Credit Card

Apply for Sainsbury’s Bank 28 Month Balance Transfer Card today

Sainsbury’s Bank 28 Month Balance Transfer Card offers up to 3 points on purchases and charges no annual fee! Read on and learn how to apply for it!

Advertisement

Enjoy 0% interest on purchases for 3 months!

If you want to enjoy a rewarding experience with a credit card, then apply for the Sainsbury’s Bank 28 Month Balance Transfer Card today!

This card offers a reward program while charging no annual fee and a 0% interest period! So stick with us and learn how to apply for it!

Online application

The process to apply for the Sainsbury’s Bank 28 Month Balance Transfer Card is simple and fast! Firstly, access their official website!

Next, hit the “Apply Now” button to get started! Further, you’ll access a page with their eligibility requirements and other important disclaimers.

Once you’ve read everything, select again the “Apply Now” button at the bottom of the page! At this point, you’ll access a small form.

Furthermore, fill out the application form with your personal and financial information, and then submit it!

Once done, you’ll get the result of your application. If approved, you’ll soon receive your credit card and enjoy its benefits!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the mobile app

Indeed, Sainsbury’s Bank offers an excellent mobile app to those interested in enjoying a convenient experience!

Still, you must complete the application process through their official website before using the app.

Once you’re a cardholder, you can easily manage your card through your smartphone!

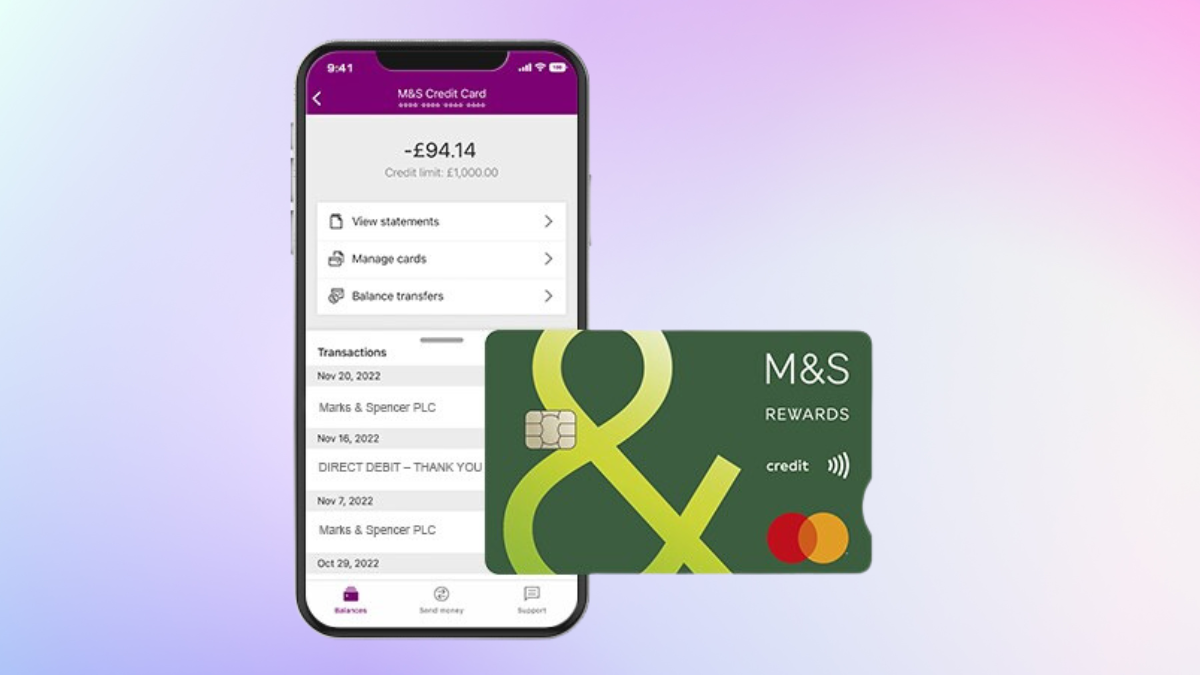

Sainsbury’s Bank 28 Month Balance Transfer Card or M&S Credit Card Shopping Plus?

Sainsbury’s Bank 28 Month Balance Transfer Card offers an excellent service to cardholders while charging no annual fee!

Customers can enjoy 0% interest at balance transfers and purchases and enjoy a reward program! But if you want to expand your options, don’t worry!

Meet the M&S Credit Card Shopping Plus! This card also brings a 0% intro interest period on purchases and balance transfers!

Plus, it has a reward program that allows you to earn while spending! Great, isn’t it? Compare both cards below!

| Sainsbury’s Bank 28 Month Balance Transfer Card | M&S Credit Card Shopping Plus | |

| Credit Score | Good; | Good; |

| Annual Fee | £0; | £0; |

| Purchase APR | 0% interest in the first 3 months. 23.95% variable after; | 0% interest for 18 months; 23.9% variable purchase rate after; |

| Cash Advance APR | 25.95%; | 29.9%; |

| Welcome Bonus | 0% interest on balance transfers for up to 28 months; | N/A; |

| Rewards | Earn up to 3 points for each £2 spent at Sainbury’s, Argos, Tu Clothing, and Habitat in the UK. Earn 1 point per £5 spent on all other purchases. | Earn 1 point per £1 spent in M&S. Earn 1 point per £5 spent elsewhere. |

Further, learn how to apply for the M&S Credit Card Shopping Plus through simple key steps! Let’s go!

Apply for the M&S Credit Card Shopping Plus

Keep reading and learn how to apply for the M&S Credit Card Shopping Plus! This card offers a great reward program and charges no annual fee!

About the author / Luis Felipe Xavier

Trending Topics

Simple and quick process: Apply for the Total Visa® Card

Apply for Total Visa® Card today and ensure 1% cash back on purchases and uncomplicated features! Build credit fast with this credit card!

Keep Reading

What is the lowest credit score possible? A Complete Guide

Learn about the lowest possible credit score with our complete guide. Discover what a bad credit score is and the factors that can cause it.

Keep ReadingYou may also like

Instant decision: Apply for the Mission Lane Visa® Credit Card

Ready to apply for the Mission Lane Visa® Credit Card but not sure where to start? Our step-by-step guide is here for you! No credit impact!

Keep Reading

Ensure 1% cash back: Total Visa® Card review

In this Total Visa® Card review, you'll find an excellent solution to build your credit score fast! Access free credit monitoring and more!

Keep Reading

Can an Overdraft Affect Your Credit Score?

Does overdraft affect your credit score? Learn facts and tips to protect your financial health and credit rating. Stay informed and secure.

Keep Reading