Credit Card

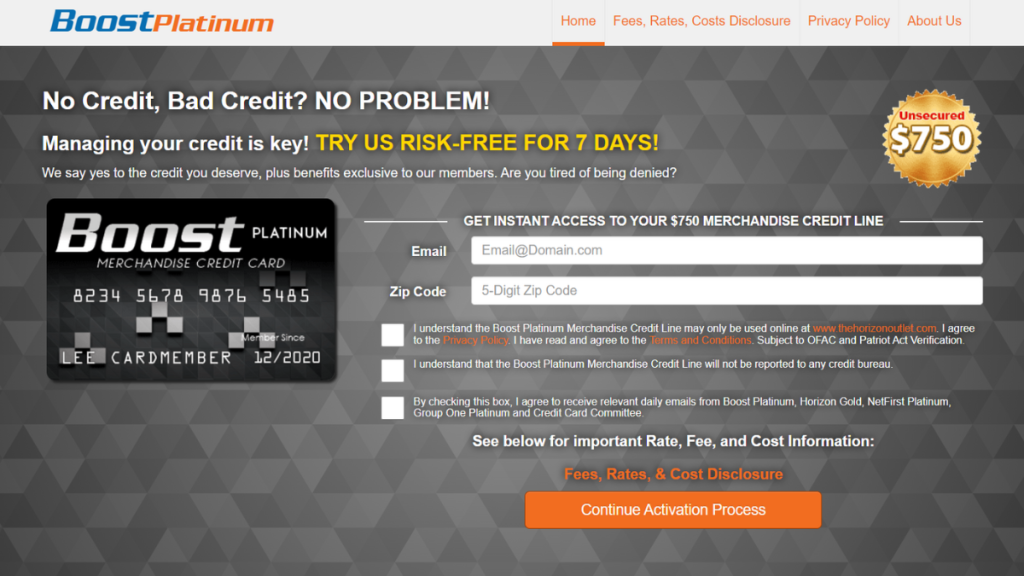

Boost Platinum Card Review: Empower Your Spending!

Are you tired of being denied a credit line because of past financial mistakes? Explore our Boost Platinum Card and ensure a new financial tools! Read on!

Advertisement

Your trusted companion in merchandise shopping

In this Boost Platinum Card review, we’ll offer a fresh perspective with a merchandise solution for those who’ve faced credit challenges.

Apply for the Boost Platinum Card

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

So join us as we unravel the benefits, potential drawbacks, and unique features of this game-changing card. Ready? Let’s get to it.

| Credit Score | Damaged to Fair Credit; |

| Annual Fee | $14.77 per month ($177.24 annually); |

| Purchase APR | None; |

| Cash Advance APR | Does not apply; |

| Welcome Bonus | There are no welcome bonuses; |

| Rewards | This is not a rewards card. |

Boost Platinum Card: All you need to know

The Boost Platinum Card is specifically crafted for individuals with damaged credit histories. It offers a seamless shopping experience .

Despite past financial setbacks, this card ensures your purchasing power remains intact. No judgment, just shopping freedom.

With it, you can get an unsecured $750 credit line. Since the card is not a Visa or Mastercard, you can only use it to shop at Horizon Outlet’s online store.

You also need to link a debit or credit card for fees and shipping costs. The card has no APR on purchases, but there are no rewards or bonuses either.

While the card doesn’t focus on credit building, its main appeal is the empowerment it brings to its cardholders.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover the Boost Platinum Card

While the card offers several advantages, it’s essential to weigh them against potential downsides. See them next in our Boost Platinum Card review.

Pros

- Specifically designed for individuals with a compromised credit history;

- Quick approvals without the hassle of extensive documentation;

- The ability to make purchases without the added pressure of credit-building;

- Clear guidelines on charges, reducing the risk of hidden fees.

- Unsecured merchandise credit line up to $750.

Cons

- The Boost Platinum doesn’t contribute to rebuilding your credit score;

- The card is merchandise specific, limiting your purchasing power;

- There’s a monthly fee attached to the card, which is high considering its limitations;

- You need to link a separate debit or credit card for fees and shipping costs;

- It doesn’t offer the range of benefits that traditional credit cards might provide.

What credit score do you need to apply?

One of the standout features of the Boost Platinum Card is that it may be available to everyone, regardless of their credit standing.

Since the issuer does not perform any credit or employment checks, you can request the card even if you’ve had financial mishaps in the past.

How to easily apply for the Boost Platinum Card?

The Boost Platinum Card could be a fantastic shopping companion if you’re struggling to get traditional cards, or if you’re just an avid shopper.

So, are you ready to take the next step? Don’t miss our following article, where we provide a step-by-step guide on how to easily apply for it.

Apply for the Boost Platinum Card

Unlock financial freedom with ease! Learn how to apply for the Boost Platinum Card and empower your spending regardless of your score.

Trending Topics

First Progress Platinum Select Mastercard® Secured Credit Card review

Check our First Progress Platinum Select Mastercard® Secured Credit Card review and begin the path to building credit!

Keep Reading

Savings vs. Checking Accounts: A 101 Guide

Learn the differences between savings vs. checking accounts with our guide. Find out which is best for your daily needs and future goals.

Keep Reading

$100 bonus: PenFed Power Cash Rewards Visa Signature® Card review

Read our full revieiw and learn how PenFed Power Cash Rewards Visa Signature® Card works! Earn up to 2% cash back on purchases and more!

Keep ReadingYou may also like

Piggyback loan: how it works, pros and cons

A piggyback loan can help you buy a home without paying for private mortgage insurance. Find out what benefits it offers and the drawbacks.

Keep Reading

Quick and simple: Apply for the GO2bank Secured Visa® Credit Card

Step into the credit world with confidence! Discover how to apply for the GO2bank Secured Visa® Credit Card with our easy guide.

Keep Reading

Apply for the Wells Fargo Active Cash® Card: no annual fees ahead

See how to apply for the Wells Fargo Active Cash® Card and enjoy no annual fees with enhanced security features. Step into smarter spending!

Keep Reading