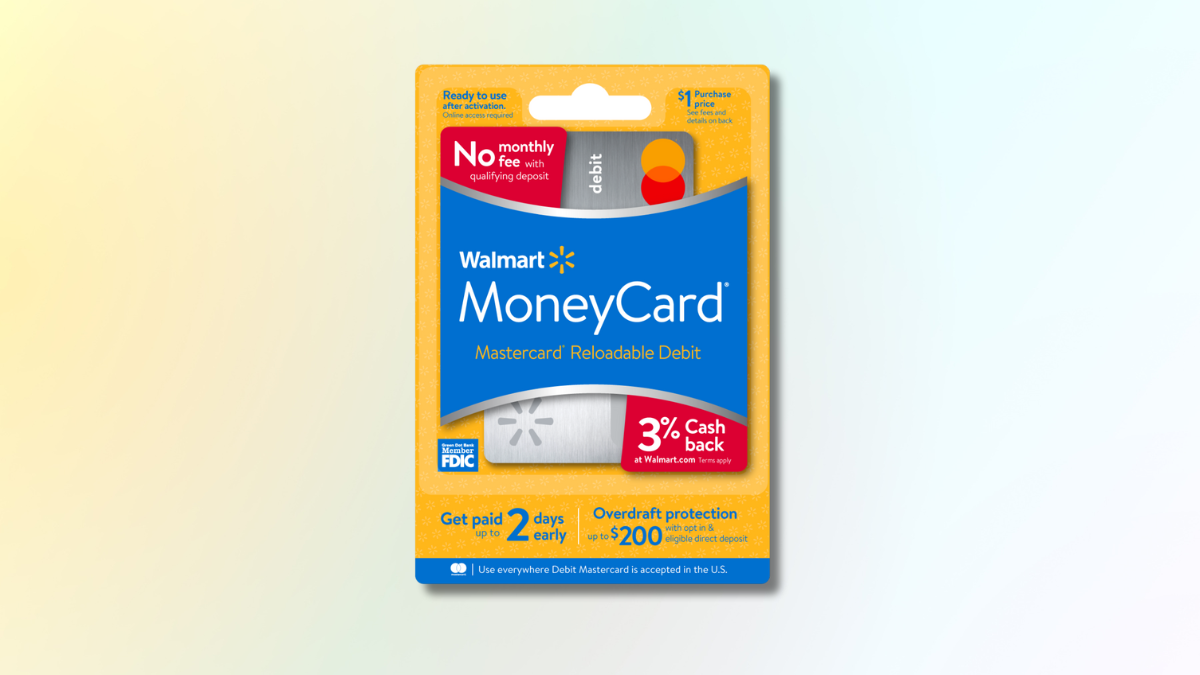

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep ReadingYou may also like

Instant decision: Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Keep Reading

Chase Freedom Unlimited® Credit Card Review: Earn Big!

Explore our Chase Freedom Unlimited® Credit Card review to uncover its cash back perks and 0% intro APR. Maximize your spending efficiency.

Keep Reading

Double your limit in no time: Apply for the Reflex Mastercard®

Ready to build your credit with the Reflex Mastercard®? Follow our step-by-step guide to apply today and control your finances.

Keep Reading