Credit Card

Boost Platinum Card Review: Empower Your Spending!

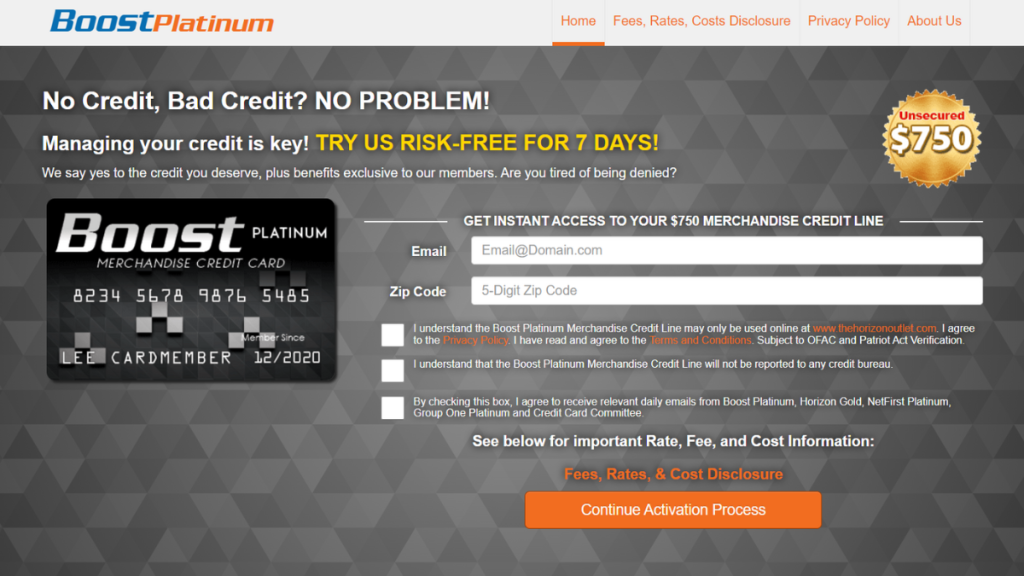

Are you tired of being denied a credit line because of past financial mistakes? Explore our Boost Platinum Card and ensure a new financial tools! Read on!

Advertisement

Your trusted companion in merchandise shopping

In this Boost Platinum Card review, we’ll offer a fresh perspective with a merchandise solution for those who’ve faced credit challenges.

Apply for the Boost Platinum Card

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

So join us as we unravel the benefits, potential drawbacks, and unique features of this game-changing card. Ready? Let’s get to it.

| Credit Score | Damaged to Fair Credit; |

| Annual Fee | $14.77 per month ($177.24 annually); |

| Purchase APR | None; |

| Cash Advance APR | Does not apply; |

| Welcome Bonus | There are no welcome bonuses; |

| Rewards | This is not a rewards card. |

Boost Platinum Card: All you need to know

The Boost Platinum Card is specifically crafted for individuals with damaged credit histories. It offers a seamless shopping experience .

Despite past financial setbacks, this card ensures your purchasing power remains intact. No judgment, just shopping freedom.

With it, you can get an unsecured $750 credit line. Since the card is not a Visa or Mastercard, you can only use it to shop at Horizon Outlet’s online store.

You also need to link a debit or credit card for fees and shipping costs. The card has no APR on purchases, but there are no rewards or bonuses either.

While the card doesn’t focus on credit building, its main appeal is the empowerment it brings to its cardholders.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Boost Platinum Card

While the card offers several advantages, it’s essential to weigh them against potential downsides. See them next in our Boost Platinum Card review.

Pros

- Specifically designed for individuals with a compromised credit history;

- Quick approvals without the hassle of extensive documentation;

- The ability to make purchases without the added pressure of credit-building;

- Clear guidelines on charges, reducing the risk of hidden fees.

- Unsecured merchandise credit line up to $750.

Cons

- The Boost Platinum doesn’t contribute to rebuilding your credit score;

- The card is merchandise specific, limiting your purchasing power;

- There’s a monthly fee attached to the card, which is high considering its limitations;

- You need to link a separate debit or credit card for fees and shipping costs;

- It doesn’t offer the range of benefits that traditional credit cards might provide.

What credit score do you need to apply?

One of the standout features of the Boost Platinum Card is that it may be available to everyone, regardless of their credit standing.

Since the issuer does not perform any credit or employment checks, you can request the card even if you’ve had financial mishaps in the past.

How to easily apply for the Boost Platinum Card?

The Boost Platinum Card could be a fantastic shopping companion if you’re struggling to get traditional cards, or if you’re just an avid shopper.

So, are you ready to take the next step? Don’t miss our following article, where we provide a step-by-step guide on how to easily apply for it.

Apply for the Boost Platinum Card

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

Trending Topics

Apply for the PayPal Prepaid Mastercard®: Hassle-free and online

Ready to take control of your finances? Learn how to apply for the PayPal Prepaid Mastercard® and enjoy secure, hassle-free spending.

Keep Reading

Chase Freedom Unlimited® Credit Card Review: Earn Big!

Explore our Chase Freedom Unlimited® Credit Card review to uncover its cash back perks and 0% intro APR. Maximize your spending efficiency.

Keep Reading

FIT® Platinum Mastercard® review: Your Gateway to Better Credit

Dive into our FIT® Platinum Mastercard® review to discover how this credit builder card can elevate your financial journey. Learn more!

Keep ReadingYou may also like

$0 annual fee: Apply for the Amazon Rewards Visa Signature Card

Read on and learn how to apply for the Amazon Rewards Visa Signature Card! Earn up to 3% cash back on purchases and pay a $0 annual fee!

Keep Reading

Apply for the Avant Personal Loans: Fund Your Dreams Fast!

Ready to uplift your finances? Learn how to apply for the Avant Personal Loans with ease and find tailored options with competitive rates.

Keep Reading