Credit Card

Your new travel card: Apply for the Halifax Clarity Credit Card

Find out everything you need to know about the application process, including how to apply online and via mobile app! No hidden fees!

Advertisement

Online and easy process

Are you ready to learn how to apply for the Halifax Clarity Credit Card? Indeed, this is a great option for travelers who want to avoid fees.

We’ll take you through the application step by step and compare the Halifax Clarity Credit Card with the Nationwide Member Credit Card. So, check out!

Online application

Indeed, to apply for the Halifax Clarity Credit Card online, follow these simple steps:

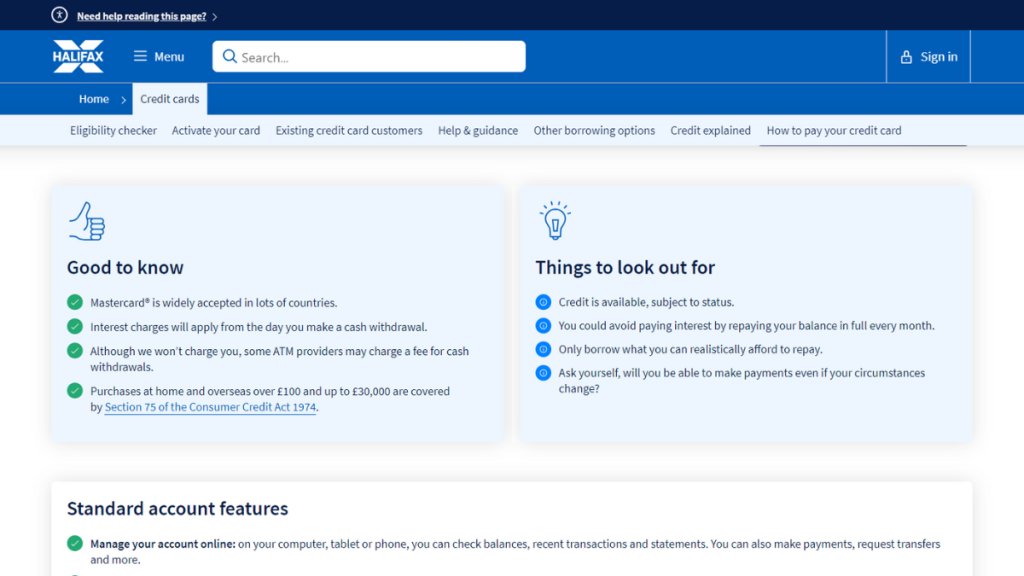

- Go to the Halifax website and click on the “Credit Cards” tab;

- Select the Halifax Clarity Credit Card from the list of options;

- Click on the “Apply now” button;

- Fill out the application form, providing all the required information, including your personal details and employment information;

- Review the terms and conditions and click on the “Submit” button.

Once you submit it, you’ll receive a response within a few minutes.

Furthermore, if your application is approved, you’ll receive your card in the mail within a few days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

In addition, if you prefer to apply for the Halifax Clarity Credit Card using the mobile app, follow these steps:

- Download the Halifax mobile app from the App Store or Google Play.

- Log in to your Halifax account or create a new one if you don’t already have one;

- Click on the “Credit Cards” tab and select the Halifax Clarity Credit Card from the list of options;

- Click on the “Apply now” button and follow the instructions to fill out the application form;

- Review the terms and conditions and click on the “Submit” button.

Indeed, just like with the online application, you’ll receive a response within a few minutes.

So if your application is approved, you’ll receive your card in the mail within a few days.

Halifax Clarity Credit Card or Sainsbury’s Bank 28 Month Balance Transfer Card?

When comparing the Halifax Clarity Credit Card and the Sainsbury’s Bank 28 Month Balance Transfer Card, it’s clear that both have their strengths.

The Halifax Clarity Credit Card stands out for its lack of foreign transaction fees and annual fees, making it an excellent choice for frequent travelers.

On the other hand, the Sainsbury’s Bank 28 Month Balance Transfer Card brings 0% interest on balance transfers for 28 months and no annual fee.

Ultimately, the decision will depend on your individual needs and preferences, so it’s important to carefully consider the features of each card.

| Halifax Clarity Credit Card | Sainsbury’s Bank 28 Month Balance Transfer Card | |

| Credit Score | 670 or higher; | Good; |

| Annual Fee | £0; | £0; |

| Purchase APR | 23.9%; | 0% interest in the first 3 months. 23.95% variable after; |

| Cash Advance APR | 23.9%; | 25.95%; |

| Welcome Bonus | N/A; | 0% interest on balance transfers for up to 28 months; |

| Rewards | N/A. | Earn up to 3 points for each £2 spent at Sainbury’s, Argos, Tu Clothing, and Habitat in the UK. Also, earn 1 point per £5 spent on all other purchases. |

Furthermore, the right credit card for you will depend on your travel habits and financial situation.

So if you’re interested in applying for the Sainsbury’s Bank 28 Month Balance Transfer Card, follow the link below!

Sainsbury’s Bank 28 Month Balance Transfer: apply

Apply Sainsbury’s Bank 28 Month Balance Transfer Card today and enjoy up to 28 months of 0% interest on balance transfers and more! Read on!

About the author / Sabrina Paes

Trending Topics

Up to 3% cash back: Apply for Upgrade Triple Cash Rewards Visa®

Learn how to apply for the Upgrade Triple Cash Rewards Visa® and earn up to 3% cash back on purchases and pay no annual fee!

Keep Reading

Citi® / AAdvantage® Executive World Elite Mastercard® review

Stick with us and review the Citi® / AAdvantage® Executive World Elite Mastercard® card's main features! Ensure 50K bonus miles and more!

Keep Reading

Apply for the Upgrade Loans: Borrow Up to $50,000

Learn how to apply for Upgrade Loans and benefit from low-interest rates and flexible terms with our step-by-step guidance.

Keep ReadingYou may also like

How to apply for the Destiny Mastercard®: Response in 60 seconds

Ready to shape your financial future? Learn how to apply for the Destiny Mastercard® today and step forward with confidence!

Keep Reading

Qualify with any type of credit: Apply for the Revvi Card

Apply for the Revvi Card today and earn 1% cash back on payments! Start building credit with confidence! Instant result application!

Keep Reading