Looking for a card that understands your past and powers your purchases?

The Boost Platinum Card is your answer, offering shopping freedom regardless of credit history!

Advertisement

Redefine your shopping journey with the Boost Platinum Card. Designed for those with past credit mishaps, it’s not just a card, but a companion in your financial pursuits. Embrace the freedom to purchase you’ve been waiting for with an unsecured $750 merchandise credit line! Read our full review to learn more about Boost and how it could help your finances.

Redefine your shopping journey with the Boost Platinum Card. Designed for those with past credit mishaps, it’s not just a card, but a companion in your financial pursuits. Embrace the freedom to purchase you’ve been waiting for with an unsecured $750 merchandise credit line! Read our full review to learn more about Boost and how it could help your finances.

You will remain in the same website

Dive into the advantages of the Boost Platinum Card and see what applying for this card will get you:

Unlock a world of exclusive shopping experiences with the Boost Platinum Card.

Crafted for those who appreciate unique and curated selections, this card is your dedicated pass to explore the vast offerings of the HorizonOutlet online store.

Advantages and special perks

- Seamless Application Experience: Dive into a hassle-free application process with the Boost Platinum Card. Say goodbye to tedious credit checks and embrace a smoother onboarding journey.

- Generous Merchandise Credit: Enjoy the luxury of a $750 merchandise credit line, ensuring you have substantial freedom to pick and choose your favorites from HorizonOutlet.

- Exclusive Shopping Platform: The Boost Platinum Card is your golden ticket to HorizonOutlet’s online store, a platform that offers a diverse range of products tailored to meet varied tastes.

- Predictable Spending: With a fixed credit line, users can easily manage and anticipate their spending, ensuring no unexpected financial surprises.

Disadvantages

- Limited Usage Scope: The Boost Platinum Card is exclusive to HorizonOutlet, which means you won’t be able to use it for purchases outside of this platform.

- No Credit Building: If you’re looking to build or repair your credit history, this card might not be the right fit as it doesn’t report to major credit bureaus.

- Absence of Reward Programs: Unlike many credit cards in the market, the Boost Platinum Card doesn’t offer any rewards, cashback, or points system to incentivize spending.

The Boost Platinum Card is a niche offering, perfect for those who cherish the unique collection at HorizonOutlet.

While it brings forth a hassle-free application process and a generous credit line, potential users should be mindful of its limitations.

It’s essential to align your expectations with the card’s specific features to ensure a satisfying shopping experience.

Absolutely! The Boost Platinum Card is optimized for the digital age, making it a prime choice for online shopping enthusiasts. With this card in hand, you can shop online at the Horizon Outlet website and choose from hundreds of different items. So whether you’re a regular online shopper or occasionally indulge in e-commerce splurges, this card promises a hassle-free and smooth experience.

As of right now, the Boost Platinum Card does not offer a dedicated mobile app. However, for all card management needs, you can access and navigate your account through the official website, which is designed to be user-friendly and intuitive. You can also call customer services at 1-800-251-6144.

Yes! One of the standout features of the Boost Platinum Card is its focus on serving individuals with past credit challenges. Recognizing that everyone might face financial hiccups at some point, this card offers a unique opportunity. It allows those with not-so-perfect credit histories to regain their purchasing power, granting them the freedom to shop without the typical boundaries or judgments.

It’s essential for potential users to know that the Boost Platinum Card, while offering plenty of shopping advantages, does not contribute to credit-building. Its primary objective is to ensure those with past credit issues can shop with ease. If credit-building is a priority, you might need to consider a different card.

The Boost Platinum Card is a financial tool tailored for individuals who’ve faced credit challenges in the past.

Offering the freedom of shopping without the typical constraints, the card provides shopping opportunities, regardless of past financial hiccups.

Apply for the Boost Platinum Card

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

However, if you’re looking for an alternative with a broader set of features, the Petal® 1 “No Annual Fee” Visa® Credit Card might be worth a glance.

This card not only offers the advantage of no annual fees but also provides a chance for responsible credit building, making it an attractive choice for many.

Curious about what the Petal® 1 “No Annual Fee” Visa® Credit Card offers? Then check the following link to learn more about how it aligns with your goals and how to apply for it.

Apply Petal® 1 “No Annual Fee” Visa® Credit Card

Wondering how to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card? Then read on! Earn up to 10% cash back on purchases!

Trending Topics

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep Reading

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Keep ReadingYou may also like

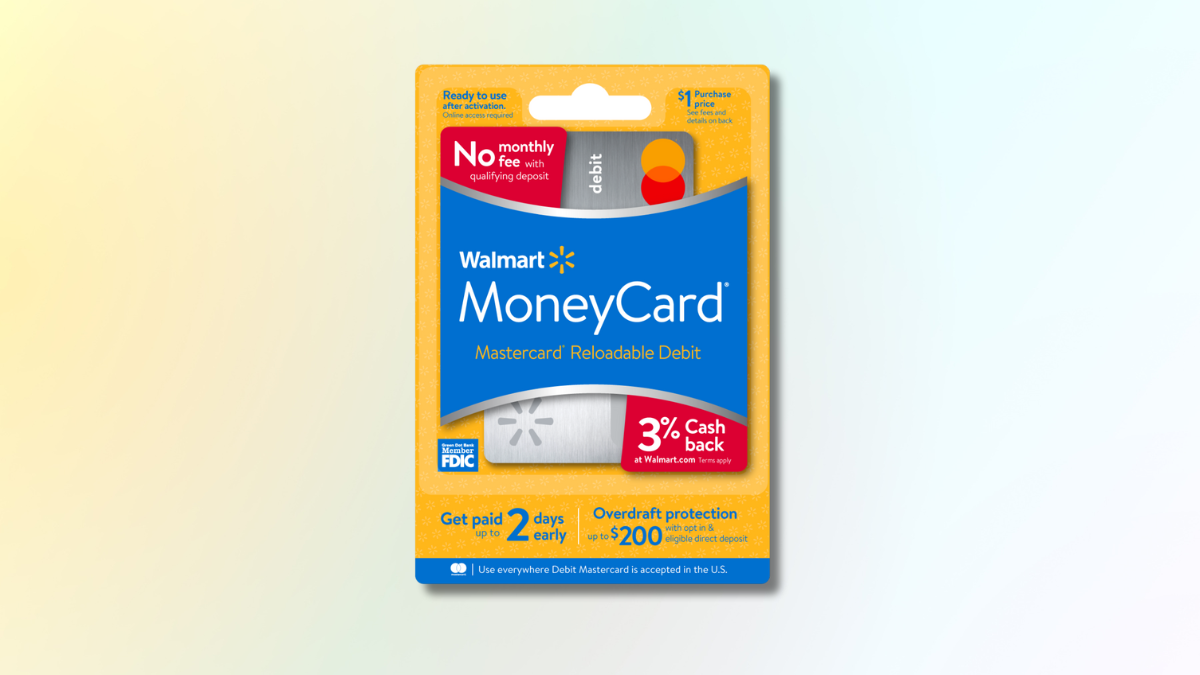

Earn 2% APY on savings: How to apply for the Walmart MoneyCard

Learn the easy steps to apply for the Walmart MoneyCard with our guide - earn up to 3% cash back on purchases! Read on and learn more!

Keep Reading

Mission Lane Visa® Credit Card review: Simplify your finances

Discover the Mission Lane Visa® Credit Card: A credit card that simplifies your life. With global acceptance. Check out!

Keep Reading

Discover it® Cash Back Credit Card Review: Boost Earnings

Explore our Discover it® Cash Back Credit Card review to uncover exclusive benefits, including a generous cash back and zero annual fees.

Keep Reading