Credit Card

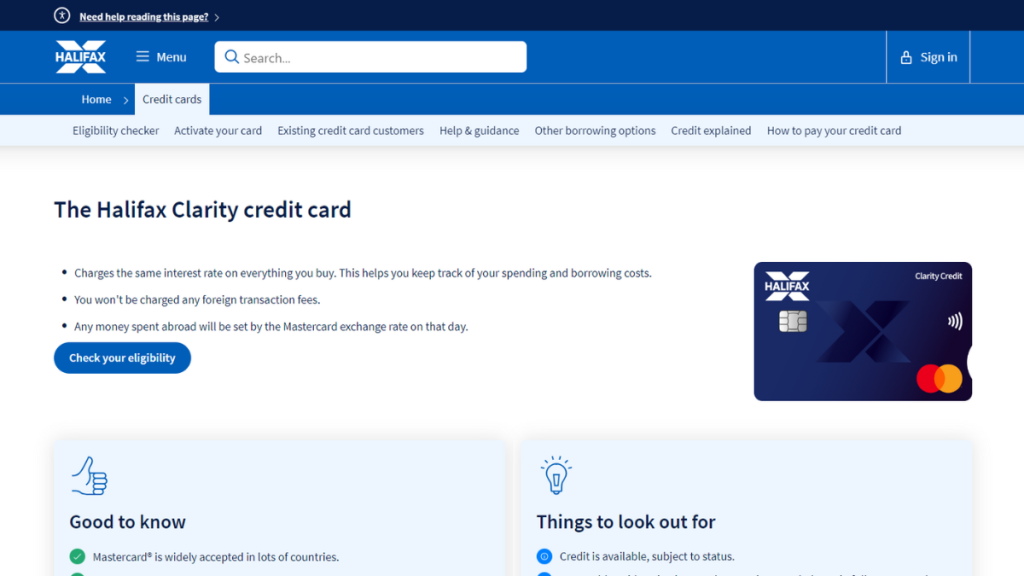

Travel smarter with no fees: Halifax Clarity Credit Card review

A popular choice for frequent travelers looking to save money on foreign transaction fees. Learn more about the Halifax Clarity Credit Card!

Advertisement

No annual fees and competitive APR for all people

Looking for a credit card that can help you save money while traveling? The Halifax Clarity Credit Card of this review may be the perfect choice for you.

Apply for the Halifax Clarity Credit Card

Learn how to apply for the Halifax Clarity Credit Card with this step-by-step guide. Read on to find out – no hidden fees!

This option offers no foreign transaction fees and a range of other benefits. So keep reading and dive into this card’s details!

| Credit Score | 670 or higher; |

| Annual Fee | £0; |

| Purchase APR | 23.9%; |

| Cash Advance APR | Not disclosed; |

| Welcome Bonus | N/A; |

| Rewards | N/A; |

Halifax Clarity Credit Card: All you need to Know

The Halifax Clarity Credit Card is a popular choice among frequent travelers due to its lack of foreign transaction fees.

Unlike many other credit cards, which charge foreign transaction fees, the Halifax Clarity Credit Card charges nothing.

Thus, this means you can use your card to make purchases overseas without worrying about additional fees eating into your budget.

The card also has no annual fee, making it an affordable option for those who don’t want to pay for the privilege of using a credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Halifax Clarity Credit Card

If you’re a frequent traveler looking for a card that can help you save money on foreign transaction fees, the Halifax Clarity Credit Card is a solid option.

It offers no annual fee, a competitive purchase APR, and the unique benefit of no foreign transaction fees.

However, weighing the pros and cons before applying for this card is important. So, check the main pros and cons of this option.

Pros

- No foreign transaction fees;

- No annual fee;

- Competitive purchase APR.

Cons

- No traditional rewards program;

- Absence of clear information about fees and rewards.

What credit score do you need to apply?

You’ll need a good to excellent credit score to apply for the Halifax Clarity Credit Card.

Thus, this means a score of 670 or higher on the FICO scale or 700 or higher on the VantageScore scale.

So, if you’re unsure what your credit score is, you can check it for free online through a credit monitoring service.

How to easily apply for the Halifax Clarity Credit Card

In conclusion, the Halifax Clarity Credit Card is a great option if you’re looking for a credit card that can help you save money on fees.

Indeed, with no annual fee and a competitive purchase APR, it’s an affordable choice for frequent travelers.

Are you ready to apply for the Halifax Clarity Credit Card? The application process is simple.

So, to learn more about the application process, check out this post below.

Apply for the Halifax Clarity Credit Card

Learn how to apply for the Halifax Clarity Credit Card with this step-by-step guide. Read on to find out – no hidden fees!

About the author / Sabrina Paes

Trending Topics

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep Reading

Make Smart Choices: Discover the Top Cards for Poor Credit

Discover which are the best credit cards for poor credit – improve your financial future with our expert recommendations and tips today!

Keep Reading

Chase Freedom Unlimited® Credit Card Review: Earn Big!

Explore our Chase Freedom Unlimited® Credit Card review to uncover its cash back perks and 0% intro APR. Maximize your spending efficiency.

Keep ReadingYou may also like

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep Reading

Chime® Debit Card review: Experience Hassle-Free banking

Explore the Chime® Debit Card - our in-depth review uncovers its benefits and features! Simplify your finances today!

Keep Reading

Find your perfect match: Choose the right credit card

Choose the right credit card for your finances and unlock your real potential! Keep reading and learn what you need to know!

Keep Reading